This calculator will estimate the size of a mortgage you could afford based on your current monthly rent payment, your down-payment, and the expected property taxes and homeowners insurance.

We also list current Exton mortgage rates to help you perform your calculations and find a local lender.

We use a singular PMI value in the above calculation, but typically the rate is slightly higher for low downpayment amounts & lower for loans with higher downpayments, shorter terms and/or higher credit scores. Homeowners who put at least 20% down do not need to pay for PMI. Buyers putting less than 20% down typically need to pay for PMI until the loan-to-value (LTV) falls to 78%, though they can request cancelation when it falls to 80%. The National Association of Realtors reported first time buyers put 7% down while the average downpayment across all buyers was 13%.

The following table shows current Exton 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

The above calculator uses your current rent payment as a baseline amount you can afford & presumes your finances are in order. It doesn't look at your debt-to-income ratio, credit score, or other factors banks may consider when determining who to lend to & what rate to charge them. Here are a couple related calculators which you can use to view your mortgage from a different perspective.

Property mortgage insurance (PMI) is an insurance policy which protects the lender in case the borrower defaults on their loan. It is typically structured as a monthly payment which is rolled into the homeowner's monthly mortgage payment. The rates can vary by lender and borrower, but the typical range falls in between 0.5% and 1% of the loan annually.

The property mortgage insurance rate is applied against the amount of the loan, so a larger loan means a higher monthly PMI payment.

The above calculator uses the same estimated PMI rate for various down payment amounts. However PMI rates are variable based on factors like:

Borrowers with a credit score above 620 and a decent down payment will get a better PMI rate than a high-risk borrower with little to no money down. In some cases high-risk borrowers may be charged as much as 4% for PMI. Instead of charging that higher rate of PMI some lenders will still offer a lower PMI rate and charge a higher interest rate on the loan. That can be mutually beneficial as the borrower can write off the interest they pay on their loan against their income.

If the PMI rate is 0.78% and a borrower obtained $190,000 for a home valued at $200,000, then the cost of PMI would be 0.0078 * $190,000 = $1,482/yr.

To calculate the monthly cost you would then divide the yearly cost by 12: $1,482/12 = $123.50 per month.

| Insurance Rate | Loan Amount | Annual Premium | Monthly Premium |

|---|---|---|---|

| 0.78% per year | $190,000 | $1,482 | $123.50 |

For a $95,000 mortgage on a $100,000 home if the borrower's credit score was the same the cost of PMI at the same rate would be half the above example.

When the loan closes, typically a borrower needs to pay for 2 months PMI upfront.If a person had a low FICO score they might be charged as much as 4.19%. On the same $190,000 loan that could increase the monthly PMI payment to $663.42.

A larger down payment on a home lowers the cost of PMI, since the home buyer would both borrow less and have a lower LTV. Examples of how the down payment can impact PMI costs shown below.

| Home Price | Down Payment | LTV | Loan Amount | Insurance Rate | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|

| $400,000 | $20,000 | 95% | $390,000 | 0.78% | $2,964 | $247.00 |

| $400,000 | $40,000 | 90% | $360,000 | 0.52% | $1,872 | $156.00 |

| $400,000 | $60,000 | 85% | $340,000 | 0.35% | $1,190 | $99.16 |

| $400,000 | $80,000 | 80% | $320,000 | not required | $0 | $0 |

Each person is unique with unique circumstances. Some homes may have expensive HOA fees while other homes have big maintenance bills or heafty homeowners insurance policies.

