The following table shows current 30-year El Monte mortgage rates. You can use the menus to select other loan durations, alter the loan amount. or change your location.

As of 2025 the conforming loan limit across the United States for single-family homes is set to $806,500, with a ceiling of 150% that amount in HERA high-cost areas where median home values are higher. Low local wages and a recent trend of outward migration to the states has depressed local real estate prices, making the $806,500 ceiling apply across Puerto Rico for single unit homes. Dual unit homes have a limit of $1,032,650, triple unit homes have a limit of $1,248,150 & quadruple unit homes have a limit of $1,551,250. Loans above conforming loan limits are considered jumbo loans. Those seeking properties in exclusive areas of the San Juan metro area may need to seek jumbo mortgages. Jumbo loans typically have a slightly higher rate of interest than conforming mortgages, though spreads vary based on credit market conditions.

Puerto Rico is popular for its picturesque beaches and rich Caribbean culture with American influences. It’s a self-governing unincorporated territory of the United States, which is located around 1,000 miles southeast of Miami, Florida. This archipelago is approximately 5,515 square miles and is also situated between the Dominican Republic and the U.S. Virgin Islands.

Puerto Rico’s house prices has been experiencing significant drops in the past decade. Its housing market is expected to remain fragile given the island’s prolonged history of economic crisis, massive debt, and high unemployment rates. Population decline also continues as many Puerto Ricans choose to move to continental U.S. states for more profitable jobs and economic security.

Despite economic hardships, the Commonwealth of Puerto Rico has seen its share of economic improvements. In Q2 of 2019, the Federal Housing Finance Agency (FHFA) reported Puerto Rico’s seasonally-adjusted home purchase-only price index increased by 14.01%, which is 13.24% in inflation-adjusted figures. This was a significant improvement compared to 2018’s small price growth of 1.35%.

In 2018, economic consulting firm Estudios Técnicos, Inc. reported that sales for newly built homes in Puerto Rico increased by 78% compared to the previous year, while sales for existing homes grew to 17%. The top three counties or municipios with the highest figures of home sales in 2018 were Ponce, Mayagüez, and San Juan. San Juan is Puerto Rico’s capital and most populous city.

The growth in demand is ascribed to tax incentives and other housing stimulus initiatives. Global Property Guide notes that housing market improvements were driven thanks to insurance and federal aid money, along with rising interest from mainland Americans looking for a bargain on property. To encourage more wealthy investors to invest in Puerto Rico, the government implemented special tax laws.

For those who invest in Puerto Rico, they are assured certain tax advantages. For instance, a U.S. citizen who officially becomes a Puerto Rico resident and moves their business to Puerto Rico may benefit from a 4% corporate tax or fixed income tax rate. They can also take advantage of 100% exemption on property taxes, as well as full exemption on dividends from export services. However, despite tax incentives, Puerto Rico faces promotional challenges. Many investors are still wary of moving to Puerto Rico due to general lack of government trust.

Puerto Rico’s economy grew by 2% in 2019 compared to the previous year, according to the International Monetary Fund (IMF). It was considered the top economic performance it had since 2003. Prior to this, the archipelago was coming from a long series of annual economic declines: 4.9% in 2018, 2.7% in 2017, and 1.3% in 2016. It also suffered a massive recession in 2006, which we will discuss in the latter sections.

Puerto Rico’s Annual GDP Growth Rates, 2013 – 2019

| Year | GDP Rate Compared to Previous Year |

|---|---|

| 2019 | + 2% |

| 2018 | – 4.9% |

| 2017 | – 2.7 |

| 2016 | – 1.3% |

| 2015 | – 1% |

| 2014 | – 1.2% |

| 2013 | – 0.3% |

Though Puerto Rico’s economy was slowly improving, a greater problem stuck. In 2020, the COVID-19 pandemic caused a massive blow to the global market. Because of this crisis, Puerto Rico’s economy has declined again by around 6% to 7.5% in 2020. In Q2 of 2020, the seasonally-adjusted home purchase-only price index fell by 4.44%, in contrast to 2019’s year-on-year increase of 13.26%.

