If you are saving up for a home and want to know how long it will take to reach a specific downpayment percentage on the home please use this calculator. If you want to convert a home price to a downpayment percent please use the first calculator below. If you want to convert a monthly rental payment into a home loan payment and figure out how much you would need to put down to buy a home use the calculator behind the second tab below. This page offers 2 down-payment calculators which you can select between using the tabs below.

For your convenience we list current El Monte mortgage rates to help homebuyers estimate their monthly payments & find local lenders.

The following table shows current 30-year mortgage rates available in El Monte. You can use the menus to select other loan durations, alter the loan amount, or change your location.

A Note on Private Mortgage Insurance

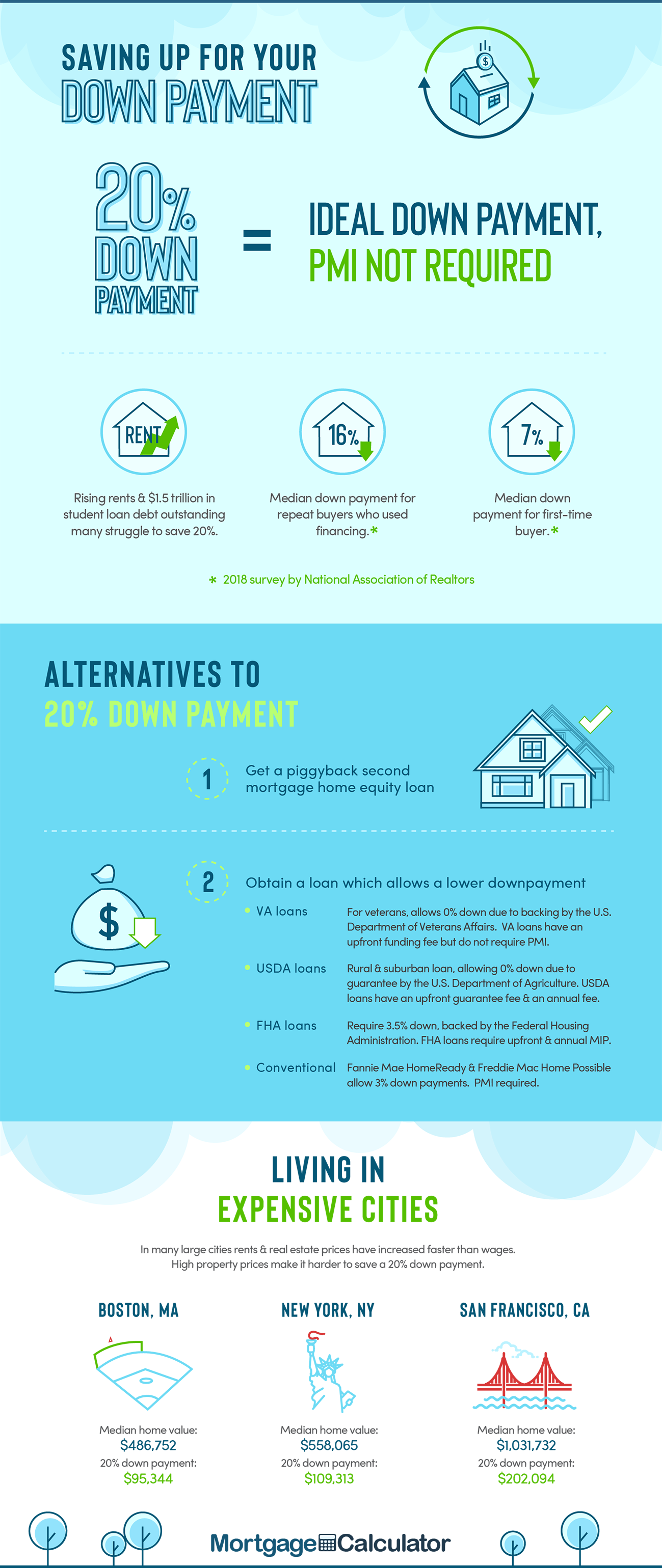

Those who pay at least 20% on a home do not require PMI, but homebuyers using a conventional mortgage with a loan-to-value (LTV) above 80% are usually required to pay PMI until the loan balance falls to 78%.

PMI typically costs from 0.35% to 0.78% of the loan balance per year. The annual payment amount is divided by 12 and this pro-rated amount is automatically added to your monthly home loan payment.

| Home Price | Down Payment | LTV | Loan Amount | Insurance Rate | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|

| $400,000 | $20,000 | 95% | $380,000 | 0.78% | $2,964 | $247.00 |

| $400,000 | $40,000 | 90% | $360,000 | 0.52% | $1,872 | $156.00 |

| $400,000 | $60,000 | 85% | $340,000 | 0.35% | $1,190 | $99.16 |

| $400,000 | $80,000 | 80% | $320,000 | not required | $0 | $0 |

Here are a range of down-payment amounts for median homes across the country. The average amount financed is 90%, so the average down-payment on a median existing home is $39,180 while the average down-payment on a median new home is $40,930. Closing costs are not included in these figures.

