This calculator helps determine the minimum allowable down payment and maximum FHA mortgage allowed on a home purchase. It creates an estimate of closing costs and required upfront Mortgage Insurance Premium (MIP). This tool is designed to determine the FHA mortgage limit for a particular purchase, not the maximum allowed for any home in your state and county. To determine the maximum purchase price for your specific area you should use https://entp.hud.gov/idapp/html/hicostlook.cfm at the HUD.gov. Then, with that data in hand, use the below calculator to determine the required down payment, FHA mortgage limit and required upfront Mortgage Insurance Premium (MIP).

For your convenience current Columbus FHA loan rates are published below. You can use these to estimate your mortgage interest rates and payments.

Here is a table listing current FHA home loan rates available in Columbus. You can use the menus to select other loan durations, alter the loan amount, or change your location.

The U.S. Department of Housing and Urban Development (HUD) has been has been helping first-time homebuyers get loans backed by the Federal Housing Administration (FHA) since 1934. Traditional lenders such as banks issue the loans, but they are insured by the FHA, reducing the risk to the lender and allowing the lender to provide better terms.

The U.S. Department of Housing and Urban Development (HUD) has been has been helping first-time homebuyers get loans backed by the Federal Housing Administration (FHA) since 1934. Traditional lenders such as banks issue the loans, but they are insured by the FHA, reducing the risk to the lender and allowing the lender to provide better terms.

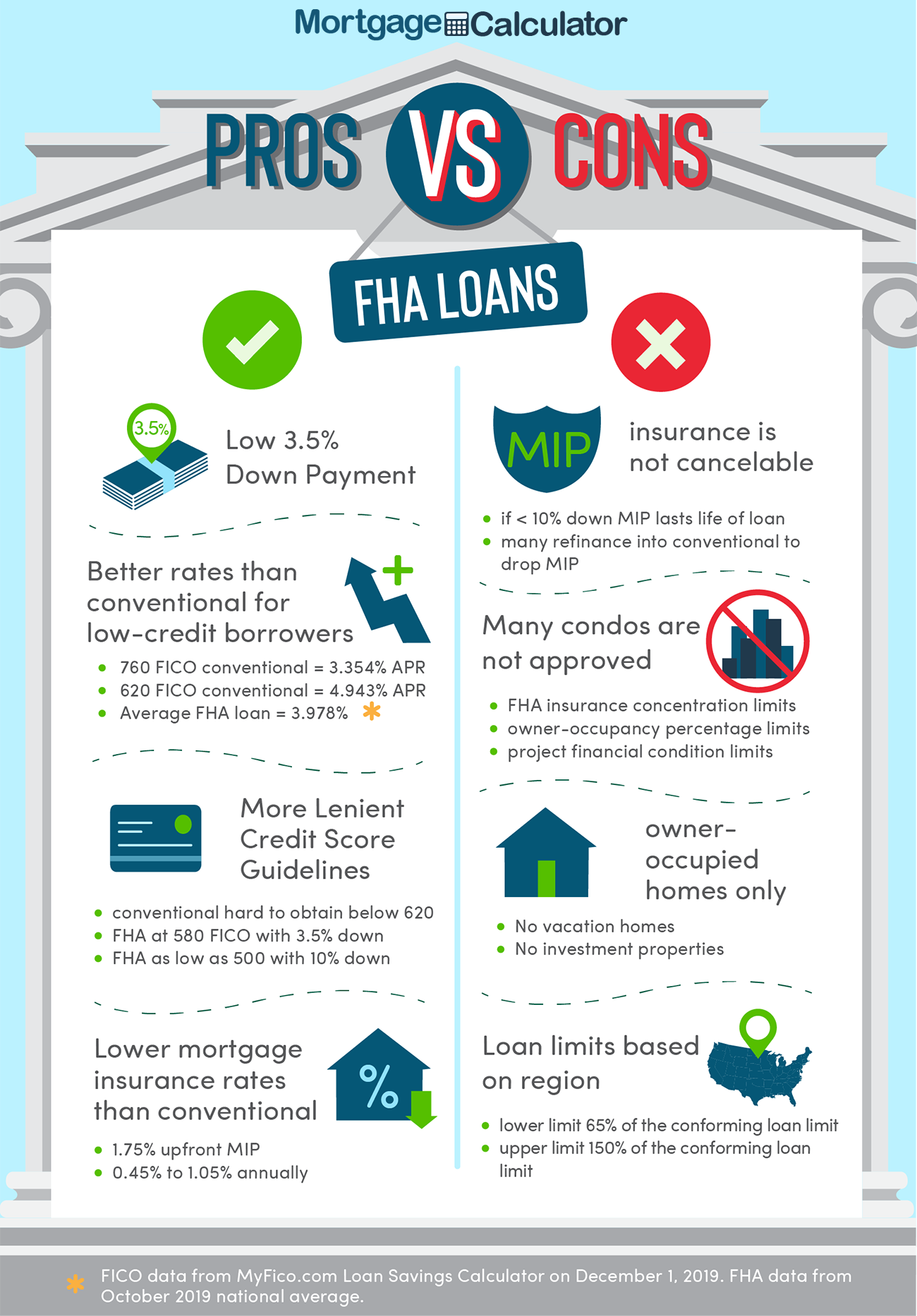

FHA loans require low down payments — typically only 3.5 percent — and low closing costs, many of which can be included in the loan. The FHA also offers loans that allow you to purchase a home in need of repairs and to roll the cost of the fixes into the primary mortgage loan. Other loans are available for seniors, for those looking to make energy improvements to their home, and for those who want to buy manufactured or mobile homes.