That being said, using the median buyer for the median home gives you a sense of what is considered "normal" across broader society. Between 2018 and 2023 the median home buyer had a downpayment fo 13.664%, which represented 48.36% of their average median income. The median home buyer purchased a home valued at 3.482 times their annual income, with the debt being equivalent to 3.005 years of pretax income.

| Year | Month | Income | Down Payment | Downpayment | Loan Amount | Property Value | LTV | Price to Income | Loan to Income |

|---|---|---|---|---|---|---|---|---|---|

| 2018 | Jan | $77,000 | $32,000 | 12.698% | $220,000 | $252,000 | 87.302% | 3.273 | 2.857 |

| 2018 | Feb | $79,000 | $31,080 | 12.188% | $223,920 | $255,000 | 87.812% | 3.228 | 2.834 |

| 2018 | Mar | $80,000 | $32,800 | 12.768% | $224,100 | $256,900 | 87.232% | 3.211 | 2.801 |

| 2018 | Apr | $80,000 | $32,350 | 12.619% | $224,000 | $256,350 | 87.381% | 3.204 | 2.800 |

| 2018 | May | $81,000 | $33,000 | 12.692% | $227,000 | $260,000 | 87.308% | 3.210 | 2.802 |

| 2018 | Jun | $83,000 | $34,833 | 13.145% | $230,167 | $265,000 | 86.855% | 3.193 | 2.773 |

| 2018 | Jul | $83,000 | $34,547 | 13.158% | $228,000 | $262,547 | 86.842% | 3.163 | 2.747 |

| 2018 | Aug | $81,000 | $34,190 | 13.150% | $225,810 | $260,000 | 86.850% | 3.210 | 2.788 |

| 2018 | Sep | $80,000 | $33,750 | 13.132% | $223,250 | $257,000 | 86.868% | 3.213 | 2.791 |

| 2018 | Oct | $80,000 | $34,600 | 13.463% | $222,400 | $257,000 | 86.537% | 3.213 | 2.780 |

| 2018 | Nov | $81,000 | $35,200 | 13.538% | $224,800 | $260,000 | 86.462% | 3.210 | 2.775 |

| 2018 | Dec | $81,000 | $34,500 | 13.168% | $227,500 | $262,000 | 86.832% | 3.235 | 2.809 |

| 2019 | Jan | $82,000 | $33,336 | 12.797% | $227,164 | $260,500 | 87.203% | 3.177 | 2.770 |

| 2019 | Feb | $81,000 | $31,375 | 12.208% | $225,625 | $257,000 | 87.792% | 3.173 | 2.785 |

| 2019 | Mar | $82,000 | $31,856 | 12.136% | $230,644 | $262,500 | 87.864% | 3.201 | 2.813 |

| 2019 | Apr | $82,000 | $32,491 | 12.261% | $232,509 | $265,000 | 87.739% | 3.232 | 2.835 |

| 2019 | May | $84,000 | $33,079 | 12.225% | $237,500 | $270,579 | 87.775% | 3.221 | 2.827 |

| 2019 | Jun | $85,000 | $34,960 | 12.644% | $241,530 | $276,490 | 87.356% | 3.253 | 2.842 |

| 2019 | Jul | $84,000 | $35,420 | 12.880% | $239,580 | $275,000 | 87.120% | 3.274 | 2.852 |

| 2019 | Aug | $83,000 | $34,847 | 12.764% | $238,153 | $273,000 | 87.236% | 3.289 | 2.869 |

| 2019 | Sep | $81,000 | $33,058 | 12.244% | $236,942 | $270,000 | 87.756% | 3.333 | 2.925 |

| 2019 | Oct | $81,000 | $34,240 | 12.559% | $238,400 | $272,640 | 87.441% | 3.366 | 2.943 |

| 2019 | Nov | $82,000 | $35,080 | 12.756% | $239,920 | $275,000 | 87.244% | 3.354 | 2.926 |

| 2019 | Dec | $83,000 | $34,500 | 12.410% | $243,500 | $278,000 | 87.590% | 3.349 | 2.934 |

| 2020 | Jan | $82,000 | $34,516 | 12.556% | $240,384 | $274,900 | 87.444% | 3.352 | 2.932 |

| 2020 | Feb | $83,000 | $33,010 | 11.874% | $244,990 | $278,000 | 88.126% | 3.349 | 2.952 |

| 2020 | Mar | $84,000 | $32,074 | 11.455% | $247,926 | $280,000 | 88.545% | 3.333 | 2.952 |

