This calculator enables you to quickly calculate the intial and maximum monthly loan payments for any I-O adjustable-rate loan & see how those payments compare against a conforming 30-year fixed-rate mortgage payment. Interest only mortgages can provide you with very low initial monthly payments, however during the introductory I-O period you are not paying off any principal.

For your convenience here is a table listing current local interest rates. You can use these rates to estimate the price of various mortgage loan products.

The following calculator shows initial monthly payments for interest only mortgages of common term lengths & FRM home loans along with how one might expect the monthly payments to change over time. Click the [+] on the right side of the calculator to add details to any section. When you are done entering your details click on the [Calculate] button. You will then see graphs of the monthly payments for the different loan types. To view a more detailed report of the loans, click on the [View Report] button.

For your convenience we list current El Monte mortgage rates to help you perform your calculations and find a local lender.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

The above calculator calculates IO ARM loans. We also offer a regular ARM calculator.

All adjustable-rate loans have floating rates which adjust throughout the duration of the loan. Typically most loans are structured as hybrid loans with a fixed period with a low initial teaser rate followed by the floating period of the loan. If a loan is 3/1 that means the first 3 years has a fixed rate & then subsequently the rate resets based on some margin above a referenced index rate.

I-O loans act similarly to ther ARM loans with one major exception. During the initial teaser rate period of the loan the home buyer who is using an I-O loan will only pay interest on the loan. Once the introductor rate is over the loan will shift into something akin to a regular adjustable-rate loan. Loans with a long initial I-O period will have higher monthly payments subsequently. If a loan pays interest only for 3 years then when the loan shifts to acting like a regular ARM the remaining interest and the full principal of the loan will be required to be paid off in the subsequent 27 years. If the initial interest-only period lasts for 10 years then the full principal of the loan & the associated interest will be required to be paid off in the subsequent 20 years.

In general, each type of ARM has a different repayment and risk profile. The following table is for a 5/1 ARM, but it does a good job of showing how things change over time.

Here's a comparison of ARM loan payments against the two most popular types of fixed-rate mortgages, with all other things being equal, assuming an adjustment to the maximum payment cap.

| Loan Type | 5/1 Hybrid ARM | 5/1 I-O ARM | 15 Year ARM | 30 Year FRM |

|---|---|---|---|---|

| Initial Interest Rate | 3.622% | 3.888% | 3.058% | 3.675% |

| Max Interest Rate | 8.622% | 8.888% | 3.058% | 3.675% |

| YR 1 - 5 P&I Payment | $911.76 | $648.00 | $1,386.75 | $917.74 |

| YR 6 P&I | $1,117.07 | $1,274.94 | $1,386.75 | $917.74 |

| YR 7 P&I | $1,336.05 | $1,521.42 | $1,386.75 | $917.74 |

| Max P&I | $1,448.91 | $2,060.58 | $1,386.75 | $917.74 |

| Average P&I Payment | $1,344.56 | $1,771.12 | $1,386.75 | $917.74 |

| Balance YR 5 | $179,767.78 | $200,000.00 | $143,216.66 | $179,928.63 |

| Total Interest Over Loan | $284,041.73 | $437,601.00 | $49,614.80 | $130,386.51 |

Table presumptions:

Most adjustable-rate mortgages have an introductory period where the rate of interest and monthly payments are fixed. After the initial introductory period the loan shifts from acting like a fixed-rate mortgage to behaving like an adjustable-rate mortgage, where rates are allowed to float or reset each year. It is the dual nature of these loans which leads to them being called a hybrid ARM. If a loan is named a 5/1 ARM then what that means is the loan is fixed for the first 5 years & then the rate resets each year thereafter. The initial loan interest rate is frequently discounted below the "fully indexed" rate one would get by adding the margin to the indexed reference rate.

These loans are typically 30-year ARMs which enable the borrower to "pick-a-payment" between four amounts: a fully amortizing 30-year payment, a fully amortizing 15-year payment, an interest-only payment, and a specified minimum payment.

When borrowers consistently make pay-option payments below the accured interest the loan becomes negative amortizing, with the loan balance growing over time. Most option ARM contracts which allow for negative amortization have a maximium negative amortization limit (at 110% to 125% of the initial loan amount). When this neg am limit is reached the loan is recast & minimum payments are automatically shifted to the fully amortizing payment.

Payment caps are similar to rate caps, but they apply to how much your monthly payment can change each year rather than the rate of interest. If an Option-ARM has a payment cap of 6% and your monthly loan payment was $1,000 per month then the payment amount won't go above $1,060 the following year. Any unpaid interest on such an Option-ARM loan would then get added to the loan's balance, leading to negative amortization.

