Estimate Affordable Home Price & Monthly Loan Payments Based on DTI Ratios

Unsure how much you can afford to spend on a house? Use this calculator to figure home loan affordability from the lender's point of view. A table on this page shows front-end and back-end ratio requirements for conventional, FHA, VA and USDA loans.

Current El Monte mortgage rates are displayed below. Given the competitive rates offered by online lenders, you may be able to save thousands by financing online at today's rates.

How much money could you save? Compare lenders serving El Monte to find the best loan to fit your needs & lock in low rates today!

By default 30-yr fixed-rate home loans are displayed in the table below. Filters enable you to change the loan amount, duration, or loan type.

Buying a home can be expensive. The U.S. Census Bureau stated that the median price of a home in the United States was $321,500 in 2019, while the average price was $383,900. If you live in large metropolitan areas like New York, San Francisco or Los Angeles, you can expect to pay significantly more.

Historical United States median and average housing prices including land are published below.

| Period | Median | % Change | Average | % Change |

|---|---|---|---|---|

| 1963 | $18,000 | $19,300 | ||

| 1964 | $18,900 | 5.00% | $20,500 | 6.22% |

| 1965 | $20,000 | 5.82% | $21,500 | 4.88% |

| 1966 | $21,400 | 7.00% | $23,300 | 8.37% |

| 1967 | $22,700 | 6.07% | $24,600 | 5.58% |

| 1968 | $24,700 | 8.81% | $26,600 | 8.13% |

| 1969 | $25,600 | 3.64% | $27,900 | 4.89% |

| 1970 | $23,400 | -8.59% | $26,600 | -4.66% |

| 1971 | $25,200 | 7.69% | $28,300 | 6.39% |

| 1972 | $27,600 | 9.52% | $30,500 | 7.77% |

| 1973 | $32,500 | 17.75% | $35,500 | 16.39% |

| 1974 | $35,900 | 10.46% | $38,900 | 9.58% |

| 1975 | $39,300 | 9.47% | $42,600 | 9.51% |

| 1976 | $44,200 | 12.47% | $48,000 | 12.68% |

| 1977 | $48,800 | 10.41% | $54,200 | 12.92% |

| 1978 | $55,700 | 14.14% | $62,500 | 15.31% |

| 1979 | $62,900 | 12.93% | $71,800 | 14.88% |

| 1980 | $64,600 | 2.70% | $76,400 | 6.41% |

| 1981 | $68,900 | 6.66% | $83,000 | 8.64% |

| 1982 | $69,300 | 0.58% | $83,900 | 1.08% |

| 1983 | $75,300 | 8.66% | $89,800 | 7.03% |

| 1984 | $79,900 | 6.11% | $97,600 | 8.69% |

| 1985 | $84,300 | 5.51% | $100,800 | 3.28% |

| 1986 | $92,000 | 9.13% | $111,900 | 11.01% |

| 1987 | $104,500 | 13.59% | $127,200 | 13.67% |

| 1988 | $112,500 | 7.66% | $138,300 | 8.73% |

| 1989 | $120,000 | 6.67% | $148,800 | 7.59% |

| 1990 | $122,900 | 2.42% | $149,800 | 0.67% |

| 1991 | $120,000 | -2.36% | $147,200 | -1.74% |

| 1992 | $121,500 | 1.25% | $144,100 | -2.11% |

| 1993 | $126,500 | 4.12% | $147,700 | 2.50% |

| 1994 | $130,000 | 2.77% | $154,500 | 4.60% |

| 1995 | $133,900 | 3.00% | $158,700 | 2.72% |

| 1996 | $140,000 | 4.56% | $166,400 | 4.85% |

| 1997 | $146,000 | 4.29% | $176,200 | 5.89% |

| 1998 | $152,500 | 4.45% | $181,900 | 3.23% |

| 1999 | $161,000 | 5.57% | $195,600 | 7.53% |

| 2000 | $169,000 | 4.97% | $207,000 | 5.83% |

| 2001 | $175,200 | 3.67% | $213,200 | 3.00% |

| 2002 | $187,600 | 7.08% | $228,700 | 7.27% |

| 2003 | $195,000 | 3.94% | $246,300 | 7.70% |

| 2004 | $221,000 | 13.33% | $274,500 | 11.45% |

| 2005 | $240,900 | 9.00% | $297,000 | 8.20% |

| 2006 | $246,500 | 2.32% | $305,900 | 3.00% |