Another part of what makes FHA loans so attractive to first-time homebuyers is that they have easy credit qualifying. If you don't have a perfect credit score, but you have a good history of paying your bills on time, you will likely qualify for an FHA loan.

Though FHA loans offer some flexibility for first-time homebuyers to help them afford a new home, it can be confusing trying to figure out just how much you can borrow under an FHA loan because of all the criteria involved with the loan.

The above FHA maximum financing calculator makes it easy for you to understand just how much you can borrow. Enter in all the variables, including the sales price of the home you wish to buy, the appraised value of the home, borrower-paid closing costs, prepaid expenses, discount points, any repairs or improvements you wish to make and include in the cost of the loan, and your mortgage insurance premium. We'll send you fast results including the cash required at closing and how much you are able to purchase.

Just enter your e-mail and have your results delivered in moments, including a plain-English explanation with everything you need to know about your borrowing options.

Although it is true that there are several different types of mortgages making a comeback, the FHA remains one of the most popular. The reasoning behind this is the multiple benefits an individual is eligible for once they qualify for this loan.

| Conventional Mortgage | FHA Mortgage | |

|---|---|---|

| Credit Score | 640 and Up | 560 and Up |

| Down Payment | 5% to 20% | 3.5% to 10% |

| Interest Rates | Higher | Lower |

| Refinancing | Requires a Credit Check | Streamlined, no Additional Credit Check Required |

| Max Loan Amounts | $806,500 in Most Areas, Up to 50% More in High-cost Areas | 115% of the Area's Median Home Prices |

| Owner Occupied | Not Mandatory | Owner Must Reside at the Property for Certain Home Styles |

| Down Payment Assistance | None | SETH, TDHCA, and TSAHC Available |

| Assumable | No | Yes |

| Allow Gifting | Yes, Only a Portion of the Down Payment | Yes, up to 100% of the Down Payment |

The FHFA sets caps on what you can borrow based on where you live or where you intend to purchase a home. These loan limits are based on the average price of a home in your area and on the type of home it is, including single family, duplex, triplex and four-plex.

In 2024, the FHFA announced that it would increase the 2025 loan limits for the program in response to rising house costs. In more high-cost areas of the United States, it would increase to $1,209,750 in HERA high-cost areas, and $1,814,625 in the special exemption areas of Alaska, Hawaii, Guam, and the U.S. Virgin Islands. Additionally, the lower end increased to $524,225, which corresponds to 65% of the $806,500 conforming loan limit. The increase for any FHA-insured reverse mortgages increased to $1,209,750, which corresponds to 150% of the $806,500 conforming loan limit. Increases for 2025 reached 3,151 counties nationwide & followed annual increases for most of the past decade.

These increases were based on a formula derived from the 2025 conforming mortgage limit of $806,500. The low end floor is set to 65% of the conforming loan limit, while high cost areas have a ceiling set to 150% of the conforming loan limit. In 2025 3,080 counties are at the floor, 103 counties are at the ceiling & 51 counties are in between.

Look Up YOUR Local FHA Loan Limit

HUD offers an interactive tool showing county-based loan limit data. For example, the 2025 limit for a single-family home in Alamance County in North Carolina is $524,225, while the limit for a duplex in the same county is $671,200, a triplex $811,275, and a four-family dwelling $1,008,300. You can look up your county on the FHA website.

Loan limits vary significantly depending on where you intend to purchase a home. For example, the 2024 loan limit for a single-family home in New York County in New York is $1,209,750. Only a couple percent of counties are at the ceiling, while thousands of counties are at the floor. Here is historical data from a few years ago. From the table you can see most loans are in counties at the floor & the loan size tends to increase in more expensive parts of the country.

| 2019 FHA Limits | # | % | FY 18 Endorsements | % of End | Amount | % $ | Average Loan |

|---|---|---|---|---|---|---|---|

| Counties at Ceiling | 73 | 2.26% | 79,639 | 7.85% | $29,085,594,869 | 13.91% | $365,218 |

| Counties in Between | 504 | 15.58% | 442,109 | 43.57% | $102,074,625,753 | 48.83% | $230,881 |

| Counties at Floor | 2,657 | 82.16% | 492,860 | 48.58% | $77,890,616,723 | 37.26% | $158,038 |

If you want to know what your local FHA loan limits are, click here. This interactive tool will show you the local FHA limits in your area. You can narrow it down by state and county. A table highlight 2025 FHA loan limits is published below. Rows display the national baseline limit, the high cost area limit, and the special exception areas.