Puerto Rico had one of the strictest stay-at-home orders and social distancing guidelines in the U.S. During the early months of the pandemic, residents followed a curfew and were only allowed to buy essentials between 5:00am to 9:00pm. This lockdown was one of the longest, which ran for 2 months. While other U.S. states had hundreds of confirmed cases, Puerto Rico recorded fewer cases and number of deaths. However, due to lack of government funding, concerned citizens worried if they had enough COVID-19 testing for the masses.

By the end of 2020, homes sold in Puerto Rico dropped by 8.3% compared to the previous year, according to data from the Office of the Commissioner of Financial Institutions (OCIF). That’s only a total of 10,209 homes. It is said to be the lowest home sales in Puerto Rico within the last three years.

According to Estudios Técnicos, housing sales should improve by 2022. They expect higher demand from able buyers who would want to take advantage of low interest rates and housing incentives. Buyers can receive financing from the Community Development Block Grant (CDBG), which is a government program that promotes housing for low to moderate income consumers. However, the firm also cautioned that expected inflation in construction sectors, along with many poor borrowers, will bring challenges for the program.

Through the first 3 quarters of 2020 real estate held up far better than it did during the 2008 housing recession. Central banks and politicians reacted faster and much more aggressively to the COVID-19 crisis than they did to the 2008 recession. Many novel and unconventional policies which began in response to the prior recession were used much more aggressively in this recession. For instance, here are some of the policies which were enacted:

On November 24, 2020 the Federal Housing Finance Agency (FHFA) raised conforming loan limits by 7.42%, reflecting strong annual growth in the nationwide FHFA House Price Index (HPI). 2022 and 2023 saw limit increases of 18.05% and 12.21%, the fastest 2-year growth rates since 1986 & 1987, and inline with the 15.95% growth in 2006. In 2024 and 2025 the limits were increased at more historically normal levels of 5.56% and 5.21%.

Lack of jobs further stifles sales in the housing market. In 2020, approximately 8.41% of Puerto Rico’s labor force was unemployed due to the pandemic. But even before this, around 94,000 or 36.2% of Puerto Rico residents were already unemployed, according to American University. And between March 16 to 30, 2020, an estimated 76,928 more people applied for unemployment benefits.

According to V2A Consulting, the high unemployment rates may be associated with the closure of around 29,000 companies and the general collapse of market expansions for new jobs. And with many Puerto Ricans leaving to pursue stable careers in the U.S. mainland, it means less people paying taxes and investing in their local economy.

The following chart shows Puerto Rico’s unemployment rates between 1999 to 2020. The data was sourced from the World Bank, World Development Indicators survey. Note that the figures were rounded off.

Puerto Rico Unemployment Rates, 1999-2020

| Year | Unemployment Rates |

|---|---|

| 1999 | 11.81% |

| 2000 | 10.08% |

| 2001 | 11.4% |

| 2002 | 11.94% |

| 2003 | 11.78% |

| 2004 | 10.31% |

| 2005 | 11.35% |

| 2006 | 11.01% |

| 2007 | 10.93% |

| 2008 | 11.48% |

| 2009 | 15% |

| 2010 | 16.1% |

| 2011 | 15.7% |

| 2012 | 14.5% |

| 2013 | 14.3% |

| 2014 | 13.9% |

| 2015 | 12% |

| 2016 | 11.8% |

| 2017 | 10% |

| 2018 | 9.2% |

| 2019 | 8.19% |

| 2020 | 8.41% |

Even before the COVID-19 crisis, Puerto Rico has been experiencing massive unemployment rates, especially after their recession in the mid-2000s. In 2010, Puerto Rico’s unemployment rate was the highest at 16.1%. Though from 2011 to 2019, they were able to reduce unemployment little by little each year. By 2020, unemployment rose back up again, though not as high as the mid-2000s. Many new jobs in the island are associated with construction and rebuilding work. However, these positions are mostly temporary, which does not provide enough job stability for people.