| 2007 | $247,900 | 0.57% | $313,600 | 2.52% |

| 2008 | $232,100 | -6.37% | $292,600 | -6.70% |

| 2009 | $216,700 | -6.64% | $270,900 | -7.42% |

| 2010 | $221,800 | 2.35% | $272,900 | 0.74% |

| 2011 | $227,200 | 2.43% | $267,900 | -1.83% |

| 2012 | $245,200 | 7.92% | $292,200 | 9.07% |

| 2013 | $268,900 | 9.67% | $324,500 | 11.05% |

| 2014 | $288,500 | 7.29% | $347,700 | 7.15% |

| 2015 | $294,200 | 1.98% | $352,700 | 1.44% |

| 2016 | $307,800 | 4.62% | $360,900 | 2.32% |

| 2017 | $323,100 | 4.97% | $384,900 | 6.65% |

| 2018 | $326,400 | 1.02% | $385,000 | 0.03% |

| 2019 | $321,500 | -1.50% | $383,900 | -0.29% |

| 2020 | $336,900 | 4.79% | $391,900 | 2.08% |

| 2021 | $397,100 | 17.87% | $464,200 | 18.45% |

| 2022 | $457,800 | 15.29% | $540,000 | 16.33% |

| 2023 | $427,400 | -6.64% | $511,100 | -5.35% |

| Yearly Average | 5.56% | 5.76% | ||

| Compounded Rate | 5.42% | 5.61% |

Understanding whether you can afford to buy a home depends on much more than just the selling price. Unless you've spent the last several years socking away everything you've earned, or you've come into a large inheritance or won some money, chances are good that you'll need to get a loan to pay for your home.

Understanding whether you can afford to buy a home depends on much more than just the selling price. Unless you've spent the last several years socking away everything you've earned, or you've come into a large inheritance or won some money, chances are good that you'll need to get a loan to pay for your home.

The Freddie Mac Primary Mortgage Market Survey for October 8, 2020 stated the average 30-year fixed-rate mortgage charges 2.87% with 0.8 fees / points. If you pay for the points upfront with other closing costs, and put 20% down on a home priced at the 2019 average you would need to save $76,780 while obtaining a loan for $307,120. Over the life of the loan you would need to repay the amount borrowed along with $286,406 in interest, for a total repayment of $593,526.

The lift in home prices from rampant money printing and elevated interest rates to cool inflation after the COVID-19 crisis changed the math dramatically in a few years. On October 26, 2023 the average 30-year fixed-rate mortgage had a 7.79% APR, while in 2023 the average home sold for $511,100.

If you pay for the points upfront with other closing costs, and put 20% down on a home priced at the 2023 average you would need to save $102,2200 while obtaining a loan for $408,880. Over the life of the loan you would need to repay the amount borrowed along with $649,723 in interest, for a total repayment of $1,058,603.

Interest rates charged to any individual borrower can fluctuate based upon:

Each person is unique with unique circumstances. Some homes may have expensive HOA fees while other homes have big maintenance bills or heafty homeowners insurance policies.

That being said, using the median buyer for the median home gives you a sense of what is considered "normal" across broader society. Between 2018 and 2023 the median home buyer had a downpayment fo 13.664%, which represented 48.36% of their average median income. The median home buyer purchased a home valued at 3.482 times their annual income, with the debt being equivalent to 3.005 years of pretax income.