| Location | Limt Set @ | 1 Unit | 2 Units | 3 Units | 4 Units |

|---|---|---|---|---|---|

| Low Cost Area | 65% of conforming limit | $524,225 | $671,200 | $811,275 | $1,008,300 |

| High Cost Area | 150% of conforming limit | $1,209,750 | $1,548,975 | $1,872,225 | $2,326,875 |

| Alaska, Hawaii, Guam & Virgin Islands | 150% of high cost area limit | $1,814,625 | $2,323,450 | $2,808,325 | $3,490,300 |

Homeowners who have an FHA backed loan are able to withdraw up to 80% of their home equity, which is a 5% reduction from the prior 85% limit. HUD announced the new lower limit on August 1, 2019 to help limit risk in the mortgage marketplace & ensure homeownership helps homeowners build wealth. Limits have increased annually through 2025. The Federal Reserve lifting interest rates sharply throughout 2023 has led to a slowdown in the real estate market & declining stock prices, which in turn will likely lead to at least a year or two of slower growth in the loan limits.

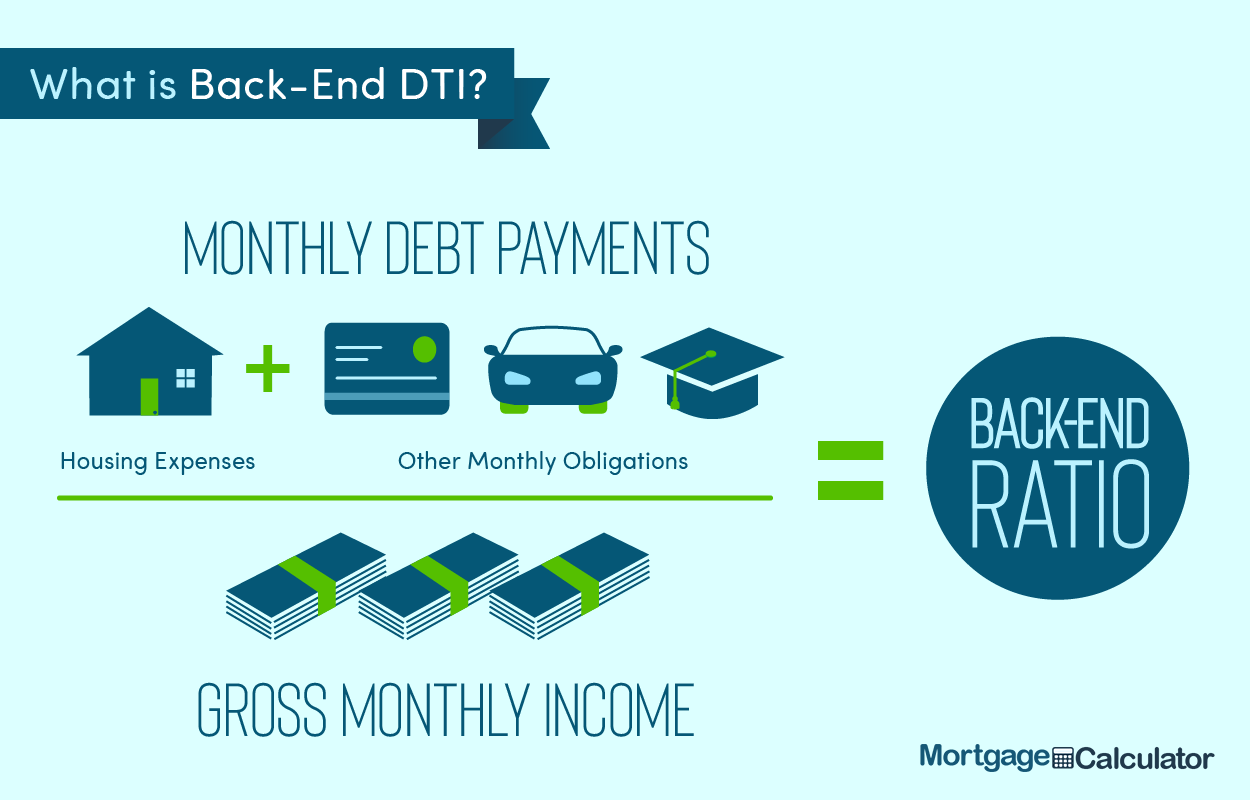

Loan limits are just a starting point for determining how much you can borrow with an FHA loan. As with other home loans, FHA loans require lenders to meet guideline for housing expense ratios and debt-to-income ratios.

Traditional mortgages require that your total monthly mortgage payment not exceed 28 percent of your monthly gross income, and that your total monthly debt payments — including your mortgage, car loan, student loans and other obligations — not exceed 31 percent of your gross monthly income. However, the FHA increases these limits, allowing you to have a 31 percent housing expense ratio and a 43 percent total debt-to-income ratio. You can find these ratios by dividing your monthly mortgage payment by your monthly income, or by totaling up your monthly debt payments and dividing them by your monthly income.