Option ARMs typically recast automatically every 5 years to adjust the ARM to payment amounts that will ensure the loan is paid off over the initial 30-year loan term.

If you only make the minimum payments near the end of a Payment-option ARM then you may also owe a balloon payment to pay off the remaining principal at the end of the loan.

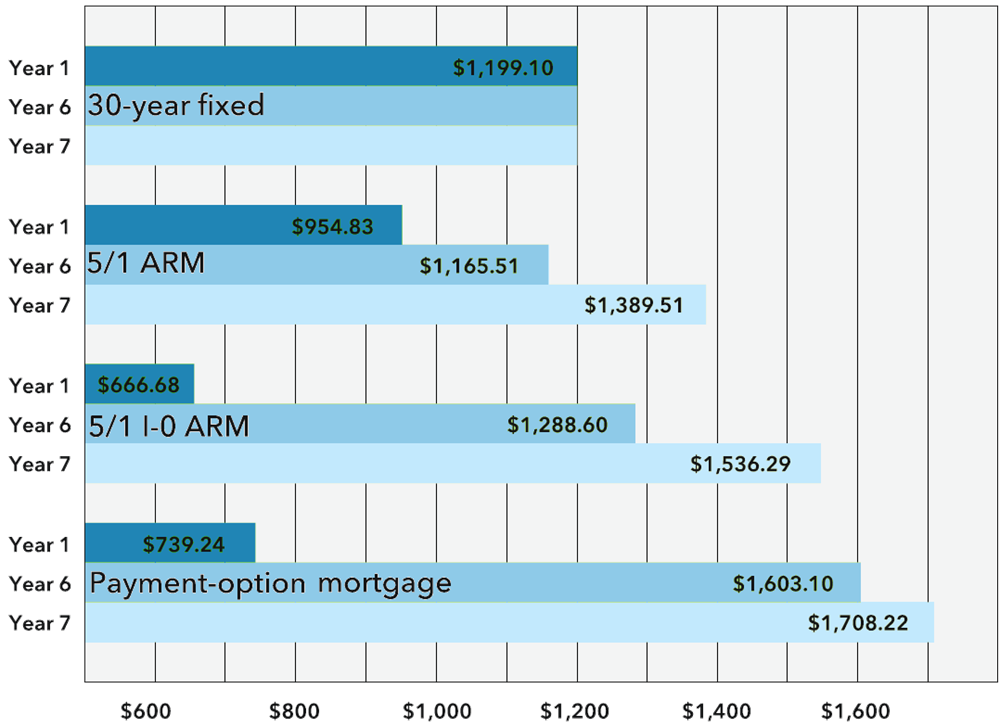

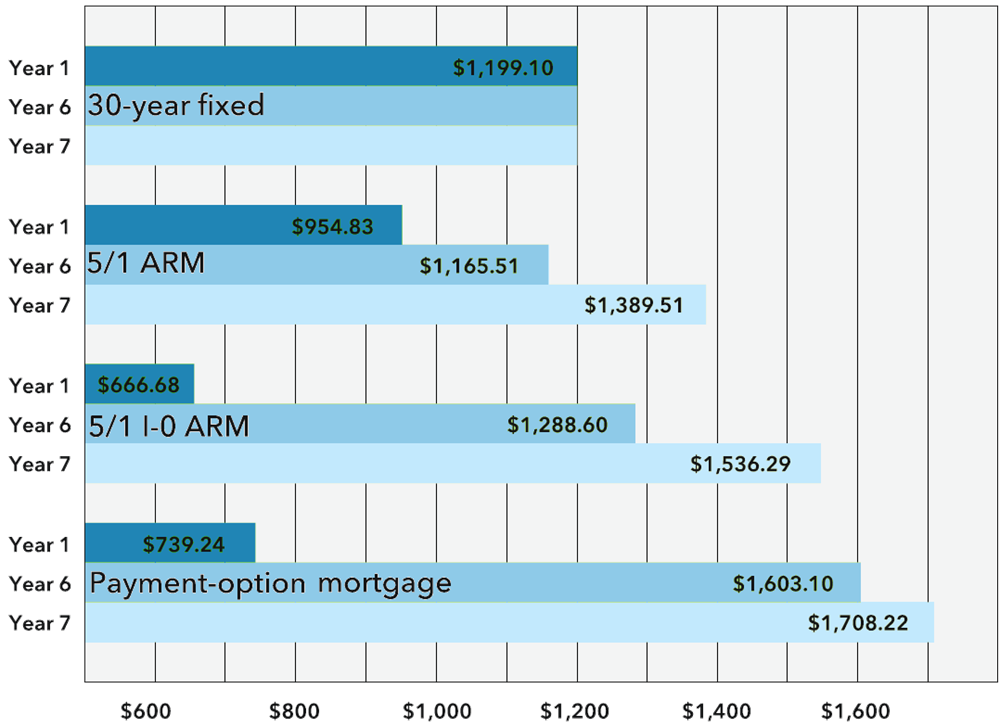

Here is a table courtesy the CFPB wich shows how loan payments can change over time for various types of ARM loans.