| 2020 | Apr | $83,000 | $31,773 | 11.348% | $248,227 | $280,000 | 88.653% | 3.373 | 2.991 |

| 2020 | May | $82,000 | $30,213 | 10.860% | $248,000 | $278,213 | 89.140% | 3.393 | 3.024 |

| 2020 | Jun | $84,000 | $31,706 | 11.125% | $253,294 | $285,000 | 88.875% | 3.393 | 3.015 |

| 2020 | Jul | $85,000 | $35,100 | 11.959% | $258,400 | $293,500 | 88.041% | 3.453 | 3.040 |

| 2020 | Aug | $85,000 | $38,000 | 12.709% | $261,000 | $299,000 | 87.291% | 3.518 | 3.071 |

| 2020 | Sep | $84,000 | $38,331 | 12.777% | $261,669 | $300,000 | 87.223% | 3.571 | 3.115 |

| 2020 | Oct | $83,000 | $37,000 | 12.292% | $264,000 | $301,000 | 87.708% | 3.627 | 3.181 |

| 2020 | Nov | $83,000 | $39,000 | 12.787% | $266,000 | $305,000 | 87.213% | 3.675 | 3.205 |

| 2020 | Dec | $83,000 | $38,107 | 12.494% | $266,893 | $305,000 | 87.506% | 3.675 | 3.216 |

| 2021 | Jan | $83,000 | $35,171 | 11.698% | $265,500 | $300,671 | 88.302% | 3.623 | 3.199 |

| 2021 | Feb | $84,000 | $38,905 | 12.550% | $271,095 | $310,000 | 87.450% | 3.690 | 3.227 |

| 2021 | Mar | $87,000 | $40,000 | 12.500% | $280,000 | $320,000 | 87.500% | 3.678 | 3.218 |

| 2021 | Apr | $89,000 | $43,100 | 13.140% | $284,900 | $328,000 | 86.860% | 3.685 | 3.201 |

| 2021 | May | $89,000 | $42,800 | 12.970% | $287,200 | $330,000 | 87.030% | 3.708 | 3.227 |

| 2021 | Jun | $90,000 | $47,000 | 13.824% | $293,000 | $340,000 | 86.176% | 3.778 | 3.256 |

| 2021 | Jul | $89,000 | $47,500 | 13.971% | $292,500 | $340,000 | 86.029% | 3.820 | 3.287 |

| 2021 | Aug | $89,000 | $45,533 | 13.392% | $294,467 | $340,000 | 86.608% | 3.820 | 3.309 |

| 2021 | Sep | $87,000 | $47,000 | 13.824% | $293,000 | $340,000 | 86.176% | 3.908 | 3.368 |

| 2021 | Oct | $87,000 | $47,424 | 13.867% | $294,566 | $341,990 | 86.133% | 3.931 | 3.386 |

| 2021 | Nov | $88,000 | $49,525 | 14.191% | $299,475 | $349,000 | 85.809% | 3.966 | 3.403 |

| 2021 | Dec | $89,000 | $50,000 | 14.286% | $300,000 | $350,000 | 85.714% | 3.933 | 3.371 |

| 2022 | Jan | $89,000 | $49,900 | 14.261% | $300,000 | $349,900 | 85.739% | 3.931 | 3.371 |

| 2022 | Feb | $92,000 | $50,805 | 14.113% | $309,195 | $360,000 | 85.888% | 3.913 | 3.361 |

| 2022 | Mar | $97,000 | $54,001 | 14.473% | $319,113 | $373,114 | 85.527% | 3.847 | 3.290 |

| 2022 | Apr | $99,000 | $57,477 | 15.166% | $321,513 | $378,990 | 84.834% | 3.828 | 3.248 |

| 2022 | May | $103,000 | $60,978 | 15.838% | $324,022 | $385,000 | 84.162% | 3.738 | 3.146 |

| 2022 | Jun | $104,000 | $61,000 | 15.844% | $324,000 | $385,000 | 84.156% | 3.702 | 3.115 |