FHA loans also require that you carry mortgage insurance, which is included in your monthly mortgage payment. The more expensive the home you buy, the more expensive the mortgage insurance will be.

Like other loans, you are also required to carry homeowners insurance, which includes paying the premium at closing, and to pay your property taxes in escrow.

Many lenders like to see credit scores in the mid-700s and higher. The FHA has lower credit score requirements, and this makes it more accessible to more people. It is good to know that your down payment will largely depend on your credit score. You can qualify with a 580 or higher FICO score and still be eligible for the 3.5% down-payment. However, if your score is below 580, you could still qualify, but you could be subjected to up to a 10% down payment.

The following table shows how the average FHA borrower credit score has changed in the recent past.

| Year | Average Credit Score |

|---|---|

| 2021 | 673 |

| 2020 | 673 |

| 2019 | 667 |

| 2018 | 670 |

| 2017 | 676 |

| 2016 | 680 |

| 2015 | 680 |

| 2014 | 682 |

| 2013 | 693 |

| 2012 | 698 |

| 2011 | 701 |

| 2010 | 697 |

| 2009 | 681 |

| 2008 | 647 |

| 2007 | 630 |

| 2006 | 641 |

| 2005 | 639 |

Loan limits are just a starting point for determining how much you can borrow with an FHA loan. As with other home loans, FHA loans require lenders to meet guideline for housing expense ratios and debt-to-income ratios.

After the recession credit standards tightened to where traditional mortgages required that total monthly mortgage payment not exceed 28 percent of your monthly gross income, and that your total monthly debt payments — including your mortgage, car loan, student loans and other obligations — not exceed 31 percent of gross monthly income. In the years since the recovery began, these limits have lifted over time & borrowers can have a back-end ratio as high as 50%. However, the FHA increases these limits, allowing you to have a 31 percent housing expense ratio and a 50 percent total debt-to-income ratio. You can find these ratios by dividing your monthly mortgage payment by your monthly income, or by totaling up your monthly debt payments and dividing them by your monthly income.

FHA loans also require that you carry mortgage insurance, which is included in your monthly mortgage payment. The larger your loan amount, the more expensive the mortgage insurance will be. Like other loans, you are also required to carry homeowner's insurance, which includes paying the premium at closing, and to pay your property taxes in escrow.

People who have high debt-to-income (DTI) ratios typically find it hard to obtain financing.

Frannie May and Freddie Mac traditionally have allow back end DTI ratios between 36 and 43%. In some cases The FHA allows up to 50% depending on your credit score. To better compete against FHA insured loans, both companies have expanded their DTI limits to 50% of pretax income in July of 2017.

In March of 2019 the FHA informed lenders they would tighten loan standards as their overall loan portfolio has grown more risky, a policy shift from the 2016 underwriting loosening which allowed automated underwriting for borrowers with a credit score below 620 or a DTI above 43%.

The following table shows the share of FHA borrowers whose debt payments exceed half of their income. The ratio has gone up more than four-fold since the turn of the century as non-bank mortgage lenders like Quicken Loans, loanDepot & Fairway Independent Mortgage have grown to a large share of the market.

| Year | Share of Borrowers |

|---|---|

| 2018 | 24.8% |

| 2017 | 20.3% |

| 2016 | 16.33% |

| 2015 | 14.58% |

| 2014 | 14.37% |

| 2013 | 13.54% |

| 2012 | 15.42% |

| 2011 | 16.69% |

| 2010 | 16.76% |

| 2009 | 18.97% |

| 2008 | 13.2% |

| 2007 | 9.48% |

| 2006 | 9.07% |

| 2005 | 6% |

| 2004 | 5.5% |

| 2003 | 4.99% |

| 2002 | 5.9% |

| 2001 | 6.25% |

| 2000 | 5.75% |

In the past few years, the documentation requirements have gone up for the FHA loan program. The more documentation you have, the better chances you have of getting approved for your loan. You'll need:

Ideally, the FHA lender would like to see at least two years worth of steady employment to qualify. If the applicant has changed jobs three times in the last year, the FHA will take further steps to verify the applicant's employment. They want to see a steady stream of income, and this helps them believe the applicant will be able to pay them back.

| Loan Type | Down Payment | Debt-to-Income | Minimum Credit Score | Mortgage Insurance | Loan Limits | Fixed or Adjustable Rates |

|---|---|---|---|---|---|---|

| Conventional Loan | 5% to 20% | Up to 50% | 640 | PMI Not Required with 20% Down | $806,500 in Most Areas | Both Available |

| FHA Loan | 3.5% to 10% | Up to 50% | 560 | 0.8% to 1.05% for 30-yr loans, 0.45% to 0.95% for 15-yr loans | 115% of the Area's Median Home Price | Both Available |

| VA Loan | 0% to 5% | Up to 41% | 620 | No PMI, Upfront Funding Fee of 1.25% to 3.3% Depending on: Down Payment, Regular Military or Reserve Status & if 1st or Subsequent use | Varies by County Limits | Both Available |

| USDA | 0% | Up to 41% | 640 for streamlined approval, can be lower | 1% Upfront, 0.35% Annually | Varies by County Limits | 15-yr & 30-yr Fixed |

To better compete with government insured loans, both of the major GSE have launched low downpayment loan options.

