Discount points are an upfront fee which homeowners can pay to access lower mortgage rates. This calculator helps you discover if you should consider paying points on your home loan & calculate how quickly the points will pay for themselves.

For your convenience current El Monte mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

How much money could you save? Compare lenders serving El Monte to find the best loan to fit your needs & lock in low rates today!

By default 30-yr fixed-rates on $320000.00 loans are displayed in the table below. Filters enable you to change the loan amount, duration, or loan type.

There are two types of points you can pay on your mortgage loan:

Determining whether you "should" pay points on your loan depends on what your financial goals are and how the points will affect the other terms of the loan, such as the interest rate or the other closing costs.

What Are Discount Points?

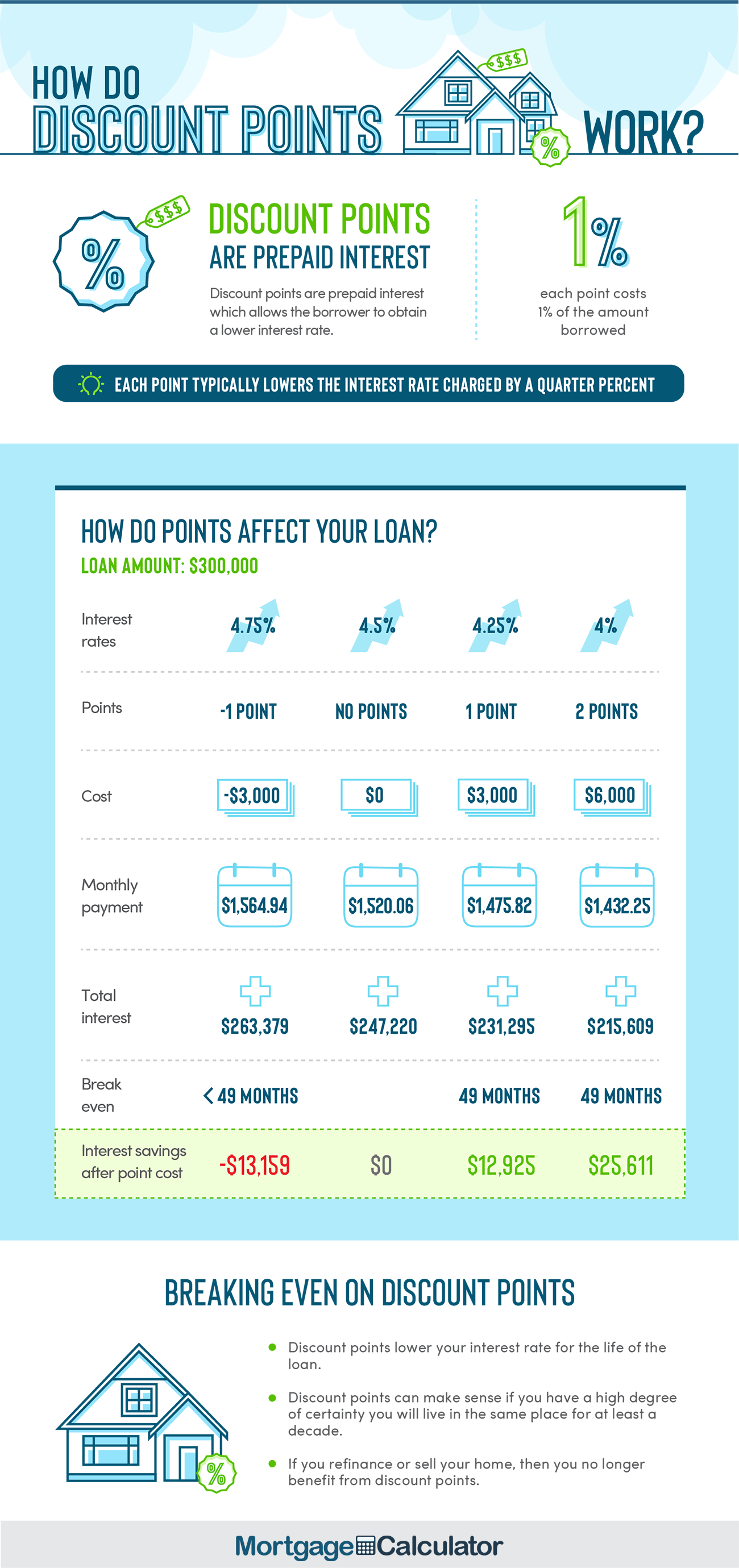

Discount points are paid to reduce the amount of interest you pay on the loan.