Lenders want to know you will be able to repay your loan before they make it. If a lender offers a "low doc" or "no doc" loan option that option will typically charge a higher rate of interest to make up for the added risk in lending you money.

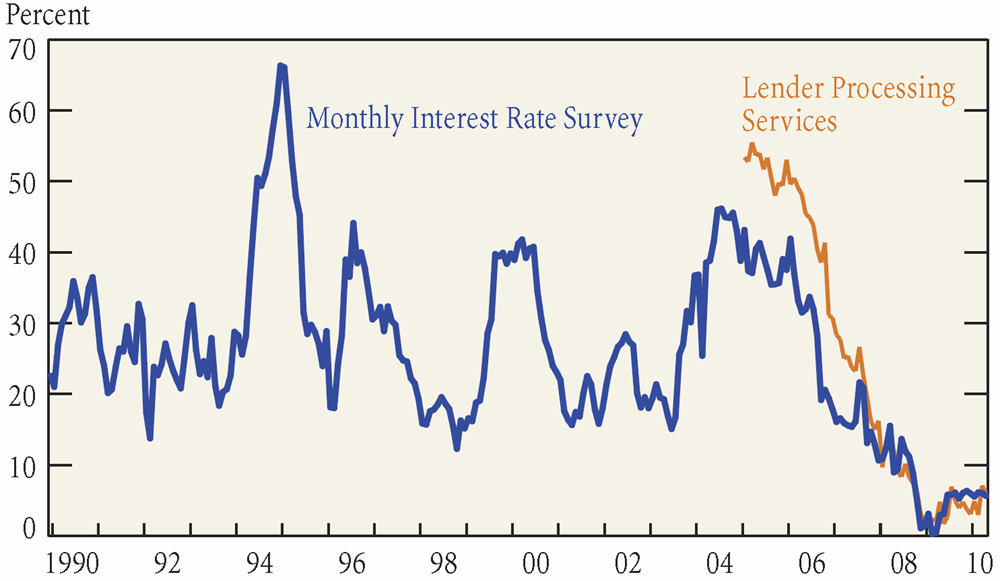

When interest rates are low fixed-rate mortgages represent the vast majority of the market, as lenders are unable to offer a large enough discount on ARMs for consumers to see the risk of a payment shock on rate resets as being justified. However when rates are higher many consumers opt for adjustable-rates in order to have lower upfront payments and/or to qualify for a larger loan.

