Are you currently renting and considering buying a home? Use this free online calculator to compare the financial costs and benefits of each option. This calculator considers rent appreciation, real estate appreciation, income tax deductions, and real estate transaction costs.

For your convenience current El Monte mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

How much money could you save? Compare lenders serving El Monte to find the best loan to fit your needs & lock in low rates today!

By default 30-yr fixed-rate loans are displayed in the table below. Filters enable you to change the loan amount, duration, or loan type.

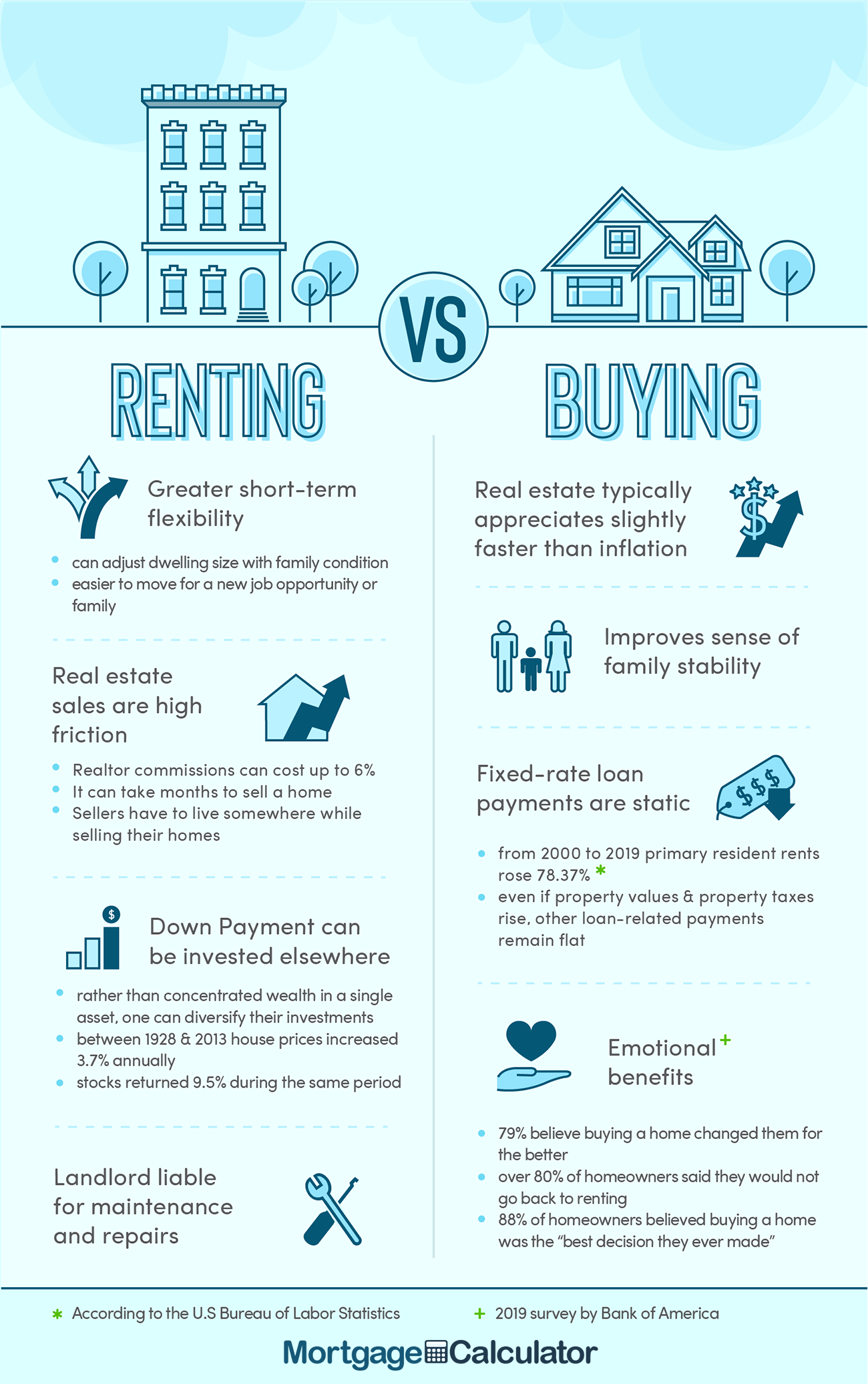

Conventional wisdom says that it's better to buy a home. Otherwise, you're just “wasting money” on rent that you could be putting toward building equity in your home and shoring up an investment that can stay with you until you retire.