| Year | Month | Income | Down Payment | Downpayment | Loan Amount | Property Value | LTV | Price to Income | Loan to Income |

|---|---|---|---|---|---|---|---|---|---|

| 2018 | Jan | $77,000 | $32,000 | 12.698% | $220,000 | $252,000 | 87.302% | 3.273 | 2.857 |

| 2018 | Feb | $79,000 | $31,080 | 12.188% | $223,920 | $255,000 | 87.812% | 3.228 | 2.834 |

| 2018 | Mar | $80,000 | $32,800 | 12.768% | $224,100 | $256,900 | 87.232% | 3.211 | 2.801 |

| 2018 | Apr | $80,000 | $32,350 | 12.619% | $224,000 | $256,350 | 87.381% | 3.204 | 2.800 |

| 2018 | May | $81,000 | $33,000 | 12.692% | $227,000 | $260,000 | 87.308% | 3.210 | 2.802 |

| 2018 | Jun | $83,000 | $34,833 | 13.145% | $230,167 | $265,000 | 86.855% | 3.193 | 2.773 |

| 2018 | Jul | $83,000 | $34,547 | 13.158% | $228,000 | $262,547 | 86.842% | 3.163 | 2.747 |

| 2018 | Aug | $81,000 | $34,190 | 13.150% | $225,810 | $260,000 | 86.850% | 3.210 | 2.788 |

| 2018 | Sep | $80,000 | $33,750 | 13.132% | $223,250 | $257,000 | 86.868% | 3.213 | 2.791 |

| 2018 | Oct | $80,000 | $34,600 | 13.463% | $222,400 | $257,000 | 86.537% | 3.213 | 2.780 |

| 2018 | Nov | $81,000 | $35,200 | 13.538% | $224,800 | $260,000 | 86.462% | 3.210 | 2.775 |

| 2018 | Dec | $81,000 | $34,500 | 13.168% | $227,500 | $262,000 | 86.832% | 3.235 | 2.809 |

| 2019 | Jan | $82,000 | $33,336 | 12.797% | $227,164 | $260,500 | 87.203% | 3.177 | 2.770 |

| 2019 | Feb | $81,000 | $31,375 | 12.208% | $225,625 | $257,000 | 87.792% | 3.173 | 2.785 |

| 2019 | Mar | $82,000 | $31,856 | 12.136% | $230,644 | $262,500 | 87.864% | 3.201 | 2.813 |

| 2019 | Apr | $82,000 | $32,491 | 12.261% | $232,509 | $265,000 | 87.739% | 3.232 | 2.835 |

| 2019 | May | $84,000 | $33,079 | 12.225% | $237,500 | $270,579 | 87.775% | 3.221 | 2.827 |

| 2019 | Jun | $85,000 | $34,960 | 12.644% | $241,530 | $276,490 | 87.356% | 3.253 | 2.842 |

| 2019 | Jul | $84,000 | $35,420 | 12.880% | $239,580 | $275,000 | 87.120% | 3.274 | 2.852 |

| 2019 | Aug | $83,000 | $34,847 | 12.764% | $238,153 | $273,000 | 87.236% | 3.289 | 2.869 |

| 2019 | Sep | $81,000 | $33,058 | 12.244% | $236,942 | $270,000 | 87.756% | 3.333 | 2.925 |

| 2019 | Oct | $81,000 | $34,240 | 12.559% | $238,400 | $272,640 | 87.441% | 3.366 | 2.943 |

| 2019 | Nov | $82,000 | $35,080 | 12.756% | $239,920 | $275,000 | 87.244% | 3.354 | 2.926 |

| 2019 | Dec | $83,000 | $34,500 | 12.410% | $243,500 | $278,000 | 87.590% | 3.349 | 2.934 |

| 2020 | Jan | $82,000 | $34,516 | 12.556% | $240,384 | $274,900 | 87.444% | 3.352 | 2.932 |

| 2020 | Feb | $83,000 | $33,010 | 11.874% | $244,990 | $278,000 | 88.126% | 3.349 | 2.952 |

| 2020 | Mar | $84,000 | $32,074 | 11.455% | $247,926 | $280,000 | 88.545% | 3.333 | 2.952 |

| 2020 | Apr | $83,000 | $31,773 | 11.348% | $248,227 | $280,000 | 88.653% | 3.373 | 2.991 |

| 2020 | May | $82,000 | $30,213 | 10.860% | $248,000 | $278,213 | 89.140% | 3.393 | 3.024 |

| 2020 | Jun | $84,000 | $31,706 | 11.125% | $253,294 | $285,000 | 88.875% | 3.393 | 3.015 |