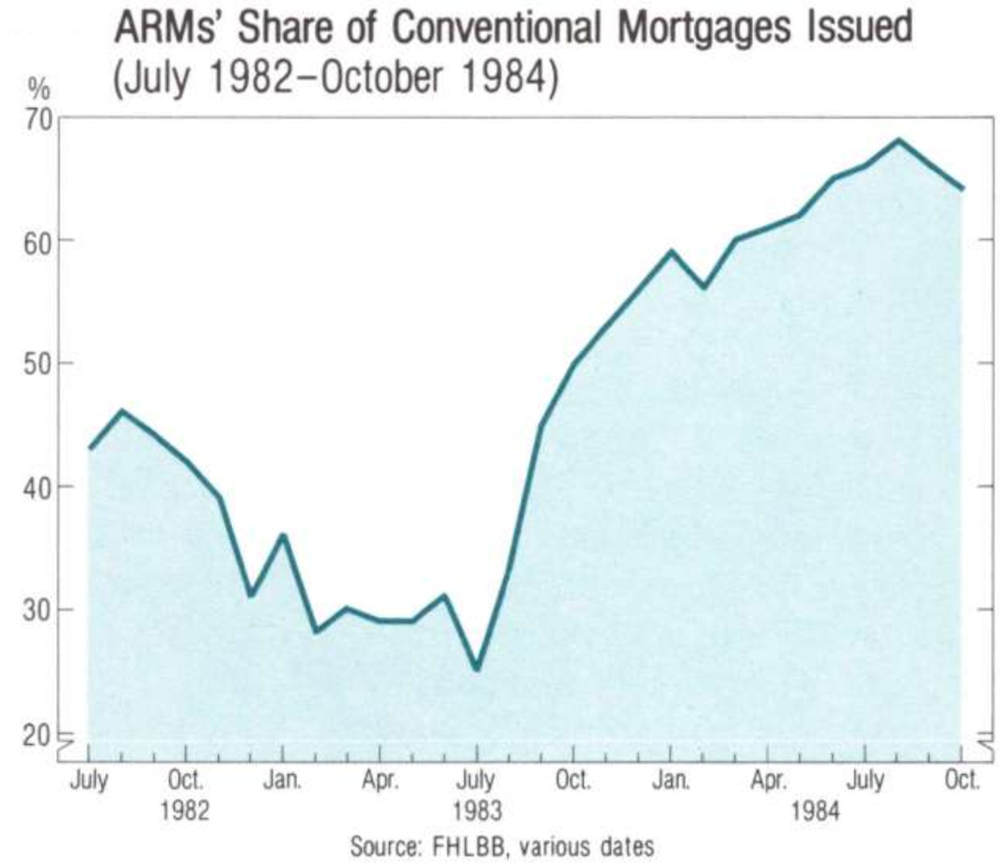

ARM loans were legalized nationally for federally chartered savings and loan institutions in 1981. By 1982 ARMs were widely issued with an estimated stock of $65 billion in loans by the end of the year. In 1983 $39 billion in additional stock was added. By 1984 ARMs accounted for about 60% of new conventional mortgages closed that year (exclusive of FHA & VA loans). Loan volumes grew so quickly that Freddie Mac tightened lending criteria in 1984 & Fannie Mae tightened their standards in 1985.

A similar spike in demand for ARMs happened in the early to mid 1990s. A smaller spike happened during the Internet stock bubble & there was an echo during the waning days of the early 2000s housing bubble.

Buying a home will probably be the biggest financial decision of your life. Make sure you understand your reference rate, margin & how your monthly loan payments might change in the worst case scenario before signing an ARM loan contract.

We offer a more in-depth guide to ARM loans & the CFPB published Consumer handbook on adjustable-rate mortgages, which offers consumers an introductory guide to ARM loans including a mortgage shopping worksheet. We've included an HTML version of their mortgage shopping worksheet below. You can also download this worksheet & bring it to your financial institution. We offer versions in the following formats: PDF, Word & Excel.

| Basic Loan Information | Fixed-Rate Mortgage | ARM 1 | ARM 2 | ARM 3 |

|---|---|---|---|---|

| Name of lender or broker & contact information | ||||

| Mortgage amount | ||||

| Loan term (e.g., 15 years, 30 years) | ||||

| Loan description (e.g., fixed rate, 3/1 ARM, payment-option ARM, interest-only ARM) |

||||

Basic Figures for Comparison |

Fixed-Rate Mortgage | ARM 1 | ARM 2 | ARM 3 |

| Fixed-rate mortgage interest rate and annual percentage rate (APR) (For graduated-payment or stepped-rate mortgages, use the ARM columns) |

||||

| ARM initial interest rate & APR How long does the initial rate apply? |

||||

| What will the interest rate be after the initial period? | ||||

| ARM Features How often can the interest rate adjust? |

||||

| What is the index and what is the current rate? | ||||

| How low could the interest rate go on this loan? | ||||

| What is the payment cap? | ||||

| Can this loan have negative amortization (that is, increase in size)? | ||||

| What is the limit to how much the balance can grow before the loan will be recalculated? | ||||

| Is there a prepayment penalty if I pay off this mortgage early? | ||||

| How long does the penalty last? How much is it? | ||||

| Is there a balloon payment on this mortgage? If so, what is the estimated amount and when would it be due? |

||||

| What are the estimated origination fees and charges for this loan? | ||||

Monthly Payment Amounts |

Fixed-Rate Mortgage | ARM 1 | ARM 2 | ARM 3 |

| What will the monthly payments be for the first year of the loan? | ||||

| Does this include taxes & insurance? Condo or homeowner's association fees? If not, what are the estimates for these amounts? |

||||

| What will my monthly payment be after 2 months if the index rate... ... stays the same? |

||||

| ...goes up 2%? | ||||

| ...goes down 2%? | ||||

| What is the most my minimum monthly payment could be after 1 year? | ||||

| What is the most my minimum monthly payment could be after 3 years? | ||||

| What is the most my minimum monthly payment could be after 5 years? |

For any home loan you are interested in the lender should be able to give you the above information before requiring you to pay any nonrefundable fees. If you remain uncertain after speaking with your lender, please consider contacting a local housing counselor or call the U.S. Department of Housing and Urban Development toll-free at 800-569-4287.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!