This calculator makes it easy for home buyers to decide if it makes sense to buy discount points to lower the interest rate on their mortgage. It calculates how many months it will take for the discount points to pay for themselves along with the monthly loan payments and net interest savings.

For your convenience we list current El Monte mortgage rates to help homebuyers estimate their monthly payments & find local lenders.

Compare your potential loan rates for loans with various points options.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

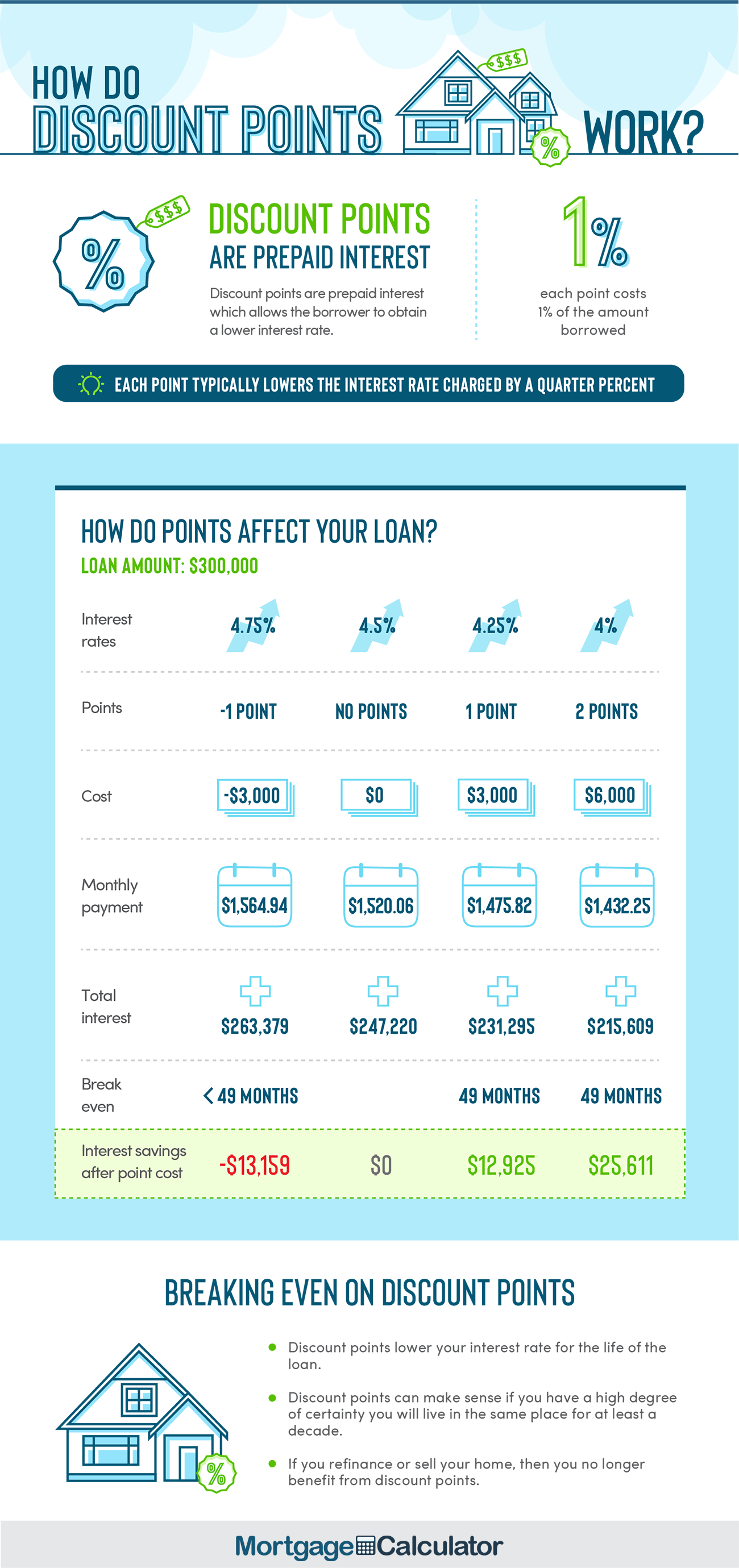

Discount points are a way of pre-paying interest on a mortgage. You pre-pay a lump sum of money and then obtain a lower interest rate for the duration of the loan.

