The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. Simply select your tax filing status and enter a few other details to estimate your total taxes. Based on your projected tax withholding for the year, we then show you your refund or the amount you may owe the IRS in April. This calculator is for filing your 2017 taxes by April 15, 2018.

We offer 1040 EZ calculators for tax years 2018, 2019, 2020, 2021, 2022, & 2023. Click here for our current year calcualtor.

Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. From the [loan type] select box you can choose between HELOCs and home equity loans of a 5, 10, 15, 20 or 30 year duration.

Tax time begins at the end of January into February, and for many people, this means they have to decide if they're going to file on their own or ask a tax professional for help. If you're filing for the first time, you might feel a little anxiety about the process because a small mistake can mean a huge headache in the future. This article will go over everything you need to know about filing your taxes. We will talk about the documents you need and why you need them, standard deductions, tools, and software to assist you in this process, as well as what to do if you overpay or end up owing money to the Internal Revenue Service. We'll also talk about what places you can go to have a tax professional do it for you, and why this is a good option to consider as well.

As you're getting ready to start the process of filing your taxes, it is helpful to have all of your information in one place. Having everything in one place will save you time when you sit down to file, as well as keep your stress levels down. If you're filing by yourself, you can just make copies of the document's you'll need and keep them in one place.

Every employer has until January 31st to get your W-2 forms in the mail. They can send them sooner, but most wait until the end of January. If you're expecting multiple forms, make a list and keep track of the ones you receive. Once you get them, compare them to your pay stubs and check for errors. If you find an error, the employer that made the error will have to give you a corrected W-2.

The 1040 EZ form is one of the more basic tax forms to file, and there is less information you will need to complete it. You must have an annual taxable income of less than $100,000 and have no dependents. You can also only file as single or jointly with your spouse. To file successfully, you will need the documents listed below.

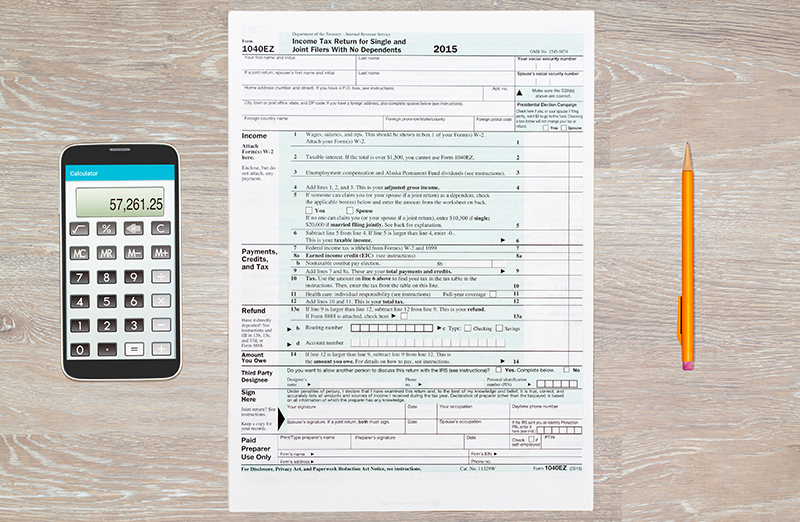

The 1040 EZ form is the easiest form out of the four main forms you can fill out for your taxes. It has four sections, and you fill in the information you gathered from the above lists.

The first section of the 1040 EZ form is your personal information. You will need to fill in your full name, social security number, address, telephone, birthday, and your filing status. If you plan to file a joint return with your spouse, you will need the same information from them as well.

The 1040 EZ restricts the type of income you can claim on your taxes. You fill in this section with all of your taxable income from your W-2s, as well as any deductions or exemptions you may have. You can list these types of income with the 1040 EZ:

This section is where you add any payments you have made by paying Federal taxes. You also add any employment interest credits, as well as any earned income credit you can claim.

The final section to the 1040 EZ is where you calculate your refund. If your payments and credits are higher than your total, you overpaid and can get a refund. If you find you've underpaid, you will have a balance due that you pay to the IRS. If you need a clearer picture of the form broken down by sections, click here.

There are many different types of deductions a person can claim on their taxes. These often influence how much you can expect in your refund, so it is a good idea to look them all over carefully and choose the ones that suit your needs.

If you would like more in-depth information and what you can and can't claim on each of these forms, as well as information on the 1040a form, click here.

If you've decided to file on your own, there are several popular tax software choices available to guide you through the process. Each one has different options available, but they all offer free versions for basic tax filing needs.

FreeTaxUSA is a very straightforward and affordable software option. It will let you upload prior year's tax paperwork from competitors, and will walk you through the filing process step by step. There is a Basic version for free with Federal taxes, and to upgrade to Deluxe will cost $6.99. However, if you're planning to file state taxes, it will cost an additional $12.95.

H&R Block has tax filing software as well. You can import your tax data from competitors, and it'll fill in your forms from that information. There is a free version along with two paid versions. The paid versions are Deluxe and Premium, and they cost $54.99 and $79.99, respectively.

TaxSlayer offers a free version for the 1040EZ form only. You have the option of preparing and filing your taxes from any device from a desktop to a tablet with ease. This software comes with a 100 percent accuracy guarantee, and there are mistakes they will reimburse you for any fees or penalties. TaxSlayer offers four versions with the first being the free Basic package. The Classic version is $22.00, and the Premium version is $40.00. The final version is for Self-Employed and costs around $55.00.

TurboTax is perfect for anyone who doesn't use technology as well. It will import and fill in all of your W-2 information, as well as your 1099s. There is an extensive question and answer section that you can access if you get stuck, and if you choose one of the paid versions, you can have a one-on-one video chat with a tax preparer. TurboTax offers a free version, Deluxe version for $54.99, Premier for $79.99, and a Self-Employed version for $114.99 per year.

If you don't feel comfortable filing on your own, several agencies will fill out the forms and file them for you. Your local H&R Block or Jackson Hewitt have offices that you can schedule appointments with a tax professional. You should also check with your bank or credit union because they will often file your taxes for you at no cost. After you schedule your appointment, bring all of your documents, forms, proof of health insurance, and driver's license with. Your tax professional will go over all of your information and input it into your forms. They will submit them for you, and you pay the filing fee. You can track your refund online or on your smart phone. They also offer liability, and if there are mistakes on your returns, they will pay them.

These two mistakes are very common. They are also relatively easy to fix once you realize there has been a mistake.

This article has covered all of the documents you will need to file your taxes, as well as the different forms you can fill out. We went over the sections of the 1040 EZ form, and what you can and can't claim with it. We touched on different tax filing software, and places you can go in person to have a tax professional help you. We talked about what to do if you overpay or owe money on your taxes, and how to file an extension. If you follow the advice from this article, you should be able to ease some of your anxiety about filing your taxes.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!