| 2020 | Jul | $85,000 | $35,100 | 11.959% | $258,400 | $293,500 | 88.041% | 3.453 | 3.040 |

| 2020 | Aug | $85,000 | $38,000 | 12.709% | $261,000 | $299,000 | 87.291% | 3.518 | 3.071 |

| 2020 | Sep | $84,000 | $38,331 | 12.777% | $261,669 | $300,000 | 87.223% | 3.571 | 3.115 |

| 2020 | Oct | $83,000 | $37,000 | 12.292% | $264,000 | $301,000 | 87.708% | 3.627 | 3.181 |

| 2020 | Nov | $83,000 | $39,000 | 12.787% | $266,000 | $305,000 | 87.213% | 3.675 | 3.205 |

| 2020 | Dec | $83,000 | $38,107 | 12.494% | $266,893 | $305,000 | 87.506% | 3.675 | 3.216 |

| 2021 | Jan | $83,000 | $35,171 | 11.698% | $265,500 | $300,671 | 88.302% | 3.623 | 3.199 |

| 2021 | Feb | $84,000 | $38,905 | 12.550% | $271,095 | $310,000 | 87.450% | 3.690 | 3.227 |

| 2021 | Mar | $87,000 | $40,000 | 12.500% | $280,000 | $320,000 | 87.500% | 3.678 | 3.218 |

| 2021 | Apr | $89,000 | $43,100 | 13.140% | $284,900 | $328,000 | 86.860% | 3.685 | 3.201 |

| 2021 | May | $89,000 | $42,800 | 12.970% | $287,200 | $330,000 | 87.030% | 3.708 | 3.227 |

| 2021 | Jun | $90,000 | $47,000 | 13.824% | $293,000 | $340,000 | 86.176% | 3.778 | 3.256 |

| 2021 | Jul | $89,000 | $47,500 | 13.971% | $292,500 | $340,000 | 86.029% | 3.820 | 3.287 |

| 2021 | Aug | $89,000 | $45,533 | 13.392% | $294,467 | $340,000 | 86.608% | 3.820 | 3.309 |

| 2021 | Sep | $87,000 | $47,000 | 13.824% | $293,000 | $340,000 | 86.176% | 3.908 | 3.368 |

| 2021 | Oct | $87,000 | $47,424 | 13.867% | $294,566 | $341,990 | 86.133% | 3.931 | 3.386 |

| 2021 | Nov | $88,000 | $49,525 | 14.191% | $299,475 | $349,000 | 85.809% | 3.966 | 3.403 |

| 2021 | Dec | $89,000 | $50,000 | 14.286% | $300,000 | $350,000 | 85.714% | 3.933 | 3.371 |

| 2022 | Jan | $89,000 | $49,900 | 14.261% | $300,000 | $349,900 | 85.739% | 3.931 | 3.371 |

| 2022 | Feb | $92,000 | $50,805 | 14.113% | $309,195 | $360,000 | 85.888% | 3.913 | 3.361 |

| 2022 | Mar | $97,000 | $54,001 | 14.473% | $319,113 | $373,114 | 85.527% | 3.847 | 3.290 |

| 2022 | Apr | $99,000 | $57,477 | 15.166% | $321,513 | $378,990 | 84.834% | 3.828 | 3.248 |

| 2022 | May | $103,000 | $60,978 | 15.838% | $324,022 | $385,000 | 84.162% | 3.738 | 3.146 |

| 2022 | Jun | $104,000 | $61,000 | 15.844% | $324,000 | $385,000 | 84.156% | 3.702 | 3.115 |

| 2022 | Jul | $102,000 | $60,070 | 16.019% | $314,930 | $375,000 | 83.981% | 3.676 | 3.088 |

| 2022 | Aug | $102,000 | $61,000 | 16.267% | $314,000 | $375,000 | 83.733% | 3.676 | 3.078 |

| 2022 | Sep | $101,000 | $56,778 | 15.345% | $313,222 | $370,000 | 84.655% | 3.663 | 3.101 |

| 2022 | Oct | $103,000 | $60,706 | 16.407% | $309,294 | $370,000 | 83.593% | 3.592 | 3.003 |