Historically speaking, Puerto Rico’s economy has followed similar trends with the U.S. However, the financial crisis of the late 2000s brought a massive economic downturn on the archipelago. Puerto Rico experienced a sharper recession far worse than the rest of America. While the U.S. housing market eventually recovered, Puerto Rico is still struggling to stabilize its economy.

When Puerto Rico’s recession began in Q4 of 2006, its economy contracted by more than 10%, with unemployment surging up to 14%. In contrast during the Great Recession, the U.S. economy only shrank by 4%, while total unemployment rose up to 6%. According to the U.S. Department of the Treasury, Puerto Rico’s economic downfall was caused by a confluence of different factors. This includes the real estate boom and bust cycle, longstanding issues with fiscal governance, and the debt crisis. The archipelago struggled with taxation and benefit structures which failed to provide security for its people. These problems further weakened confidence among its stakeholders.

In 2019, the Global Property Guide reported that Puerto Rico has lost around 20% of its jobs since 2007. The population has also declined by about 13% in the past decade, which is close to a 40-year low. Along with the lack of employment and on-going outmigration, Puerto Rico’s poverty rate has grown to a record high of 45%. And with less people contributing to taxes, Puerto Rico’s retirement and public health systems have become insolvent. The massive out-migration has not only caused lower home prices, it also forced Puerto Rico to restructure its government debt.

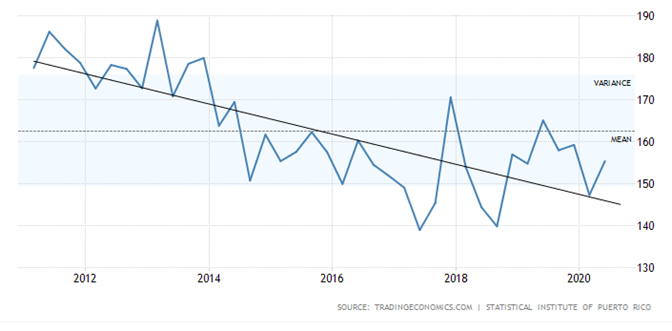

The prolonged economic crisis has collapsed real estate prices for years. Puerto Rico has lost nearly $30 billion in the housing market, according to Estudios Técnicos. The following graph illustrates the trend for Puerto Rico’s House Price Index from 2010 to 2020. It shows that the housing prices have mostly declined and has not recovered after the recession. The graph is sourced from Trading Economics.

In 2017, a category four cyclone named hurricane Maria devasted Puerto Rico. It was the most powerful storm to hit the island since 1932. The massive destruction forced more residents to eventually relocate to the U.S. mainland. An estimated $90 billion was damaged by hurricane Maria, with residential property accounting for the largest part of storm destruction, pegged at $37 billion. This aggravated the already downward trend of home prices in the island. Because of significantly low house prices, more continental Americans showed interest in buying property in Puerto Rico.

In 2018, Point2 Homes looked into Puerto Rico properties and surveyed home price figures. Within the last eight years, the median home selling price on the island decreased by around 48%. That’s from a median home selling price of $224,000 in 2010, to a median home selling price of $116,750 in 2018. In the town of Humacao, for instance, the median house price fell from $250,000 in 2016 to $97,250 in March 2018. Right before the hurricane struck in September 2017, the median property prices in Puerto Rico were around $136,500. This is 15% higher before the destruction caused by the hurricane.

The following table compares median home prices for 16 of the most searched Puerto Rico housing markets in the Point2 Homes portal. It shows how median home prices have changed between 2010, 2013, 2016, and 2018.