Freddie Mac has a Home Possible loan program which allows down payments as low as 3% to 5%, while Fannie Mae offers a HomeReady loan program that requires a 3% down payment.

Although you will technically have to have a credit score to qualify for a FHA loan, you can still qualify with no or extremely thin credit history. Lenders can look at nontraditional types of payments to establish an applicant's reliability. They'll look at things like rent payments, student loan payments, utility payments, or credit card payments.

Ideally, you want at least a year of reliable payments before you apply for an FHA loan. It is important to know that a lender may not reject an application simply because the applicant chose not to use credit in the past. No matter if you have traditional or nontraditional credit, your FHA loan officer will look into it when you apply.

Lenders understand that some things are simply out of your control, but there are several things you can control and you should be mindful of them when you're waiting to qualify or close on your FHA loan.

Visit FHALoans.com today to prequalify.

When it comes to conforming mortgages and FHA loans, there are several key differences that you have to take into consideration before deciding which one will make the most sense for you.

If you've filed for bankruptcy and you want to qualify for an FHA loan, you'll have to wait two years and you'll have had to re-established your credit within this two years.

A conforming mortgage normally requires a four-year period between successfully qualifying for a mortgage and a bankruptcy. You'll be expected to re-establish your credit inside of these four years. There are exceptions, and some lenders do accept a two-years instead of the more traditional four.

FHA loans don't concentrate on credit scores, but they look at the applicant's entire credit profile. If you're below a 580 credit score, the down payment amount increases from 3.5% to 10%. Typically, you do need a credit score of 500 or above to qualify.

Conforming mortgages look at credit scores, and the higher your credit score is, the less you'll pay each month for insurance. Additionally, most Conforming mortgages look for credit scores of 740 and above, but they'll typically accept a credit score of 620 and up.

Your FHA loans will require a 3.5% down payment, and this is for any property type. There is also an annual fee of 0.85% that gets added to this mortgage.

A Conforming mortgage by Frannie Mae or Freddie Mac can require a down payment as low as 3%. However, the loan amount can only go up to $417,000, and you must be a first-time home buyer.

Conforming loans have private mortgage insurance (PMI) added to every loan where the borrower puts less than 20% down on the home. It works out to about 1.05% annually for a 30-year loan up to $417,000 with 3% down. However, you can pay this off in as little as two years. As soon as you pay the balance down to 78% of the home's purchase price, the PMI is removed.

The FHA loans come with a mortgage insurance premium (MIP) that lasts for the life of your mortgage. The ~ 0.85% fee is added annually to your balance. There is also a 1.75% mortgage insurance premium added on upon closing the loan. This works out to $1,750 for every $100,000 you borrow and you can pay this either in cash or add it on to the total balance.

The following graphic describes FHA MIP. Beneath it are tables showing how annual MIP changes for various loan scenarios using a variety of loan amounts & loan-to-value (LTV) ratios.

Central bank interest rate reductions and money printing in response to the COVID-19 lockdowns put a bid under real estate, which boosted homeowner equity. Reduced default rates and lower interest rates that led to many refinances. These factors led to the FHA mortgage insurance fund being funded at over 500% the minimum amount required by Congress. Starting March 20, 2023 the annual MIP rate decreases by 30 basis points, or 0.3%.

On loans with at least 10% down the MIP payments are only required for the first 11 years.

| LTV | Loan Amount | New MIP | Old MIP |

|---|---|---|---|

| > 95% | > $726,200 | 0.75% | 1.05% |

| > 90% & ≤ 95% | > $726,200 | 0.70% | 1.00% |

| ≤ 90% | > $726,200 | 0.70% | 1.00% |

| 95% | ≤ $726,200 | 0.55% | 0.85% |

| > 90% & ≤ 95% | ≤ $726,200 | 0.50% | 0.80% |

| ≤ 90% | ≤ $726,200 | 0.50% | 0.80% |

In 2025 the conforming loan limit was lifted to $806,500, whereas $726,200 was the conforming loan limit in 2023.

| LTV | Loan Amount | New MIP | Old MIP |

|---|---|---|---|

| ≤ 78% | > $726,200 | 0.15% | 0.45% |

| 78.01% to 90% | > $726,200 | 0.40% | 0.70% |

| > 90% | > $726,200 | 0.65% | 0.95% |

| ≤ 90% | ≤ $726,200 | 0.15% | 0.45% |

| > 90% | ≤ $726,200 | 0.40% | 0.70% |

In 2025 the conforming loan limit was lifted to $806,500, whereas $726,200 was the conforming loan limit in 2023.

Loans originated on or after June 3, 2013 have the following annual MIP requirements.

| Term | LTV | MIP Required |

|---|---|---|

| ≤ 15 years | ≤ 90% | 11 years |

| ≤ 15 years | > 90% | full loan term |

| > 15 years | ≤ 90% | 11 years |

| > 15 years | > 90% | full loan term |

Loans before that date had a similar MIP requirement with the following exceptions

If you choose to get a mortgage through the FHA loan program, it will allow a non-occupying co-borrower to live in the home instead of the applicant or co-signer themselves.