| 2022 | Jul | $102,000 | $60,070 | 16.019% | $314,930 | $375,000 | 83.981% | 3.676 | 3.088 |

| 2022 | Aug | $102,000 | $61,000 | 16.267% | $314,000 | $375,000 | 83.733% | 3.676 | 3.078 |

| 2022 | Sep | $101,000 | $56,778 | 15.345% | $313,222 | $370,000 | 84.655% | 3.663 | 3.101 |

| 2022 | Oct | $103,000 | $60,706 | 16.407% | $309,294 | $370,000 | 83.593% | 3.592 | 3.003 |

| 2022 | Nov | $105,000 | $59,087 | 16.188% | $305,913 | $365,000 | 83.812% | 3.476 | 2.913 |

| 2022 | Dec | $105,000 | $57,312 | 15.702% | $307,688 | $365,000 | 84.298% | 3.476 | 2.930 |

| 2023 | Jan | $104,000 | $55,515 | 15.425% | $304,385 | $359,900 | 84.575% | 3.461 | 2.927 |

| 2023 | Feb | $105,000 | $53,990 | 14.792% | $311,000 | $364,990 | 85.208% | 3.476 | 2.962 |

| 2023 | Mar | $107,000 | $54,500 | 14.770% | $314,500 | $369,000 | 85.230% | 3.449 | 2.939 |

| 2023 | Apr | $108,000 | $54,970 | 14.811% | $316,167 | $371,137 | 85.189% | 3.436 | 2.927 |

| 2023 | May | $110,000 | $59,100 | 15.557% | $320,800 | $379,900 | 84.443% | 3.454 | 2.916 |

| 2023 | Jun | $111,000 | $58,419 | 15.337% | $322,471 | $380,890 | 84.663% | 3.431 | 2.905 |

| 2023 | Jul | $110,000 | $60,650 | 15.961% | $319,350 | $380,000 | 84.039% | 3.455 | 2.903 |

| 2023 | Aug | $110,000 | $61,775 | 16.266% | $318,000 | $379,775 | 83.734% | 3.453 | 2.891 |

| 2023 | Sep | $109,000 | $59,883 | 16.054% | $313,117 | $373,000 | 83.946% | 3.422 | 2.873 |

| 2023 | Oct | $110,000 | $61,500 | 16.492% | $311,400 | $372,900 | 83.508% | 3.390 | 2.831 |

| 2023 | Nov | $111,000 | $62,754 | 16.824% | $310,246 | $373,000 | 83.176% | 3.360 | 2.795 |

| 2023 | Dec | $110,000 | $58,742 | 15.876% | $311,258 | $370,000 | 84.124% | 3.364 | 2.830 |

| Average | $90,486 | $43,761 | 13.664% | $272,007 | $315,768 | 86.336% | 3.482 | 3.005 |

Source: 2023 Mortgage Market Activity and Trends [PDF]

If your down payment is 20% or more of the home's value you do not have to pay for PMI.

Some home buyers obtain a second mortgage to fill the gap between their down payment amount and the 20% down payment requirement to drop PMI. For example, if you bought a $250,000 home and had $20,000 as a down payment then you would get a second mortgage for an additional $30,000 so that the two added together to 20% of the value of the home.

With a conventional loan if you start off with PMI on your loan you are not required to keep paying PMI in perpetuity. Whenever a loan gets below 78% loan-to-value, lenders are automatically required to remove PMI. You can also request it gets removed earlier as soon as your loan gets at 80% LTV. The 80% LTV can be achieved by any of the following:

If your house has increased in value with the local market you may need to hire an appraiser to confirm the value of your house to your bank. This can typically cost around $400 to $500. Some banks may be less willing to trust the input of appraisers when dropping PMI, so ask your bank what their policies are before hiring an appraiser.

Finally, government-backed loan programs like VA & FHA loans have their own loan insurance policies.

More background information on PMI is available here.