| 2022 | Nov | $105,000 | $59,087 | 16.188% | $305,913 | $365,000 | 83.812% | 3.476 | 2.913 |

| 2022 | Dec | $105,000 | $57,312 | 15.702% | $307,688 | $365,000 | 84.298% | 3.476 | 2.930 |

| 2023 | Jan | $104,000 | $55,515 | 15.425% | $304,385 | $359,900 | 84.575% | 3.461 | 2.927 |

| 2023 | Feb | $105,000 | $53,990 | 14.792% | $311,000 | $364,990 | 85.208% | 3.476 | 2.962 |

| 2023 | Mar | $107,000 | $54,500 | 14.770% | $314,500 | $369,000 | 85.230% | 3.449 | 2.939 |

| 2023 | Apr | $108,000 | $54,970 | 14.811% | $316,167 | $371,137 | 85.189% | 3.436 | 2.927 |

| 2023 | May | $110,000 | $59,100 | 15.557% | $320,800 | $379,900 | 84.443% | 3.454 | 2.916 |

| 2023 | Jun | $111,000 | $58,419 | 15.337% | $322,471 | $380,890 | 84.663% | 3.431 | 2.905 |

| 2023 | Jul | $110,000 | $60,650 | 15.961% | $319,350 | $380,000 | 84.039% | 3.455 | 2.903 |

| 2023 | Aug | $110,000 | $61,775 | 16.266% | $318,000 | $379,775 | 83.734% | 3.453 | 2.891 |

| 2023 | Sep | $109,000 | $59,883 | 16.054% | $313,117 | $373,000 | 83.946% | 3.422 | 2.873 |

| 2023 | Oct | $110,000 | $61,500 | 16.492% | $311,400 | $372,900 | 83.508% | 3.390 | 2.831 |

| 2023 | Nov | $111,000 | $62,754 | 16.824% | $310,246 | $373,000 | 83.176% | 3.360 | 2.795 |

| 2023 | Dec | $110,000 | $58,742 | 15.876% | $311,258 | $370,000 | 84.124% | 3.364 | 2.830 |

| Average | $90,486 | $43,761 | 13.664% | $272,007 | $315,768 | 86.336% | 3.482 | 3.005 |

Source: 2023 Mortgage Market Activity and Trends [PDF]

Financial Leverage & Economic Risks

If you put 20% down on your home that investment is using 5x leverage. If you put 10% down that investment is using 10x leverage. The results of the above calculator can offer a rough idea of max loan qualification, however for most people it is better not to get close to the limit so they have a financial cushion in case of a layoff or a downturn in the broader economy.

When mortgage lenders evaluate your ability to afford a loan, they consider all the factors in the loan, such as the interest rate, private mortgage insurance and homeowner's insurance. They also consider your own financial profile, including how the monthly mortgage payment will add to your overall debt and how much income you are expected to make while you are paying for the home.

Obtaining Investment Returns

Those who are seeking investment returns will usually obtain higher returns in the stock market & stock investments are much more liquid & easier to sell than homes. Over the longterm real estate generally appreciates only slightly better than the inflation rate across the broader economy. Since 1963 U.S. residential real estate has appreciated about 5.42% per year in the United States. Over the past 140 years U.S. stocks have returned 9.2%.

Part of the real estate market appreciation has been homes becoming physically larger. In 1973 the average new home was 1,660 square feet and the median new house was 1,525 square feet. By 2015 the average new house was 2,687 square feet and the median new house was 2,467 square feet. Both average and median home sizes were up 62% and that was before the COVID-19 crisis accelerated the work from home movement.

Two criteria that mortgage lenders look at to understand how much you can afford are the housing expense ratio, known as the “front-end ratio,” and the total debt-to-income ratio, known as the “back-end ratio.”

The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want your monthly mortgage payment to exceed 28 percent of your gross monthly income. The monthly mortgage payment includes principle, interest, property taxes, homeowner's insurance and any other fees that must be included. These costs are commonly referred to as PITI, which is derived from: pincipal, interest, tax & insurance.