A Conforming mortgage won't allow this practice, and this makes it harder to qualify. This means that if you have a co-signer, they must live on the property once the loan has gone through.

The low down payment requirement coupled with allowing looser credit standards than typical conforming mortgages makes FHA loans a widely popular option. In 2016 FHA loans represented 19.9% of home purchases, 10.9% of refinances & 15.8% of the total mortgage market. The following table shows how popular FHA loans have been over time by loan count. FHA loans represent a slightly lower share of dollar amount as FHA loans tend to skew lower than the national average loan amount.

| Year | FHA Buy | FHA Refi | FHA Total | FHA Purchase * | Total Purchase # | FHA Refi * | Total Refi # | FHA Total * | Market Total # |

|---|---|---|---|---|---|---|---|---|---|

| 1996 | 15.4% | 5.8% | 12.3% | 696,504 | 4,524,674 | 123,475 | 2,146,882 | 819,979 | 6,671,555 |

| 1997 | 16.4% | 6.8% | 13.9% | 758,967 | 4,624,352 | 109,546 | 1,608,195 | 868,513 | 6,232,547 |

| 1998 | 13.9% | 6.8% | 10.5% | 787,703 | 5,656,199 | 348,044 | 5,138,962 | 1,135,747 | 10,795,161 |

| 1999 | 14.7% | 4.1% | 9.5% | 913,216 | 6,226,372 | 244,578 | 5,955,905 | 1,157,794 | 12,182,277 |

| 2000 | 13.9% | 3.9% | 11.7% | 844,835 | 6,074,004 | 65,987 | 1,692,510 | 910,822 | 7,766,513 |

| 2001 | 14.3% | 7.4% | 11.0% | 869,524 | 6,100,159 | 407,424 | 5,526,541 | 1,276,948 | 11,626,700 |

| 2002 | 11.5% | 4.0% | 7.0% | 764,453 | 6,624,756 | 411,781 | 10,296,778 | 1,176,234 | 16,921,535 |

| 2003 | 9.1% | 3.6% | 5.2% | 630,119 | 6,954,384 | 652,853 | 17,932,247 | 1,282,972 | 24,886,631 |

| 2004 | 6.9% | 3.3% | 5.0% | 467,293 | 6,791,344 | 248,428 | 7,527,744 | 715,721 | 14,319,088 |

| 2005 | 4.5% | 1.8% | 3.1% | 322,915 | 7,233,456 | 133,261 | 7,251,637 | 456,176 | 14,485,093 |

| 2006 | 4.5% | 2.0% | 3.3% | 295,261 | 6,563,679 | 115,859 | 5,765,899 | 411,120 | 12,329,578 |

| 2007 | 6.1% | 4.2% | 5.1% | 317,181 | 5,222,266 | 211,093 | 5,071,725 | 528,274 | 10,293,991 |

| 2008 | 24.1% | 15.6% | 19.8% | 844,893 | 3,508,103 | 560,767 | 3,583,680 | 1,405,660 | 7,091,783 |

| 2009 | 32.6% | 14.8% | 21.1% | 1,088,356 | 3,338,302 | 896,558 | 6,052,223 | 1,984,914 | 9,390,525 |

| 2010 | 32.3% | 9.5% | 17.5% | 944,159 | 2,925,707 | 518,571 | 5,432,837 | 1,462,730 | 8,358,544 |

| 2011 | 30.2% | 7.5% | 15.9% | 760,340 | 2,515,612 | 321,847 | 4,298,919 | 1,082,187 | 6,814,531 |

| 2012 | 26.7% | 7.9% | 13.4% | 738,230 | 2,760,736 | 526,635 | 6,678,526 | 1,264,865 | 9,439,262 |

| 2013 | 20.4% | 9.4% | 13.5% | 664,954 | 3,259,986 | 507,014 | 5,421,942 | 1,171,968 | 8,681,928 |

| 2014 | 18.3% | 8.0% | 14.1% | 601,332 | 3,292,713 | 181,867 | 2,277,100 | 783,199 | 5,569,813 |

| 2015 | 21.7% | 12.7% | 17.5% | 811,088 | 3,744,196 | 409,540 | 3,236,960 | 1,220,628 | 6,981,156 |

| 2016 | 21.0% | 10.4% | 15.9% | 891,211 | 4,235,623 | 413,175 | 3,976,054 | 1,304,386 | 8,211,677 |

| 2017 | 19.0% | 11.8% | 16.4% | 852,241 | 4,477,935 | 309,146 | 2,612,448 | 1,161,387 | 7,090,383 |

| 2018 | 16.8% | 10.9% | 15.0% | 759,837 | 4,521,918 | 213,631 | 1,954,512 | 973,468 | 6,476,430 |

* U.S. Department of HUD as of August 15, 2019. Originations based on beginning amortization dates.

# Includes all conventional and government single family forward originations. Mortgage Bankers Association of America, “MBA Mortgage Finance Forecast,” August, 2019.