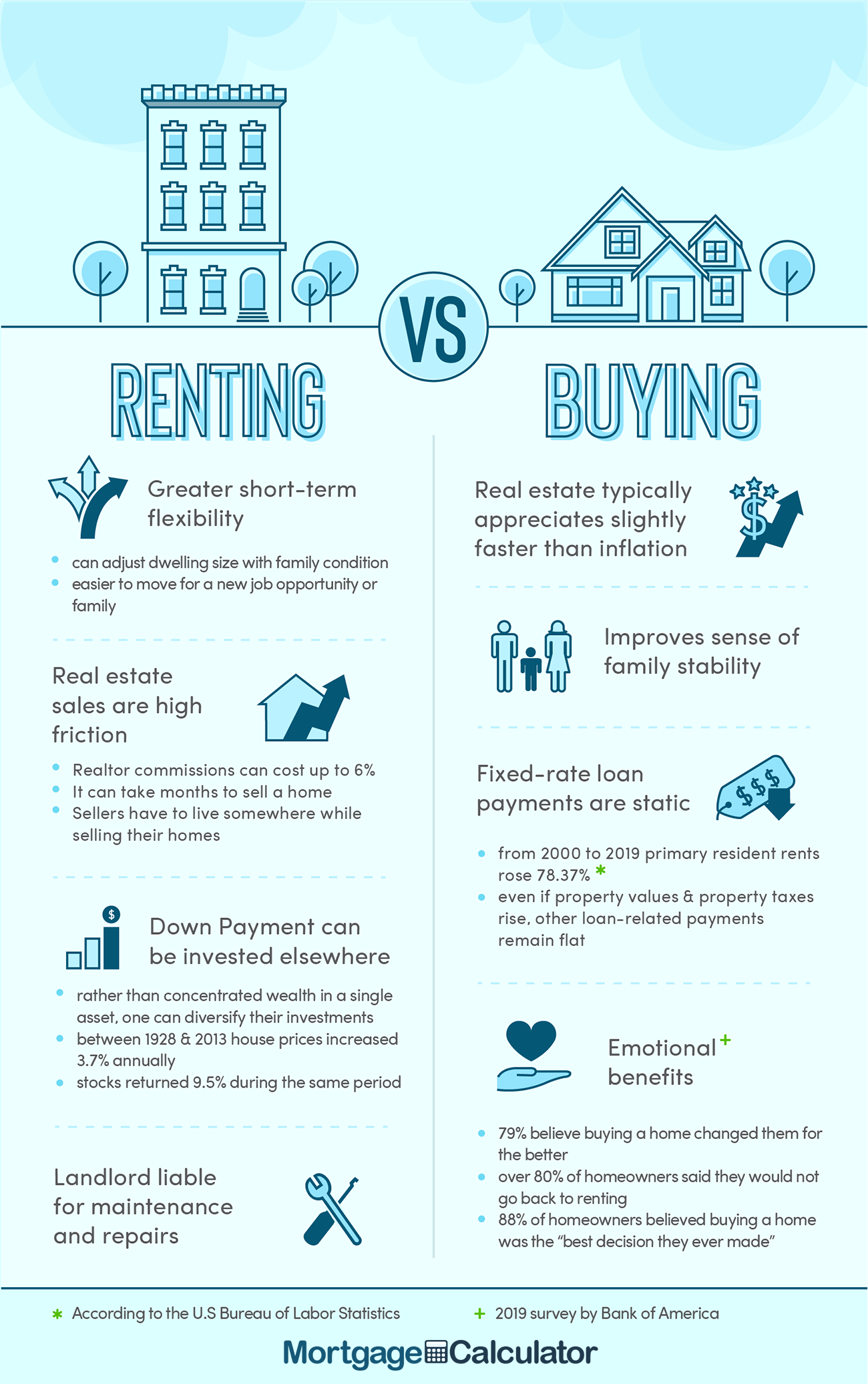

If rents rise and you own your home you are not exposed to increasing rents.

