In May of 2023, the World Health Organization declared an end to the COVID-19 pandemic that rattled the world in 2020. Nevertheless, the aftereffects of the global pandemic could be observed in many aspects. This includes the real estate market, where the prices of homes have been greatly affected over the past four years. Our team at Mortgage Calculator has gathered data on home prices from the beginning of the pandemic in March 2020 to October 2024 to better understand the lasting impact of COVID-19 on home prices around the United States.

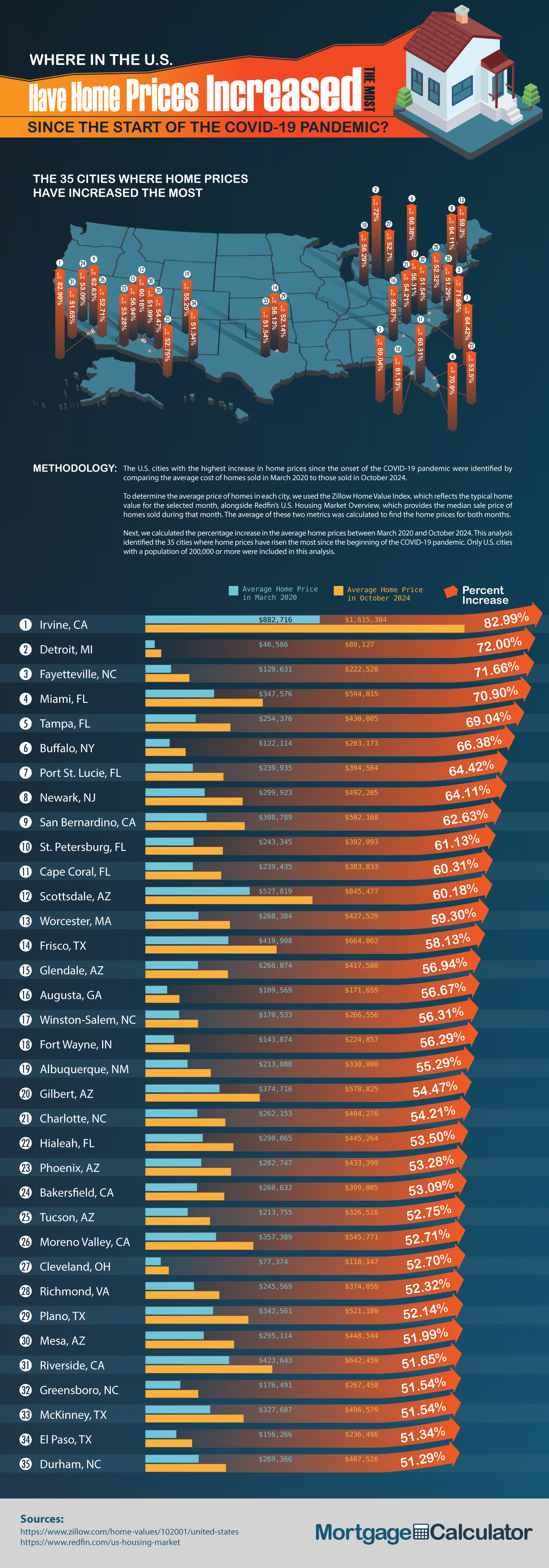

In Irvine, California, there was a staggering 82.99% increase in home prices from March 2020 to October 2024. In 2020, the average home price was $882,716. However, by the time 2024 rolled around, the average price had risen to $1,615,304.

The city with the second highest rise in home prices was Detroit, Michigan, with prices skyrocketing 72% from March 2020 to October 2024. The average house sold for $46,586 in 2020 and rose to $80,127 in 2024.

Fayetteville, North Carolina, saw the third-highest rise in home prices at 71.66% from March 2020 to October 2024. This percentage translates to an average home price of $129,631 in 2020 to $222,528 in 2024.

Miami, Florida, had a 70.9% increase during the pandemic. The average home price was $347,576 in March 2020 and rose to $594,015 in October 2024.

Rounding out the top five locations for increased home prices is Tampa, Florida, with an increase of 69.04%. In 2020, the average home could be purchased for $347,576. In 2024, the average home now goes for $430,005.

Since the pandemic was an unprecedented event in modern times, the average person had little leeway or knowledge to navigate the economy. People lost jobs, and most of the people who lost jobs were from poorer economic backgrounds. Customer-facing industries were hit the hardest due to the mandatory reduction of face-to-face interactions. In February of 2020, unemployment was at 3.5%. By April of the same year, the rate had risen to around 14.8%. This was the highest rate of unemployment in 80 years.

Fewer people sought to buy homes, and fewer people also sought to sell their homes during this volatile period. The average interest rate rose above 7%, the highest in decades. Homeowners with low interest rates were motivated to stay put, as moving would mean losing their favorable rates.