In March of 2019 the FHA announced tightened underwriting standards, which is expected to impact about 4% to 5% of the demand for FHA-insured loans, leading to somewhere between 40,000 and 50,000 fewer loans a year.

The FHA-type loan has had a history of dropping off and rising up again. As of 2013, the FHA mortgages are sitting at around 21%. The FHA mortgages experienced a large jump in popularity with Millennial buyers as people who were born between 1980 and 1999 are more predisposed to apply for FHA loans. Currently, 35% of Millennials have opted to use an FHA loan, and this percentage is way above the FHA's overall market share percentage of 21%. Nationally, the FHA backs around 16% of all mortgages.

Historically, this market share has experienced lows and highs for a number of reasons, and it's currently starting to go into a low point even with its popularity with the Millennial age group. The FHA's mortgage market share by dollar volume was just 17.3% in the last quarter of 2016. A few reasons for this share shift are:

Housing Bubble

During the housing bubble credit standards were loose on conforming mortgages. This meant marginal home buyers had less incentive to seek out FHA loans since almost anyone with a pulse could "qualify" for a standard conforming mortgage.

Housing Market Crash

The FHA offers mortgages to people with lower credit scores and thin credit histories. When credit dried up in the wake of the housing market crash & many ARM loans reset many people rushed into FHA loans.

Fee Adjustment

Once the United States housing bubble crashed, the liquidity people had access to was drastically reduced. This caused an FHA share boost after the crash and this. The slow recovery, in turn, caused the FHA default rate shoot up and any cash reserves that the FHA set aside for emergencies was quickly depleted. To offset the losses, in 2013 the FHA to increase its fees. The fee increase caused dollar share of FHA loans to slide as:

Refinancing

Many FHA borrowers with significant home equity turned to different mortgages. Conforming mortgages offer private mortgage insurance that you can have removed as soon as you pay down to 78% of the property's purchase price, whereas FHA loans are now required to keep MPI throughout the duration of the loan. As loans age & homeowners build equity the conventional mortgage becomes a relatively better deal.

The FHA also offers mortgage insurance, and they based their rates using the risk-based model. This means any applicants that are considered to be a higher risk of defaulting will pay more in insurance fees each month. Additionally, anyone who gets an FHA mortgage will pay an insurance premium of 1.75% when they close on the deal. They can either pay this out-of-pocket in cash or have it rolled into their premium.

For a 30-year loan with a minimum down payment of 3.5%, the annual insurance premium is currently 0.85%. If you have an FHA loan with a term of 15 years and you pay a down payment of 5.00%, your insurance premium is 0.70%.

For a 15-year loan, the MIP will be automatically canceled when your total balance falls below 78% of your home's purchase value. There is no minimum waiting time for this loan like there is on the 30-year loan.

These guidelines only apply to your FHA loan if you had it on or before June 3, 2013. If you became qualified and got your FHA mortgage after this date, your mortgage insurance premium is permanent, and it won't automatically cancel. The only way out of paying it is to refinance your FHA loan into a conventional loan.

If you're having trouble with your conventional loan, you can refinance it into an FHA loan. There are a few reasons someone would do this, and they are listed below.

The FHA offers a streamlined refinancing process for people who want to refinance their existing FHA loans. This program is sometimes called the FHA-to-FHA refinancing program, and it is the fastest and most simple way for FHA-insured homeowners to refinance their existing mortgages. This is because the original mortgage is already FHA backed, and this cuts out a lot of the refinancing process. By refinancing with this streamlined process, the borrowers get better rates on their loans, and it reduces the risk of default.

Streamline refinancing doesn't require a home appraisal because you've already had one appraisal, and the FHA assumes the original price is still current. This applies even if you owe double the amount that your home is currently worth. The FHA will refinance your existing loan without any additional cost to the borrower.

The first time you apply for your FHA loan, the FHA-backed lender will look at your total credit file to decide if you're eligible for the mortgage or not. When you refinance, they won't look at your credit history again. This will reduce the time the refinancing process takes, and get the borrower their new terms quicker.

Since the lender checked your employment history and all of your documentation the first time you applied for the FHA program, they won't do it again for your refinance. They assume nothing has changed, and this works to speed the entire process up.

When you refinance out of your FHA mortgage into a conventional mortgage, you're doing so to get a few benefits that you wouldn't have with your FHA mortgage. These can include:

| ✓ Pros | ⨯ Cons |

|---|---|

| Private mortgage insurance is removed once the loan-to-value ratio falls below 78% | More restrictive credit and income requirements |

| Private mortgage insurance payments are lower | Closing costs on a refinance range from 1% to 5% |

The FHA is very flexible about the types of homes you can purchase with the program. A single family home, two unit homes, three-unit homes, four-unit homes, condominiums, mobile homes, and manufactured homes are all eligible.

FHA Loans are Assumable

If you have a loan through the FHA program and you sell your home before you pay it off, you can offer the potential buyer the right to assume your FHA loan. Once the FHA approves the buyer, the former borrower is released from all of their obligations and liability. It's like the new buyer had the FHA loan to begin with.