The United States offers homeowners a number of tax benefits. Mortgage interest expenses, closing costs, mortgage points, home equity interest expenses, and real estate taxes can be written off when calculating personal income taxes.

Unlike a car which typically depreciates as it ages, real estate usually appreciates due to the finite amount of land on the planet, growing global population & inflationary monetary policies from central banks. Homeowners not only benefit from the inflationary trends, but an individual selling their primary residence can exclude up to $250,000 of capital gains from federal income tax provided they meet certain requirements. Married couples can deduct up to twice that amount.

While homeownership is certainly sold as being part of the American Dream and offering a sense of security, homeownership can be more expensive than many people realize. For example, if you are 20 years into a 30 year mortgage and get laid off during a recession, it may be hard to find another job & it may be hard to tap the equity built up in your house due to tightening credit conditions. Missing a few payments could quickly lead to a foreclosure situation, even though the house had significant positive equity and a solid multi-decade payment history.

Many politicians promise free money, particularly at the later stages of bubbles.

As economic choices become less rational based on the economics, the decisions get marketed on an emotional dimension & get clouded by the promise of free money.

For example, in the run up to the American financial crisis of 2008/2009 the housing bubble was primed with the following sales pitch for "the American Dream."

What was the outcome of the above "dream" speech pitching a new taxpayer-backed American Dream Downpayment Fund to make housing affordable?

A disaster.

The bubble crashed, leading to a wave of foreclosures and declining home ownership rates.

The promises of affordable housing plans rarely work as marketed.

Behind efforts to sell the dream was a pyramid of fraud...

...and while the outcome was predictable, those in power were shocked & nobody who caused the mess was held accountable.

In China government subsidies are offered to help rural migrants from the countryside move to urban areas, but if the prices of the associated real estate were allowed to fall such subsidies wouldn't be needed. It would be more efficient to give the homes away or let their prices fall & have the apartments sold at a lower price than to lock a person in debt at a higher property value propped up by subsidies. Rather than those subsidies benefiting buyers they ultimately benefit property developers.

Rather than down payment assistance schemes making housing more affordable, they are usually intentionally flawed programs designed to flow funds to selected parties. The outcome is an acceleration of home price increases until the debt carrying cost exceeds the value of the underlying asset to the point the narrative falls apart. Then the speculative bubble blows up in spite of the program. The outcome of the United Kingdom's Help to Buy and Help to Buy London will mirror the above American Dream Downpayment Fund.

The ability to buy a house does not mean one necessarily should buy a house. Nearly half of the people who get married in the United States also get divorced. Finances are a leading cost of divorce and assets encumbered by debt can be hard and expensive to distribute during divorces.

If you know you want to live in a location for an extended period of time then it can make sense to buy. Due to how mortgages amortize and the high cost of real estate transactions, it is advisable to avoid buying a home using debt unless you believe you will live in it for at least 5 years. If you think you may want to move again soon due to family changes, career opportunities, required education, or wanting to travel then it can make sense to rent so it is far easier for you to move without the stress of a high-cost & high-friction transaction.

If you plan on having kids make sure you consider your school district before buying a home, as sending a kid to a charter school can be quite expensive.

If you have a strong down payment on a house and plenty of cash savings then your personal leverage is limited. Whereas if you don't have a down payment saved up & no cash reserves then your leverage is theoretically infinite.

| Home Price | Down Payment | Home Debt | Liquid Cash Savings | Personal Leverage Ratio |

|---|---|---|---|---|

| $400,000 | $0 | $400,000 | $0 | infinite |

| $400,000 | $40,000 | $360,000 | $40,000 | 10:1 |

| $400,000 | $80,000 | $320,000 | $0 | 5:1 |

| $400,000 | $80,000 | $320,000 | $80,000 | 2.5:1 |

The problem with financial leverage is you never know when market conditions will shift, or when you might have a personal issue impacting either your income or your need for savings.

Other things to consider when thinking about buying a house are:

At any given point in time some part of the global economy is stagnating while another part of the economy is in a bubble.