| October 2023 Price | 3% | 5% | 10% | 15% | 20% | |

|---|---|---|---|---|---|---|

| Median Existing Home | $391,800 | $11,754 | $19,590 | $39,180 | $58,770 | $78,360 |

| Median Existing Single-Family Home | $396,100 | $11,883 | $19,805 | $39,610 | $59,415 | $79,220 |

| Median Existing Condos & Co-ops | $356,000 | $10,950 | $17,800 |

$35,600 | $53,400 | $71,200 |

| Median Existing West Home | $602,200 | $18,060 | $30,110 | $60,220 | $90,330 | $120,440 |

| Median Existing Northeast Home | $439,200 | $13,176 | $21,960 | $43,920 | $65,880 | $87,840 |

| Median Existing South Home | $357,700 | $10,731 | $17,885 | $35,770 | $53,655 | $71,540 |

| Median Existing Midwest Home | $285,100 | $8,553 | $14,255 | $28,510 | $42,765 | $57,020 |

| Median New Home * | $409,300 | $12,279 | $20,465 | $40,930 | $61,395 | $81,860 |

| Average New Home * | $487,000 | $14,610 | $24,350 | $48,700 | $73,050 | $97,400 |

Sources: * Census.gov, all others NAR

Rules of thumb for quickly estimating down-payment amounts:

The above rules of thumb will skew slightly low because they do not include closing costs, which typically run between 2% to 5% of the home purchase price.

The more you can afford to put down on a house the less capital will accumulate interest. Further, outside of saving on interest payments, there is another benefit for putting down at least 20%.

For a standard conforming mortgage, it is ideal to put at least 20% down on the loan. Loans which have less than 20% down-payment have a loan-to-value (LTV) above 80% & are required to carry property mortgage insurance (PMI), which is an additional expense paid by the home buyer to insure the lender will get paid in case the homeowner can not make payments. These insurance payments must be made until the LTV falls below 80% & are automatically removed when the LTV falls to 78%.

PMI ranges from 0.3% to 1.5% of the initial loan amount, with the consumer's credit score & the down-payment amount factoring into the rate.

Some buyers may apply for a second mortgage to help pay part of their down-payment & remove PMI insurance requirements. This loan format is often referred to as a "piggyback loan," where a borrower pays 10% down on the home & uses the second mortgage for the next 10% down to avoid PMI payments.

Here is an illustrative chart of estimated monthly PMI costs based on a flat rate of 0.55%. Please note that as your down payment goes up the PMI rate is lower, so the savings on PMI by making a larger downpayment are more subtantial. When you put 20% down PMI is not required.

| October 2023 Price | 3% down | 5% down | 10% down | 15% down | 20% down | |

|---|---|---|---|---|---|---|

| Median Existing Home | $391,800 | $174.19 | $170.60 | $161.20 | $152.64 | $0 |

| Median Existing Single-Family Home | $396,100 | $176.10 | $172.47 | $163.39 | $154.31 | $0 |

| Median Existing Condos & Co-ops | $356,000 | $158.15 | $155.01 | $146.85 | $138.69 | $0 |

| Median Existing West Home | $602,200 | $267.73 | $262.21 | $248.41 | $234.61 | $0 |

| Median Existing Northeast Home | $439,200 | $195.26 | $191.24 | $181.17 | $171.11 | $0 |

| Median Existing South Home | $357,700 | $159.03 | $155.75 | $147.55 | $139.35 | $0 |

| Median Existing Midwest Home | $285,100 | $126.75 | $124.14 | $117.60 | $111.07 | $0 |

| Median New Home * | $409,300 | $181.97 | $178.22 | $168.84 | $159.46 | $0 |

| Average New Home * | $487,000 | $216.51 | $212.05 | $200.89 | $189.73 | $0 |

Sources: * Census.gov, all others NAR

Years to build 22% equity (& remove PMI payments) for a 30 year conforming loan, based on down-payment amount & loan interest rate.

| Down-payment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 8.5 | 7.5 | 6 | 4 |

| 4% | 9.5 | 8.5 | 6.5 | 4.5 |

| 5% | 10.5 | 9.5 | 7.5 | 5 |

| 6% | 11.5 | 10.5 | 8.5 | 5.5 |

| 7% | 12.5 | 11.5 | 9 | 6.5 |

| 8% | 13.5 | 12 | 10 | 7 |

| 9% | 14.5 | 13.5 | 11 | 8 |

| 10% | 15.5 | 14.5 | 12 | 9 |

Years to build 22% equity (& remove PMI payments) for a 15 year conforming loan, based on down-payment amount & loan interest rate.

| Down-payment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 3.5 | 3 | 2.5 | 1 |

| 4% | 4 | 3.5 | 2.5 | 1.5 |

| 5% | 4 | 3.5 | 2.5 | 1.5 |

| 6% | 4 | 4 | 3 | 2 |

| 7% | 4.5 | 4 | 3.5 | 2 |

| 8% | 5 | 4.5 | 3.5 | 2.5 |

| 9% | 5 | 4.5 | 3.5 | 2.5 |

| 10% | 5 | 5 | 3.5 | 2.5 |

If the value of your home increases significantly during the loan, you may be able to get PMI removed quicker than shown in the above charts if the bank recognizes the increased value of your home. To do so, you will have to contact your lender when your LTV is below 80% to request the removal of PMI.