Puerto Rico Median House Prices, 2010 – 2018

| Market | 2010 | 2013 | 2016 | 2018 | 2010-2018 price change |

|---|---|---|---|---|---|

| Puerto Rico overall | $224,000 | $175,000 | $144,900 | $116,750 | -48% |

| Humacao | $369,000 | $280,000 | $250,000 | $97,250 | -74% |

| Aguadilla | $375,000 | $200,000 | $185,000 | $99,000 | -74% |

| Rio Grande | $325,000 | $260,000 | $226,500 | $124,500 | -62% |

| Carolina | $235,000 | $180,000 | $139,500 | $91,000 | -61% |

| Dorado | $475,000 | $359,500 | $415,000 | $190,000 | -60% |

| San Juan | $265,000 | $250,000 | $200,000 | $107,450 | -59% |

| Fajardo | $79,500 | $129,000 | $139,000 | $167,000 | -52% |

| Ponce | $160,000 | $149,500 | $97,450 | $86,000 | -46% |

| Arecibo | $145,000 | $124,900 | $100,000 | $78,500 | -46% |

| Bayamón | $169,000 | $130,000 | $113,600 | $99,000 | -41% |

| Mayaguez | $210,000 | $130,000 | $175,000 | $126,950 | -40% |

| Caguas | $198,000 | $156,500 | $135,450 | $128,000 | -35% |

| Cabo Rojo | $230,000 | $200,000 | $175,000 | $175,000 | -24% |

| Isabela | $227,000 | $195,000 | $180,000 | $174,900 | -23% |

| Guaynabo | $290,000 | $270,000 | $262,250 | $248,000 | -14% |

| Rincon | $265,000 | $252,500 | $240,000 | $230,000 | -13% |

2020 brought a two-month long lockdown for Puerto Rico. This caused sharp sales declines in the housing market between March and April 2020. However, small improvements have occurred since then. In October 2020, Weekly Journal reported a 2% growth in new home sales compared to July 2019. This development is promising, especially since it has surpassed pre-COVID property sales figures. The new home sales median was 2,730 in July 2019. But in 2020, this grew to 2,773 new home sales.

CEO of San Juan Realty Group, Nick Pastrana, provided the Weekly Journal with property sales figures. The following chart shows median home sales for 2020, and compares the difference from 2019. It includes the months of March to July, where March 2020 marked the start of the lockdown, while the housing market resumed activity in May.

| Month / Year | New Property Sales | $ Difference from 2019 |

|---|---|---|

| March 2020 | 1,598 | -41% |

| April 2020 | 278 | -90% |

| May 2020 | 1,205 | -56% |

| June 2020 | 2,298 | -16% |

| July 2020 | 2,773 | 2% |

Moreover, the decrease in mortgage rates have contributed to the increase in housing sales. According to the Puerto Rico Mortgage Banks Association (ABHPR in Spanish initials), more homebuyers are encouraged to take mortgages because of substantially low rates. This has partially increased sales, which seem to be looking up for the Puerto Rico housing market.

Due to the COVID-19 crisis, the Federal Reserve has kept benchmark rates near zero in 2020 to stimulate market activity. This aims to promote growth and economic recovery for the U.S. economy. The Fed also reiterated that it may keep benchmark short-term interest rates low until 2023. The money printing after the COVID-19 lockdowns caused a spike of inflation which was not transitory, forcing the Federal Reserve to lift rates at a fast rate throughout 2022 and early 2023.

As of 2025, the conforming loan limit across the United States for single-family homes is set to $806,500, with a ceiling of 150% that amount in HERA high-cost areas where median home values are higher. Low local wages and a recent trend of outward migration to the states has depressed local real estate prices, making the $806,500 ceiling apply across Puerto Rico for single unit homes. Dual unit homes have a limit of $1,032,650, triple unit homes have a limit of $1,248,150 & quadruple unit homes have a limit of $1,551,250.

Loans above conforming loan limits are considered jumbo loans. Those seeking properties in exclusive areas of the San Juan metro area may need to seek jumbo mortgages. Jumbo loans typically have a slightly higher rate of interest than conforming mortgages, though spreads vary based on credit market conditions.

Since the recession, Puerto Rico residents have been leaving in search of more stable opportunities. Many people tend to move to Florida, citing family connections and prospective jobs. It is also in close proximity to the island of Puerto Rico.