How Much Do Points Cost?

Every point on the loan is equal to 1 percent of the total loan cost. For example, 1 point on a $200,000 loan would be $2,000. If you paid 4 points, you would pay $8,000.

Can You Buy Partial Points?

Yes. Some lenders showcased in the above mortgage rate table list whole-number points while others may offer loans with no points or fractions of a point like 0.79 points.

How Many Discount Points Can I Buy?

The maximum number of points varies by lender, but it is uncommon for consumers to pay more than 4 discount points.

How Much Does a Point Lower Interest Rates?

The amount you can save on your interest rate by paying for points will vary by lender. However, for each loan point you purchase, you can typically reduce the interest rate on your loan by 1/8 percent or 1/4 percent. 25 basis points or a quarter of a percent is the most common value associated with a discount point.

How Are Points Treated for Tax Purposes?

Discount points are used to buy a lower interest rate throughout the loan. From a tax persepctive they are treated as pre-paid interest. Provided your mortgage document states the number of discount points which were purchased and the number of points you purchased is within the normal range where you live then you may deduct the cost of discount points from your income taxes.

Who Should Buy Points?

People who are confident they will live in their house for many years and do not expect to refinance in the next few years can save significant interest expenses over the life of their loan by buying discount points.

Who Should Avoid Points?

If you believe interest rates will head lower soon or you will be likely to refinance or sell the home and move you should not buy points as you are paying to lock in a lower rate for the duration of the loan. If you pay points and then refinance or sell the home a few years later you have paid the full cost of the points but did not obtain most of their benefits.

Can You Have Negative Points?

Yes. Negative mortgage points are known as a yield spread premium or rebate. Homeowners who have limited money for a downpayment may use a negative point to help cover some of the upfront loan closing costs.

Take the example of the $200,000 loan: If you have a 30-year fixed-rate loan with a 4.5 percent interest rate, your basic monthly mortgage payment would be $993.10. However, if you pay two points and your interest rate drops to 4 percent, your monthly payment would be $954.83.

Take the example of the $200,000 loan: If you have a 30-year fixed-rate loan with a 4.5 percent interest rate, your basic monthly mortgage payment would be $993.10. However, if you pay two points and your interest rate drops to 4 percent, your monthly payment would be $954.83.

Not only can paying points save you money every month, but it can also save you thousands in interest over the life of the loan.

The amount of time it takes for you to recoup the points expense is called the breakeven point. In the above example the breakeven point would be 5 years and 9 months.

If you invested the cost of points into a savings account instead of buying points it would earn $1.67 per month, so that would take the breakeven point of points to 5 years and 11 months.

If you do not plan to stay in your home over the full life of the loan or you think you may refinance in the near future, you need to carefully evaluate your potential savings. Though you will pay less each month with points, you will pay more up front. You should stay in the home long enough to recoup your investment through your monthly savings, or you may end up losing money by paying points.

Most lenders charge origination points to cover the expense of originating the loan. Some loans may charge fees in place of some closing costs. While discount points are tax deductible, loan origination fees are not.

You should analyze your statement carefully to be sure that you aren't paying more in origination and closing costs than you need to pay. Work with your broker to get a proper understanding of all the fees.

Using the above calculator can help you to determine whether paying points on your mortgage is really worth it to you to help you meet your financial goals. You can use the calculator to learn just how much you can expect to save both on your monthly mortgage payment and during the life of the loan. Experiment with different point values to see how you can maximize your savings.

Buying Points Versus Other Investments

Keep in mind how long you plan to stay in the home when making your decision. If you only plan to be in your home for five years or less, you may consider how you can put the money toward other investments that may have higher yield than what you can expect to save on interest by buying points.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!