These distortions can happen either:

Sometimes these conditions are obvious, but typically they are not unless one studies finance full time. If you look at a single market in isolation it can be hard to appreciate the market dynamics along with how quickly things may change. One has to be able to extract themselves from the influence of friends, marketing, and their daily experiences to subjectively view the local economy.

Worse yet, one of the hardest aspects of a real estate bubble is the whole time it is inflating you are still stuck paying rising rents, so even if you opt out of buying a house, you are still investing in the bubble through paying rising rents. The only way to opt out is to move to a cheaper location away from the bubble.

When market conditions turn dour and sellers are desperate buyers can move into the core markets or make other lifestyle upgrades.

Rarely is such a sharp contrast seen within 1 country with the cities in such close proximity.

While the US property market outside of San Francisco may not be in a Vancouver-like bubble, the mortgage market is now more centralized than it was before the financial crisis.

"The supply of mortgages in America has an air of distinctly socialist command-and-control about it. Some 65-80% of all new home loans are repackaged by organs of the state. The structure of these loans, their volume and the risks they entail are controlled not by markets but by administrative fiat. No one is keen to make transparent the subsidies and dangers involved, the risks of which are in effect borne by taxpayers.

...

Almost everyone in the business worries that regulation of the new mortgage originators which funnel loans to the government-guarantee firms is too loose."

There are many investing maxims which help you know if you are in a bubble. But a number of obvious ones are: real estate investment becoming a common topic of conversation, people with low wages owning multiple homes, a hockey stick graph price trend, construction cranes dotting the skyline in every direction, and developer financing of condo unit purchases.

The phrase "the market can stay irrational longer than you can stay solvent" applies to many lines of investing, but when it comes to real estate you still have to live somewhere even if the people around you are blowing a speculative bubble. So what do you do?

Real estate prices have historically followed real rates of inflation. At any given time some local markets will out-perform while others under-perform. If a market is already hot & has been for many years then buying in may guarantee future losses, as hot markets which get more expensive eventually lose steam. Markets can only get so expensive before they become unaffordable & must eventually correct. Whereas if you buy counter-cyclically you have a far greater margin of safety.

Put another way, a million dollar mansion in Alberta is probably a safer bet at this point than a $7 million tear down in Vancouver.

The millennials fleeing Vancouver are the front edge of a shift in taste as younger people who don't have as much wealth built up are more exposed to the impact of the rising rents and shifting economics.

Not only are individual markets variable in performance, but there is also the global macro impact of central bank rate setting policies. As interest rates rise the cost per thousand for a loan goes up, which in turn means the sales price of a house must fall for a new buyer to afford the same monthly payment.

If you buy while asset prices are inflated it is a better deal to buy in areas with higher property taxes where there are less bubble dynamics driving up home prices. If you buy in an area which does exhibit pro cyclical bubble dynamics then it is best to buy counter-cyclically.

If you buy a house at a low interest rate you lock in the low interest rate. That is fine so long as you plan on living in the home for the duration of the loan, but if you intend to sell the home in a few years then if the buyer is not a cash buyer they will need to pay less than you did for the home to have the same monthly payment.

If you buy a house when interest rates are higher you pay more interest on the loan, but if rates drop you can then refinance at a lower rate of interest.

If you own a home and have it paid off, you can't benefit from rising prices unless you either sell it or borrow against it. However, if you borrow against it then you end up missing out on much of the freedom offered by home ownership, as you must worry about making monthly payments. And while owning a more valuable home can sound nice on paper, the whole time real estate prices rise the local property taxes are also rising.

It can also be hard to either downsize or upsize while in a local bubble for fear of being out of market, or having the risk of carrying 2 properties at once. Further, people are far more likely to get fired during an economic downturn.

Real estate is an emotional purchase in which humans suffer from herding behavior.

Major crashes are more likely in markets where "real estate prices only go up" because the pain associated with a market crash are not part of the local memory.

The more obviously true something is, the less true it will eventually become.