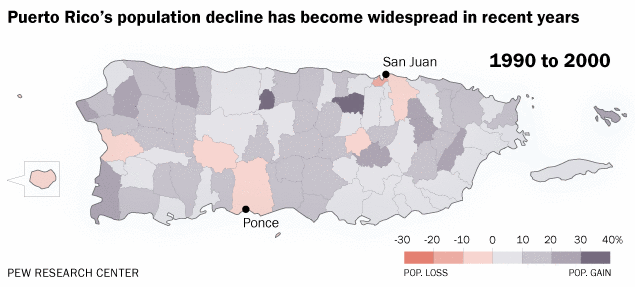

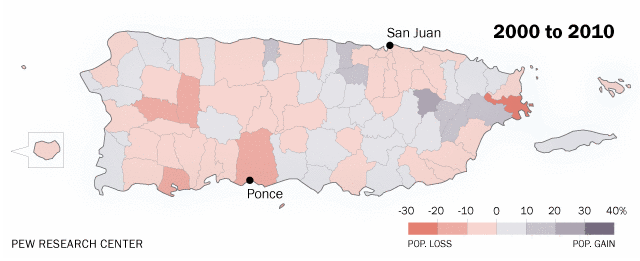

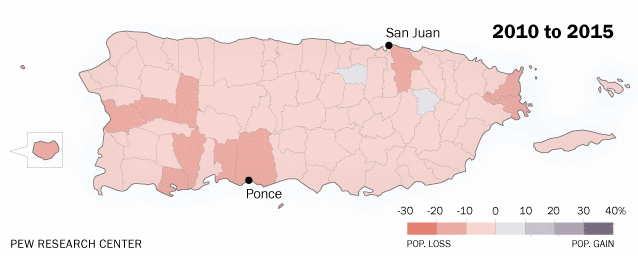

In 2016, Pew Research Center published images comparing how much the Puerto Rico Population has changed. The following maps illustrate population changes between 1990 to 2000, 2000 to 2010, and 2010 to 2015. The gray areas denote population increase, while the peach areas indicate population loss. Notice how in 2010 to 2015, the entire map has almost turned peach.

Between 1990 to 2000, population in Puerto Rico was steadily growing. Throughout these years, the island’s population increased by 8.1%. However, from 2000 to 2010, especially after Puerto Rico’s economic recession, the population decreased by 2.2%. In the following years between 2010 to 2015, the Puerto Rico population declined by 6.8%. In 2015, the archipelago’s population was estimated at 3.47 million, which is less than 334,000 people compared to 2000, for a total population decline of 9%. A third of this population loss took place between 2010 and 2015 alone.

The most affected municipio was San Juan, which is the island’s capital with the largest metropolitan area. San Juan’s population dropped by 40,000 residents between 2010 to 2015. That’s 10% of the municipio’s population, which is the highest numeric drop compared to other municipios. On the bright side, only one municipio experienced a considerable population increase between 2010 to 2015. Gurabo, which is located in the eastern region of Puerto Rico, had a population increase of 4%. That’s an added 1,900 people. As for other parts of the island, most places suffered population declines.

By 2016, more people continued to leave Puerto Rico. The following table compares population changes between 2010 and 2016 for five of the largest municipios in the archipelago. Notice how the population change for all municipios were negative.

| Rank | Municipio | 2016 pop | 2010 pop | Change | 2016 land area | 2016 pop density |

|---|---|---|---|---|---|---|

| 1 | San Juan | 347,052 | 395,326 | - 12.21% | 39.5 mi² | 8,786/mi² |

| 2 | Bayamón | 184,374 | 208,116 | -11.41% | 27.0 mi² | 6,829/mi² |

| 3 | Carolina | 158,457 | 176,762 | -10.36% | 20.7 mi² | 7,655/mi² |

| 4 | Ponce | 145,278 | 166,327 | -12.66% | 30.7 mi² | 4,732/mi² |

| 5 | Caguas | 132,164 | 142,893 | -7.51% | 10.9 mi² | 12,125/mi² |

In 2018, Puerto Rico’s population was at 3.2 million, the lowest recorded since 1979. It declined sharply from 2017 onwards when hurricanes Maria and Irma devastated the island, with Maria being the more damaging storm. Since its highest in 2004, the number of people in Puerto Rico have dropped by around 632,000. Projections in 2017 reported that Puerto Rico’s population is expected to fall to around 3 million residents in 2025.

