The first calculator figures monthly automotive loan payments. To help you see current market conditions and find a local lender current El Monte auto loan rates are published in a table below the calculator. The second calculator helps you figure out what vehicle price you can afford for a given monthly loan payment.

Use this calculator to estimate the vehicle price you can afford given a set monthly loan payment. To help you see current market conditions and find a local lender current El Monte auto loan rates are published in a table below the calculator.

Whether you buy new or used, it's wise to get pre-approved for a loan before you ever step on a car lot. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and provide you with an amount and interest rate. A FICO score can be between 300 and 850. The higher the score the lower the interest rate you will be offered. People with a bad credit history may pay interest rates that are more than double prime rates. You can also shop for auto loans online if you aren't concerned about where your personal information goes. Armed with a pre-approved loan you are now in control and have a choice to go with dealer financing or stick with your bank, whichever rate is lower.

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It's your leverage in the negotiating process. If you don't have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don't worry, the dealer still makes a profit. There is something called “holdback” which the manufacturer gives the dealer for each vehicle. It's usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models. Need to learn the industry lingo? Check out our car buying glossary.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn't hit his quota.

Get a Free Online Quote

You can shop online and get instant automobile quotes at sites like CarsDirect and TrueCar. If you are not comfortable buying online you can always use their quotes to see if the traditional dealer will match the price. After the Covid-19 crisis many shoppers have preferred to buy online instead of haggling in showrooms. Some industry analysts expect the shift to stick after the crisis has passed. Online automotive shopping services Vroom and Carvana were recently valued at over $5 billion and $22 billion respectively, outpacing the values of traditional offline dealerships like Auto Nation and CarMax.

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some "buy here, pay here" dealerships specifically focus on subprime borrowers.

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that's a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year's model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it's a “salvage” should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it's best to avoid these.

Program Cars Are Often a Great Value

Something called a “program car” is usually an exceptional bargain. A program car is a one that was driven on company business by a manufacturer employee. They are driven very little and are well maintained. They usually have 10,000 miles or less on the odometer. Dealers pay low prices for them and are not shy to advertise them. They usually still have factory warranties. Still not convinced to buy used? Then consider insurance costs on a used car will typically be significantly less expensive than on a new one.