For the employees who were able to keep their jobs during the pandemic, a change still had to occur to ensure they could perform their work. This essentially turned the labor market into an experiment for the viability of remote work. Businesses that weren’t deemed an essential service had to adopt a work-from-home model to comply with COVID-19 restrictions if they wanted to stay open.

After work-from-home practices were implemented, many of these businesses found that it was a viable way to continue running the business. This proved the case for many blue-collar jobs, even after the pandemic constraints were lifted. On the side of the employees, individuals had already gotten a taste of how the ability to perform their work remotely meant they could save time and money while increasing flexibility around their workday. As long as productivity remains the same or increases, it appears that remote work is here to stay.

How did this affect the housing market? Working remotely allowed many individuals previously tethered to city centers by their workplace to continue their careers while potentially increasing or maintaining their quality of life at a much lower cost. Understandably, this has been an excellent opportunity for many workers to move to lower-cost cities without sacrificing their jobs.

Though home prices have risen overall, home ownership is still ideal for millions. There is good news: the housing market conditions are improving for buyers. Regardless of your status as a first-time home buyer or an experienced home owner, the most important factor will be your ability to comfortably afford a home at this time. For current renters, the decision to purchase a house may depend on whether it is more beneficial or easier for them to rent or buy at this time. Other important factors to consider are your credit score, down payment, property taxes, and mortgage pre-approval loans. It may be difficult for buyers not to be disheartened by current housing market prices, but many resources can still guide you through the process.

| % Change Rank | City | March 2020 Average Home Price | October 2024 Average Home Price | $ △ | % △ |

|---|---|---|---|---|---|

| 1 | Irvine, CA | $882,716 | $1,615,304 | $732,588 | 82.99% |

| 2 | Detroit, MI | $46,586 | $80,127 | $33,541 | 72.00% |

| 3 | Fayetteville, NC | $129,631 | $222,528 | $92,897 | 71.66% |

| 4 | Miami, FL | $347,576 | $594,015 | $246,439 | 70.90% |

| 5 | Tampa, FL | $254,376 | $430,005 | $175,629 | 69.04% |

| 6 | Buffalo, NY | $122,114 | $203,173 | $81,059 | 66.38% |

| 7 | Port St. Lucie, FL | $239,935 | $394,504 | $154,569 | 64.42% |

| 8 | Newark, NJ | $299,923 | $492,205 | $192,282 | 64.11% |

| 9 | San Bernardino, CA | $308,789 | $502,168 | $193,379 | 62.63% |

| 10 | St. Petersburg, FL | $243,345 | $392,093 | $148,748 | 61.13% |

| 11 | Cape Coral, FL | $239,435 | $383,833 | $144,398 | 60.31% |

| 12 | Scottsdale, AZ | $527,819 | $845,477 | $317,658 | 60.18% |

| 13 | Worcester, MA | $268,384 | $427,529 | $159,145 | 59.30% |

| 14 | Frisco, TX | $419,908 | $664,002 | $244,094 | 58.13% |

| 15 | Glendale, AZ | $266,074 | $417,580 | $151,506 | 56.94% |

| 16 | Augusta, GA | $109,569 | $171,659 | $62,090 | 56.67% |

| 17 | Winston-Salem, NC | $170,533 | $266,556 | $96,023 | 56.31% |

| 18 | Fort Wayne, IN | $143,874 | $224,857 | $80,983 | 56.29% |

| 19 | Albuquerque, NM | $213,088 | $330,900 | $117,812 | 55.29% |

| 20 | Gilbert, AZ | $374,716 | $578,825 | $204,109 | 54.47% |

| 21 | Charlotte, NC | $262,153 | $404,276 | $142,123 | 54.21% |

| 22 | Hialeah, FL | $290,065 | $445,264 | $155,199 | 53.50% |

| 23 | Phoenix, AZ | $282,747 | $433,399 | $150,652 | 53.28% |

| 24 | Bakersfield, CA | $260,632 | $399,005 | $138,373 | 53.09% |

| 25 | Tucson, AZ | $213,755 | $326,516 | $112,761 | 52.75% |

| 26 | Moreno Valley, CA | $357,389 | $545,771 | $188,382 | 52.71% |

| 27 | Cleveland, OH | $77,374 | $118,147 | $40,773 | 52.70% |

| 28 | Richmond, VA | $245,569 | $374,059 | $128,490 | 52.32% |

| 29 | Plano, TX | $342,561 | $521,189 | $178,628 | 52.14% |

| 30 | Mesa, AZ | $295,114 | $448,544 | $153,430 | 51.99% |

| 31 | Riverside, CA | $423,643 | $642,459 | $218,816 | 51.65% |

| 32 | Greensboro, NC | $176,491 | $267,458 | $90,967 | 51.54% |

| 33 | McKinney, TX | $327,687 | $496,579 | $168,892 | 51.54% |

| 34 | El Paso, TX | $156,266 | $236,496 | $80,230 | 51.34% |

| 35 | Durham, NC | $269,366 | $407,516 | $138,150 | 51.29% |