FRONT END RATIO FORMULA:

FER = PITI / monthly pre-tax salary; or

FER = PITI / (annual pre-tax salary / 12)

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by 0.28 and divide the total by 12. This will give you the monthly payment that you can afford.

Many lenders place more emphasis on the back-end ratio than the front-end ratio. In the next section we will display a table of widely used loan programs, along with the limits associated with each.

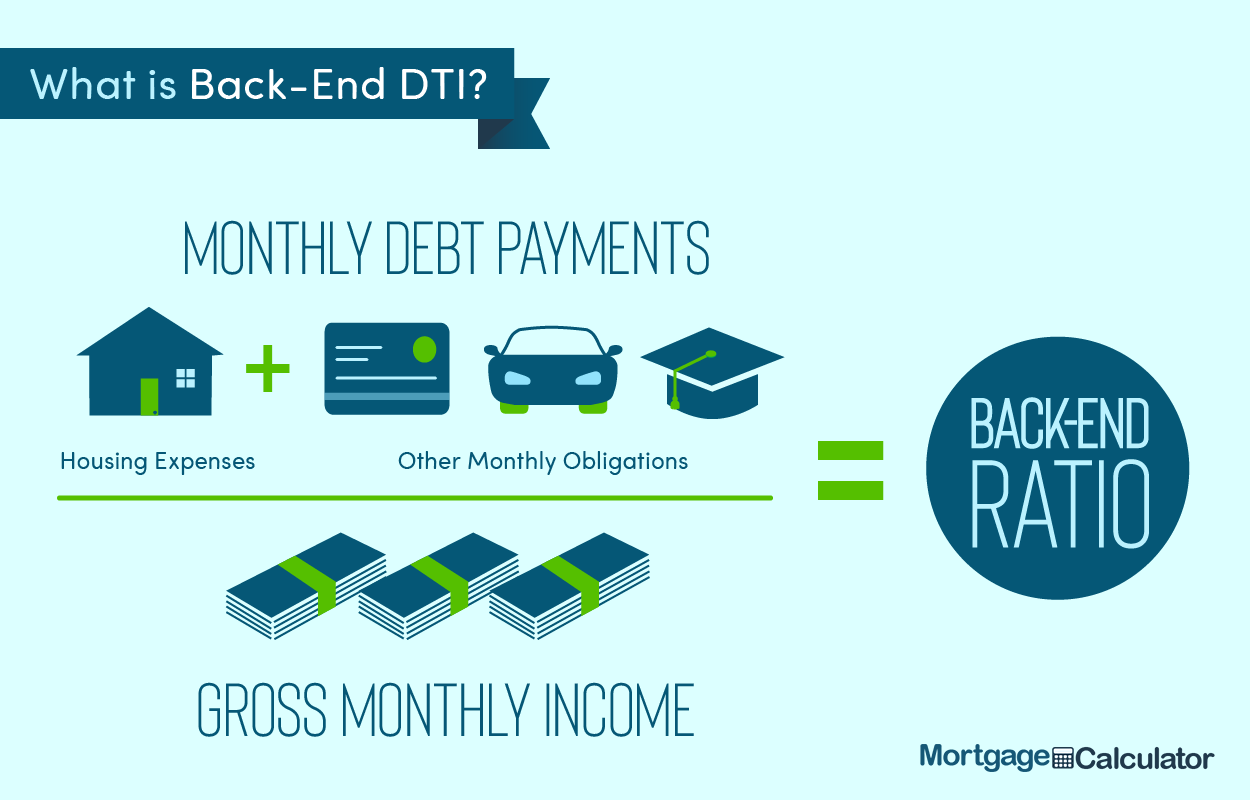

The debt-to-income, or back-end, ratio, analyzes how much of your gross income must go toward debt payments, including your mortgage, credit cards, car loans student loans, medical expenses, child support, alimony and other obligations. Most lenders do not want your total debts, including your mortgage, to be more than 36 percent of your gross monthly income.

Determining your monthly mortgage payment based on your other debts is a bit more complicated. Multiply your annual salary by 0.36 percent, then divide the total by 12. This is the maximum amount you can pay toward debts each month. Subtract your other debts — including your car payment, your student loan payment and other debt payments — from this amount to determine the maximum amount you can spend on your monthly mortgage payment.