It is possible to buy a home with little or no money down, however the ability to do so depends on how tight lending standards are, the background of the applicant & the credit quality of the applicant. Some programs are available exclusively to military members, low income communities & first time home buyers.

Typical banks want at least a 3% down-payment & PMI to insure loans. Loans with a 3% down-payment are called Conventional 97 mortgages.

Fannie Mae has approved mortgage lenders to offer a HomeReady lending program that only requires a 3% down-payment. The program can be used by first-time & repeat home buyers to finance or refinance a home in lower-income & minority-heavy areas. The minimum credit score for HomeReady loan qualification is 620.

Freddie Mac offers 2 low down-payment mortgage options.

Their Home Possible program requires a 5% down-payment & can be used on most types of property using a variety of fixed & adjustable rate loan terms.

Home Possible Advantage requires a 3% down-payment, but can allow up to 105% financing when combined with a second mortgage. These can only be applied to fixed-rate mortgages on primary residences.

Some federal loan programs may come with the ability to buy a home with little to no money down.

All-cash buyers represent a small segment of the overall home buying market.

Traditionally most home buyers in the United States have financed their home purchases. According to the National Association of Realtors, in 2016, 88% of home buyers used mortgage financing.

Before many cash-rich buyers from China & other countries purchased escape hatch homes the percent of buyers leveraging financing has historically ranged between 92% & 93%.

A big part of what controls the average down-payment largely comes down to what loan programs are popular at the time. For example, in 2013 the FHA significantly increased fees associated with their loan programs, which in turn has made conventional mortgage loans relatively more attractive & increased the market-share of conventional loans.

Here is the breakdown of buyers by financing type.

| Mortgage Type | % of buyers in 2016 |

|---|---|

| fixed | 92% |

| adjustable | 8% |

| conventional | 59% |

| FHA | 24% |

| VA | 12% |

| Generation | Used Financing | Down-payment | Amount Financed |

|---|---|---|---|

| Gen Y | 98% | 7% | 93% |

| Gen X | 96% | 10% | 90% |

| Baby Boomers | 76% | 17% | 83% |

| Silent Generation | 58% | 22% | 78% |

| Overall | 88% | 10% | 90% |

While a 20% down-payment is a popular benchmark, some borrowers can borrow up to 97% of a home's value with property mortgage insurance, while others leverage federal programs with no down-payment requirements. One of the primary determinants of the percent financed is how old the home buyer is. Here are 2016 home financing statistics based on the age of the home buyer.

| Buyer Age | Total | < 37 | 37 - 51 | 52 - 61 | 62 to 70 | 71 to 91 |

|---|---|---|---|---|---|---|

| Less than 50% | 9% | 6% | 5% | 10% | 19% | 20% |

| 50% to 59% | 4 | 1 | 4 | 3 | 7 | 11 |

| 60% to 69% | 4 | 2 | 4 | 5 | 10 | 11 |

| 70% to 79% | 11 | 8 | 12 | 15 | 14 | 16 |

| 80% to 89% | 23 | 24 | 24 | 25 | 16 | 22 |

| 90% to 94% | 14 | 18 | 15 | 9 | 10 | 2 |

| 95% to 99% | 21 | 26 | 23 | 17 | 10 | 6 |

| 100% – Financed entire purchase | 14 | 15 | 12 | 13 | 15 | 14 |

| Median percent financed | 90% | 93% | 90% | 86% | 81% | 76% |

| Buyer Age | Total | < 37 | 37 - 51 | 52 - 61 | 62 - 70 | 71 - 91 |

|---|---|---|---|---|---|---|

| < 6 months | 40% | 38% | 39% | 48% | 47% | 58% |

| 6 - 12 months | 15% | 18% | 14% | 9% | 8% | 6% |

| 12 to 18 months | 9% | 10% | 10% | 7% | 4% | 3% |

| 18 to 24 months | 7% | 8% | 8% | 4% | 4% | 2% |

| over 2 years | 29% | 24% | 27% | 30% | 35% | 31% |

| Buyer Age | Totals | < 37 | 37 to 51 | 52 to 61 | 62 to 70 | 71 to 91 |

|---|---|---|---|---|---|---|

| Have had application denied | 5% | 5% | 6% | 7% | 3% | 4% |

| Median number of times application was denied | 1 | 1 | 1 | 1 | 1 | 2 |

| Debt to income ratio | 15% | 18% | 20% | 13% | 9% | 7% |

| Low credit score | 14 | 14 | 22 | 16 | 3 | 3 |

| Income was unable to be verified | 6 | 4 | 12 | 10 | 3 | 7 |

| Not enough money in reserves | 4 | 3 | 7 | 3 | 1 | 6 |

| Insufficient downpayment | 3 | 4 | 4 | 4 | 3 | |

| Too soon after refinancing another property | 2 | 1 | 2 | 6 | 4 | |

| Other | 54 | 60 | 36 | 57 | 68 | 67 |

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!