If your FHA loan originated before December 1, 1986, you are eligible for the FHA's simple assumability process. The simple process means that the FHA isn't required to approve the new lender, and it speeds up the process. If your FHA loan originated after this date, the FHA is required to check the new buyer's creditworthiness.

While there are all age groups that qualify for and use the FHA program, there are a few groups that are drawn to this program.

Since the FHA program doesn't require a large down payment, many first-time homebuyers use this program. It allows them to save up for emergency funds or various other expenses. As of 2015, it was estimated that around 75% of the people who had an FHA loan were first-time homebuyers. It isn't unusual to get a down payment as low as 3.5%, and this works to save the borrower money. Additionally, there are less stringent qualification guidelines.

Millennials are another large group of people that seem to be drawn to the FHA program as well. The fact that you can use the FHA program for a variety of homes, the alternate credit requirements, and the low down payments attract the younger generation. In 2017, over 35% of Millennials who purchased a home used the FHA program to secure financing.

FHA Home Buyer Statistics Born Between 1980 and 1999

| Female | Male | Single | Married | Average Credit Score | Average Home Price | Average Loan Amount | Average Mortgage Rate |

|---|---|---|---|---|---|---|---|

| 38% | 62% | 56% | 44% | 689 | $187,837 | $176,326 | 4.24% |

Source: Ellie Mae Millennial Tracker, data retrieved October 24, 2017

In 1934, the United States was starting to recover from the Great Depression, and around one in four people found themselves renting their homes instead of buying them. The Federal Housing Administration (FHA) was established to get more people owning their homes quicker.

In 1934, getting a home mortgage was a difficult process as credit standards tightened in response to the stock market crash of 1929 & the ongoing great depression. The individual who wanted to obtain the home loan had to pay up to 50% of the loan's cost as a down-payment. Additionally, the mortgages usually came with five-year balloon payment terms. This would be a hard loan to obtain today, and it was nearly impossible by 1934's standards.

The government wanted to increase the number of people who owned their homes. To do this, they introduced the FHA loan program. The government believed that the more people who owned their homes, the more stable neighborhoods would be, and the quicker the economy would improve.

The FHA loan program came with its Mortgage Insurance Premium program, and this program insured lenders against any 'bad' loans. Once the FHA program caught on, people saw mortgage rates dropping, the requirements dropped, and the traditional five-year mortgage was replaced with 15 and 30-year terms. Today, the FHA is the biggest mortgage lender in the world.

In addition to the standard & widely popular FHA home loan programs, the FHA also insures loans for home repairs & reverse mortgages. Both programs are explained below.

Once you've applied and gotten the funding, you have six months to complete any and all repair work you intend to do in your home. The repair money is put into an escrow account, and the contracting crew will be paid as they complete the work. Your contractor should be familiar with how the 203(k) process works before you decide on them.

The minimum loan requirement is $5,000, and the maximum limit has a cap that varies by your location. If you're purchasing a simple single-family home, you'll fall between these limits. If you have smaller projects, there is an additional Streamlined 203(k) program available. The interest rate varies by your credit score, but you should expect to pay 1% or slightly higher than you would on a standard loan. Additionally, they have both fixed and variable rate loans available. As of January 1, 2022, the FHA raised the limits on the HECM loans. The HECM loan has a maximum limit of $970,800.

The Home Equity Conversion Mortgage (HECM) is a reverse mortgage plan that is designed for homeowners that are 62 or older. You'll apply and get this loan, and it is put on the senior's home as a lien. The senior is paid proceeds over time, and as long as the senior lives in the home, there are no repayment obligations.

Below are the eligibility requirements and program costs & here is a reverse mortgage calculator.

| Overview | HECM Reverse Mortgage | Standard Mortgage |

|---|---|---|

| Purpose | Provide funding to existing homeowner of advanced age | Makes to possible to purchase a house |

| Eligibility | 62 or older, Equity in the owner-occupied home, Demonstrated the ability and willingness to pay the property taxes and insurance | Ability to make the required payments, Able to make the required down payment, A steady credit history |

| Lender Protection | Property collateral only | Borrower’s ability and willingness to repay the money and Property collateral as backup |

| Loan Amount Determinants | Equity in the property and the Borrower’s age | Property value, Applicant’s income, Applicant’s credit and the Applicant’s financial assets |

| Payout of Funds | Cash withdrawal at outset, and/or Monthly payment, and/or Future draws under credit line | Withdrawal at outset and used for home purchase |

| Repayment Requirements | No periodic payments required, Balance due on the borrower's death or a permanent move-out | Monthly periodic payments usually required, Payments of balance outstanding (“balloon”) may be required |

| Debt Changes Over Time | Rises over time as interest accrues | Declines over time from principal payments |

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility.

Don't pay too much for your mortgage. Leverage our lender network to get a FHA loan at today's historically low mortgage rates.

Check your mortgage options with a trusted Columbus lender.

Answer a few questions below and connect with a lender who can help you lock-in a low rate FHA loan and save today!