Once you have the two numbers and a sense of the interest rate you may qualify for, you can use a mortgage calculator to determine the cost of the home that you can afford.

BACK END RATIO FORMULA:

FER = (PITI + all other monthly debt payments) / monthly pre-tax salary; or

FER = (PITI + all other monthly debt payments) / (annual pre-tax salary / 12)

The above calculator gives you all the answers you need in one stop — determining your front- and back-end ratios and compares it to the interest rate on the loan and the length of the loan. You can also enter information about the annual taxes and insurance on the home. You'll get a clear picture of just how much home you can afford in moments, with the results e-mailed to you in a plain-English and easy-to-understand format. Just enter your e-mail and you can even have a copy of your information saved for later & available to show lenders other real estate professionals.

Here is a table of common mortgage programs, who they cater to & what their limits are. Different lenders have different criteria for their maximum front- and back-end ratios and other factors that consider to determine how much you qualify to borrow. In particular, loan programs from the U.S. Department of Agriculture, Veterans Affairs and the Federal Housing Administration have very stringent criteria, which may also include specific caps on your income, regardless or how low your debt levels are.

| Loan | Who Should Use? | Front DTI | Back DTI | Hard Cap | Down | Additional Info |

|---|---|---|---|---|---|---|

| Baseline | 28% | 36% | 20% | Historical baseline for a great home buyer who qualifies for a competitive APR. 35% of borrowers who finance put at least 20% down - about 2/3 don't. Those who don't are usually required to get PMI until LTV drops below 80%. | ||

| Conventional | Most home buyers | back-end ratio more important | 36%-43% | 45%-50% | 3% to 20% | Every lender decided based on a variety of factors. Most borrowers choose FRM over ARM loans. 30-year FRM is the most popular option. MIP is similar to PMI, though lasts onger. |

| FHA | Borrowers with poor credit scores & limited downpayment | 31% | 43% | 57% | 3.5% | Higher ratios also require compensating factors for loan approval. Credit score above 580 ok, credit score from 500-579 require 10% downpayment. |

| VA | Active duty military members & veterans | back-end ratio more important | 41% | ~ 47% | 0% | Each veteran is considered based on a variety of factors. Approvals above 41% require an explanation. Both BAH and BAS are counted as income to help borrwers qualify. Loans have a relatively small funding fee. |

| USDA | Low-income rural | 29% | 41% | 41% | 0% | Maximum allowable income is 115% of local median income. Most of the land mass of the nation outside of large cities qualify for USDA. Top backend limit rises to 44% with PITI below 32%. A small funding fee of about 1% is added to the loan. |

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

"the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach."

Why Did They Suggest the Change?

"The Bureau is proposing a price-based approach because it preliminarily concludes that a loan’s price, as measured by comparing a loan’s annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumer’s ability to repay than DTI alone."

How Does This Impact Loan Qualification for Low-income Buyers?

"For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers."

Having the ability to buy something does not mean that one necessarily should. Owning a home is both a significant commitment and a serious lifestyle choice. Renting a home is a more flexible arrangement than buying. Here are some factors to consider beyond the above financial ratios.

1

Do you plan on living in the area for an extended period of time? Real estate transactions are typically large, leveraged, high-friction transactions. Between closing costs, real estate commissions & other related fees, many home buyers may spend about eight or nine percent of the home's price between buying and selling it. If you live in a place for a significant period of time the home appreciation can more than offset any costs, but if you only live there a couple years before moving again it is likely to cost you as the first few years of a loan's payments go primarily toward interest.

2

How secure is your source of income? If your job may require you to move then owning a home may harm your career flexibility. If you are in a field with high employee churn then renting may be a better option.

3

Will you be adding to your family in the near future? If you buy a house & quickly outgrow it, there's no guarantee that it will be easy to simulaneously sell your current home and buy a larger one.

4

What are the local market conditions? During many busts markets like Phoenix and Las Vegas have been cheap to buy in. Other markets like San Francisco and New York City are typically priced well above equivalent rent payments.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!