“The basic cause, you know, embedded in psychology, was a pervasive belief that house prices couldn’t go down and everyone, virtually everybody, succumbed to that. But that’s the only way you get a bubble is when basically a very high percentage of the population buys into some originally sound premise. It’s quite interesting how that develops.”

“The originally sound premise that becomes distorted as time passes and people forget the original sound premise and start focusing solely on the price action. So the media investors, the mortgage bankers, the public, me, my neighbor… you name it — people overwhelmingly came to believe that house prices could not fall significantly. And since it was biggest asset class in the country and it was the easiest class to borrow against, it created probably the biggest bubble in our history.” - Warren Buffett

Garth Turner's Greater Fool blog is one of the best guides to the emotional narrative associated with bubble dynamics in real estate.

Most US consumers opt for fixed-rate 30 year mortgages. These loans lock in a fixed rate of interest for the duration of the loan. If interest rates go up the loan payments do not change. However, if one requires 30 years to pay off their home there is no guarantee their employment status and wages will remain steady or growing throughout that entire period. For this reason, we generally recommend 15 year fixed-rate mortgages over 30 year loans. The sooner your house is paid off the more freedom you have in terms of being able to travel, explore other job opportunities further away, and to be able to better take care of extended family.

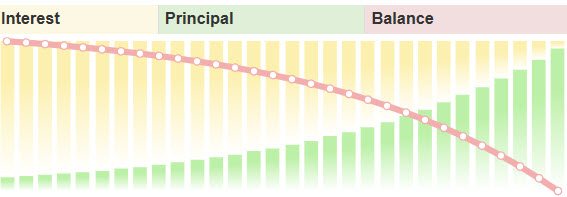

If you are uncertain if you can afford the higher monthly payments associated with a 15-year mortgage you may want to take a 30-year mortgage and make extra payments. Making extra payments early in the life of the loan has a huge impact on how long it will take to pay off the loan, as when people buy a 30-year mortgage they are buying the term rather than the amount of money & most of the early payments on such a loan go toward paying on interest. The following amortization graph makes this easy to visualize.

Make sure your extra payments are applied to the principal of the loan. Even one extra payment a year can shave many years off the life of the loan.

Fixed or Adjustable Rates?

Wealthy people who have a strong return on their investments & who are looking for a tax write off may prefer adjustable rates. But for people who have limited means the risk of an adjustable rate vastly exceeds the rewards of the lower initial teaser rate.

If you take a multi-hundred year look at bond prices, bonds have never been more expensive than they are today.

Bond prices and yields are reciprocals. As rates drop bonds get more expensive. The problem is as the bond bubble pops and rates rise, so will the monthly payments on adjustable rate or interest only mortgages.

When calculating the monthly payments on a fixed vs adjustable-rate loan don't consider only what the current payments will be, but also calculate what they payment might be at the rate cap on an adjustable rate mortgage, as there is no guarantee mortgage rates will stay as low as they are today over the next 30 years.

In fact, about 30 years ago mortgage rates topped out at over 18%!

The following graph shows how 30-year conventional mortgage rates are driven by the 10-year treasury constant maturity rate. It also shows how one can get a rate nearly as low as the 5-1 ARM teaser rate by obtaining a 15-year fixed mortgage.

In December of 2015 the Federal Reserve raised the Federal Funds rate for the first time since 2006. The hiking cycle ended a couple years later, then the country went into a zero interest rate environment after the spread of COVID-19. Inflation from the COVID-19 money printing caused the Federal Reserve to lift rates at the fastest rate in a century. The money printing helped push asset prices higher & real estate transaction volumes have fallen after rates normalized with mortgages reaching into the 7% to 8% range after touching lows around 3% a couple years prior.

If rates are likely to fall then adjustable rates may be a better option if there is a signficant rate reduction over fixed rates. If rates rise further then those who have adjustable rates will have wished they had either a 15-year or 30-year fixed rate loan.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted Exton lender.

Answer a few questions below and connect with a lender who can help you save today!