Points cost 1% of the balance of the loan. If a borrower buys 2 points on a $200,000 home loan then the cost of points will be 2% of $200,000, or $4,000.

Each lender is unique in terms of how much of a discount the points buy, but typically the following are fairly common across the industry.

Fixed-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 1/8 (0.125%) to 1/4 of a percent (0.25%) for the duration of the loan. In most cases 1/4 of a percent is the default for fixed-rate loans.

Adjustable-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 3/8 of a percent (0.375%), though this discount only applies during the introductory loan period with the teaser-rate.

Cost of Discount Points

As mentioned above, each discount point costs 1% of the amount borrowed. Discount points can be paid for upfront, or in some cases, rolled into the loan.

Fractional Discount Points

Some lenders may offer loans with fractional discount points. In mortgage rate listing tables it is not uncommon to see a loan with 1.1 discount points.

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | None | 1 | 2 |

|---|---|---|---|

| Cost of Points | N/A | $2,000 | $4,000 |

| Interest Rate | 5.25% | 5.00% | 4.75% |

| Monthly Payment | $1,104.41 | $1,073.64 | $1,043.29 |

| Monthly Payment Savings | N/A | $30.77 | $61.12 |

| Months to Break Even | N/A | 49 | 49 |

| Loan Balance at Break Even Point | $187,493.46 | $186,966.78 | $186,423.08 |

| Interest Cost Over Life of Loan | $197,585.34 | $186,513.11 | $175,588.13 |

| Interest Savings Over Life of Loan | N/A | $11,072.22 | $21,997.21 |

| Net Savings (Interest Savings Less Cost of Points) | N/A | $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

Buying points is betting that you are going to stay in your home without altering the loan for many years.

Points are an upfront fee which enables the buyer to obtain a lower rate for the duration of the loan. This means the fee is paid upfront & then savings associated with the points accrue over time. The buyer spends thousands of Dollars upfront & then saves some amount like $25, $50 or $100 per month. After some number of years owning the home, the buyer ends up benefiting from the points purchase.

If the homeowner does any of the following early in the loan they'll forfeit most of the benefit of points:

The simple calculation for breaking even on points is to take the cost of the points divided by the difference between monthly payments. So if points cost you $2,000 and saved $40 per month then it would take 50 months to break even (2000/40 = 50).

This simplified method unfortnately leaves out the impact of the varying amounts owed on different home loans.

The balances on various loan options are repaid at different rates depending on the rate of interest charged and the amount of the loan. A more advanced calculation to figure out the break even point on points purchases also accounts for the difference in loan balances between the various options.

Our above calculator uses this option to figure the break even point, since if you wanted to refinance your loan or sell the home at some point the remaining balance on the loan would impact your finances at that point.

While a point typically lowers the rate on FRMs by 0.25% it typically lowers the rate on ARMs by 0.375%, however the rate discount on ARMs is only applied to the introductory period of the loan.

ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it. When that shift happens, points are no longer applied for the duration of the loan.

When using the above calculator for ARM loans, keep in mind that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money buying points.

| Loan Type | Fixed Introductory Period | Breakeven Point Must Be Less Than |

|---|---|---|

| 3-1 ARM | 3 years | 36 months, or whenever you think you would likely refinance |

| 5-1 ARM | 5 years | 60 months, or whenever you think you would likely refinance |

| 7-1 ARM | 7 years | 84 months, or whenever you think you would likely refinance |

| 10-1 ARM | 10 years | 120 months, or whenever you think you would likely refinance |

People who are likely to keep their current mortgage for a long time. They would have the following attributes:

If any of the above are not true, then points are likely a bad purchase. If you lose your job, think interest rates are headed lower, have bad credit, or plan on having kids and are buying a house where there is not enough room for the family then you are unlikely to benefit from buying points.