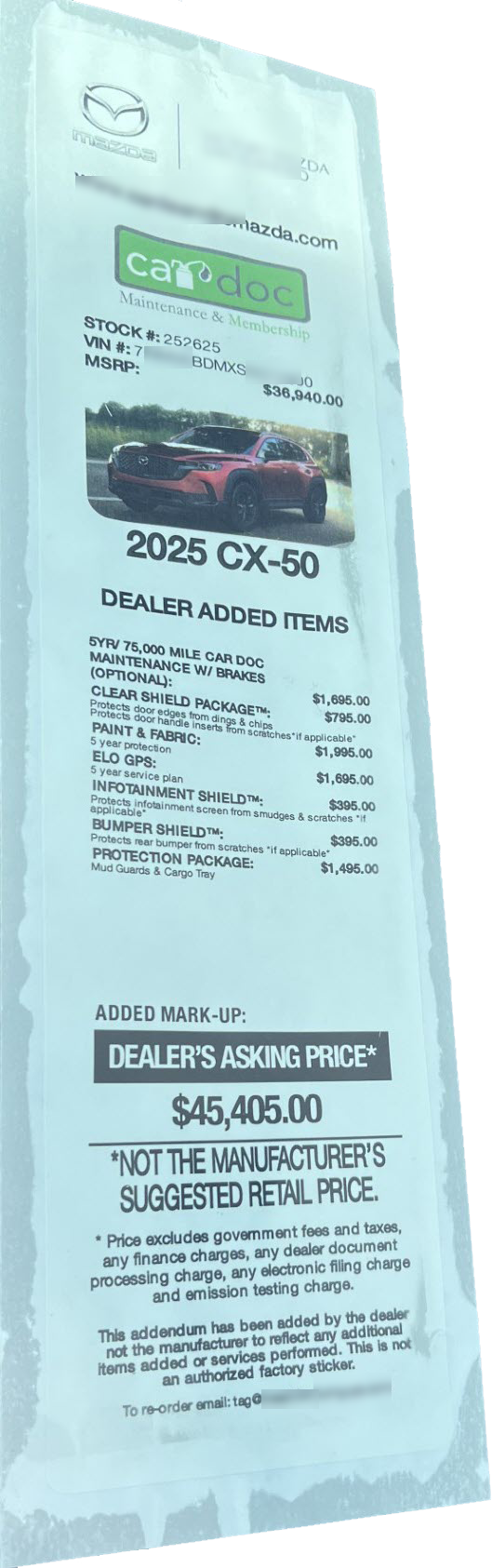

Dealer added items are an attempt for the dealership to juice their profit margins by adding junk fees to the car price. These junk fees are mostly items with zero or negligible value, where the dealership can then negotiate a starting price from above MSRP.

Dealer added items are an attempt for the dealership to juice their profit margins by adding junk fees to the car price. These junk fees are mostly items with zero or negligible value, where the dealership can then negotiate a starting price from above MSRP.

Push back on these junk fees and threaten to walk and the dealership will quickly suggest they can remove them, which means they were not a real expense already embedded in the car, but a phantom set of add ons.

When you shop in affluent areas with forthright dealerships you tend to typically be able to get some discount to MSRP, whereas the sort of lower end ghetto dealers who predate on people with poor credit you can expect lots of junk fees added.

The cost of said junk fees only gets worse if the car is financed, because then the buyer buys the junk fees twice - they pay the initial price & then the interest.

If you get the sense a dealer is being dishonest with you simply shop elsewhere rather than arguing against the absurdities.

The sticker to the right is for a Mazda CX-50. When my wife spoke on the phone with the dealer he said they had "hundreds" off CX-50s on the lot. When she got there she saw they had a total of 3 of the type of car she liked, and the remaining were other models.

We blurred out the domain name and business name of the San Leandro Mazda dealership, but you can see how their junk fees increased the car price from an MSRP of $36,940 to $45,405.

Their junk fees included:

If you objectively look at almost any of those fees they simply don't make sense. Examples:

The dealership left my wife with such a foul taste she left, and instead went for an Audi that was about $4,000 below MSRP, which made it cheaper than the Maza for $8,465 over MSRP.

When it comes to borrowing money, a wise shopper looks at the total cost of the loan, and not just at the monthly payment. Too many advertisements state only the monthly payment. You need to dig deeper to see the real story. In general, a lower interest rate will cost you less money. A $20,000 loan at 5% for 60 months (5 years) will cost you a total of $22,645.48, whereas the same loan at 3% will cost you $21,562.43. That's a savings of $1,083.05.

When it comes to borrowing money, a wise shopper looks at the total cost of the loan, and not just at the monthly payment. Too many advertisements state only the monthly payment. You need to dig deeper to see the real story. In general, a lower interest rate will cost you less money. A $20,000 loan at 5% for 60 months (5 years) will cost you a total of $22,645.48, whereas the same loan at 3% will cost you $21,562.43. That's a savings of $1,083.05.

That same wise shopper will look not only at the interest rate but also the length of the loan. The longer you stretch out the payments, the more expensive the loan will be. Let's take that same $20,000 loan above at 5% at 5 years and see how much we can save by paying it off in 3 years. So, $20,000 at 5% for 36 months will cost $21,579.05 saving you $1,066.43. Using the calculator above (assuming $0 down payment, $0 trade-in and 1% sales tax) you will see that the monthly payment for the 5 year loan is $377.42 and the monthly payment for the 3 year loan is $599.42. If you can easily handle the higher payment the savings are well worth it.

If your credit drastically improves & your initial loan was at a higher interest rate, it may be worth looking into refinancing at a lower rate.

Although it's convenient to trade in your old vehicle to the dealer at the time of purchasing another, it's not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice; from the Arizona Attorney General to the FTC. Don't underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it's extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a "for sale" sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!