However, from a purely economical standpoint, deciding whether to buy or rent a home may not always be so black and white. Your current financial circumstances and the state of the current housing market both play a big role in determining what is the right choice for you.

Real Estate Appreciation

One of the biggest advantages of buying a home is that you can build equity. There is no guarantee for home appreciation, since the unique qualities of the property and the neighborhood and city where it is located will have a big influence on its value, but most real estate experts agree that the average rate of appreciation is about 3 to 4 percent per year.

You could be one of the unlucky ones whose property nosedives in value, but on average, you can expect your home to increase in value over time.

Customize Your Dwelling

If you decide you want to add on to your home or knock down a wall, owning the property allows you to customize the home to better fit your needs and wants.

Federal Income Tax Deductions

You can deduct home mortgage interest on up to $750,000 of mortgage debt. Since you are likely to pay several thousand dollars in mortgage interest over the course of the year, this can add up to a significant savings at the end of the year.

Avoid Rising Rental Costs

Buying a home offers you the advantage of a fixed monthly payment (assuming you chose a fixed-rate mortgage rather than an adjustable-rate mortgage). When you rent a place, your landlord could increase your monthly rent each year. Some other expenses like maintanence, insurance and property taxes may rise as well, though those costs typically rise slower than rents since these costs are also inputs to landlords.

Owning a home can be unpredictable. The roof may spring a leak. The water heater may break. The heating system may need to be replaced. Termites may infect the wood. The septic tank may fail. These are all costly repairs. And then there are acts of nature which require insurance to protect against.

When you rent, your landlord is responsible for making repairs & insuring the property. When you own a home, you have to make them, and they can occur at any time and without any warning. You could find yourself thousands of dollars in debt — or living in a cold, damp house. When buying a condo the homeowner is still responsible for most of these types of repairs & must pay HOA dues.

Your property taxes and insurance could also increase from year to year with little notice.

Real estate is one of the most expensive investments most people will ever make. And the real estate market is rather illiquid with high transaction costs.

An Anchor Provides Stability, but Also Requires Stability Elsewhere

To make buying real estate worth it, you need to be somewhat stable in both your finances and your life. If you know that you don't plan to stay in the area for at least five or six years, buying may end up costing you much more in the long run.

If you try to sell your home before five or six years (or more, depending on the terms of your loan), you may not recoup all your expenses, including your down payment, closing costs and Realtor commission fees. Buying a second house before selling your first home can temporarily leave homeowners with 2 mortgage payments to make each month.

The real estate market can be unpredictable. When you buy your home, it may be a boom year. However, by the time you are ready to sell, home prices may have dropped dramatically, making it difficult, if not impossible, for you to sell at a profit.

Higher Returning & More Diversified Opportunities

The U.S. equity market has returned about 9.2% per year over the past 140 years. Further, when you invest in a diversified portfolio you can access liquidity by selling portions of it and periodically rebalancing your investments.

From 1963 to 2019 the median home price in the United States rose from $18,000 to $321,500, compounding at 5.28% annually. Over the same time period the average US home price increased from $19,300 to $383,900, for a 5.48% compounded annual rate of return.

The size of homes also increased significantly. In 1973 the average new home was 1,660 square feet and the median new house was 1,525 square feet. By 2015 the average new house was 2,687 square feet and the median new house was 2,467 square feet. Both average and median home sizes were up 62% and that was before the COVID-19 crisis accelerated the work from home movement.

After factoring in a 62% larger housing size, the annual RoR for the median house between 1963 and 2019 fell to 4.32% while the rate for the average house falls to 4.58%.

The following video from Kahn Academy discusses the real estate market.

Ultimately, only you can decide whether renting or buying is the right choice for you. However, the above calculator can help you run the numbers to get a strictly economical analysis to help you decide. You'll have to decide the value of being the owner of your own space and having the freedom to make the home your own. If you are still uncertain, a third option to consider is a rent-to-own property.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!