Points can be financed, or rolled into the loan. The big issue with financing points is you increase the loan's balance immediately. This in turn significantly increases the number of months it takes to break even.

In the examples shown in the table above financing the points would take the break even point from 49 months to 121 months for the loan with 1 point & 120 months for the loan with 2 points.

Living in the same home for over 4 years is common, so buying points which break even in 4 years is not a bad idea. Historically most homeowners have refinanced or moved homes every 5 to 7 years. Betting that you'll remain in place & not refinance your home for over a decade is typically a bad bet. For this reason it is not advisable to finance points.

Home mortgage points are tax-deductible in full in the year you pay them, or throughout the duration of your loan.

The IRS guidelines list the following requirements:

As mentioned above, mortgage points are tax deductible. Loan origination fees are not.

Loan origination fees can be expressed in Dollar terms or as points. A $200,000 loan might cost $3,000 (or 1.5%) to originate & process. This can be expressed either in Dollars or as 1.5 origination points.

Origination fees are negotiable but they help a lender cover their basic overhead & mitigate the risk a consumer may pre-pay their mortgage before the overhead is covered. On conforming mortgages this fee typically runs somewhere between $750 to $,1200.

These fees are typically incremented by half-percent. The most common fee is 1%, though the maximum loan origination fee is 3% on Qualified Mortgages of $100,000 or more.

Negative points, which are also referred to as rebate points or lender credits, are the opposite of mortgage points. Rather than paying an upfront fee to lower the interest rate of the loan, you are paid an upfront fee to be charged a higher interest rate for the duration of the loan.

An easy way to think of negative points is embedding closing costs in the interest rate charged on the loan.

Negative points typically come with some limitations.

Any loans which are advertised as having "no closing costs" typically have negative points embedded in them where the cost of originating the loan is paid through a higher rate of interest on the loan. This fee should be disclosed on your Loan Estimate (LE) and Closing Disclosure (CD).

Another term for covering the origination costs with a higher rate is "yield spread premium." These fees are the commission earned by a mortgage broker or loan officer in exchange for finding a loan.

When you obtain negative points the bank is betting you are likely to pay the higher rate of interest for an extended period of time. If you pay the higher rate of interest for the duration of the loan then the bank gets the winning end of the deal. Many people still take the deal though because we tend to discount the future & over-value a lump sum in the present. It is the same reason credit cards are so profitable for banks.

Buyers who are charged negative points should ensure that any extra above & beyond the closing cost is applied against the loan's principal.

If you are likely to pay off the home soon before the bank reaches their break even then you could get the winning end of the deal. There are many reasons a buyer might repay the loan soon including stock options which are coming due soon, an inheritance in the near future, or a professional flipper who only needs financing in the short term while they rehab the home.

In the above calculator the break even point calculates how long it takes for points to pay for themselves if a home buyer opts to buy mortgage discount points. A homeowner needs to live in the home without refinancing for an extended period of time for the points to pay for themselves.

If the home buyer is instead selling points, the opposite is true. Paying off the home sooner means making more money from the negative points. When a lender sells you negative points they are betting you will not pay off your home loan soon.

Rolling the savings from the negative points into paying on the loan's balance extends the period of time in which the points are profitable for the homebuyer.

The longer the homeowner pays a higher rate of interest the more they'll compensate the bank with that higher rate of interest. Eventually they will end up paying more interest than they otherwise would have.

For people employing negative points the break even date is the amount of time before the bank would get the better end of the deal if they were selling lender credits. Buyers who pay off the loan before the break even date while employing negative points will make money on the points.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!