Each county or municipio lost significant populations of at least 2% in 2018. Areas which housed the largest populations also experienced the fastest rates of decline. Municipios such as San Juan, Bayamón, Carolina, and Ponce all had a population decline of 4% or more between 2017 to 2018. The municipio or Las Marías experienced the largest decrease, with over 5% of its population.

Because of the massive storm devastation, 33 of the island’s 78 municipios experienced a total population decline of 15% in 2018. And between 2008 to 2018, the following municipios experienced the largest population decrease in Puerto Rico:

Massive out-migrations have certainly affected Puerto Rico’s demographic makeup. According to a New York Fed report, the island’s migrants tend to be from younger groups and less educated segments of society. People ages 16 to 30 typically make up the percentage of this demographic. In 2012 alone, out-migrants comprised a third of all people, while a little over one-fifth was left of the population. This pattern suggested that out-migration has hastened the pace of the island’s aging population. And in recent years, more of Puerto Rico’s people have been seniors or non-working residents.

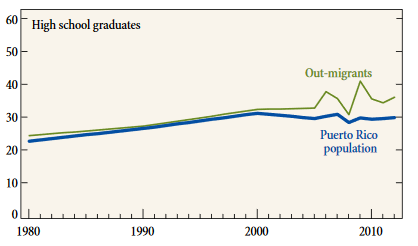

Next, the report looked into the education levels of Puerto Rico’s population versus out-migrants. The data was taken from the American and Puerto Rico Community Survey for the years 2005 to 2012. For example, in 2012, around 37% of out-migrants had a high school diploma compared to 30% of Puerto Rico’s population.

Given the pervasive unemployment among younger and less educated workers, we expect migration to be high in this segment. People without a high school diploma, on the other hand, face greater struggles when they try to leave the archipelago. Thus, the opportunity is taken mostly by less financially stable out-migrants, at least with high school level education.

Is Out-migration in Puerto Rico Causing Brain Drain?

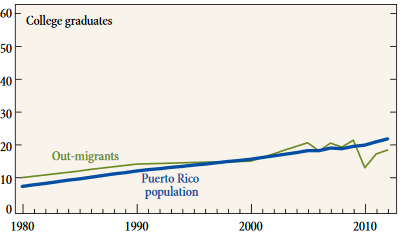

Brain drain is characterized by a loss of the nation’s most educated and highest human capital citizens. Based on studies, Puerto Rico has experienced a net loss of citizens across all education groups, including college graduates. However, a closer look at the composition of out-migrants show that college-educated citizens were not overrepresented among those leaving Puerto Rico.

The following graph compares the trend of high school graduate out-migrants with the Puerto Rico population between 1980 to 2012. Notice the higher trend of high school educated out-migrants than the general population.

In contrast to the previous graph, the next one compares the college educated out-migrants with the Puerto Rico population. See how the trend has less college-out migrants than the general population.

*Graphs from the New York Fed

Again, this data was taken from an old survey between 1980 to 2012, which means a higher number of college graduates could be leaving in more recent years. Brain drain could be more apparent now with updated research. But consider how wealthy and educated people typically do not have the urgent need to leave if they are generally stable. Thus, poorer, less educated segments, tend to comprise more of Puerto Rico’s out-migrants.

The prolonged economic downturn did not only cause widespread out-migrations. It also forced more Puerto Rico residents to become renters. In 2017, the U.S. Department of Housing and Urban Development (HUD) reported that renter decline has been limited since 2010 to an average of 1,225 households a year, which is more than 0.3% annually. The shift to more rental demand over the years has also contributed to the weakening real estate market.

At the time of HUD’s report, around 500 more rental units were under construction. In recent years, there may likely be a lot more. In addition, the vacancy rate was at 12.8% in 2017. Due to the continuous population decline, the vacancy rate increased from 10% in 2010, and 7.4% in 2000.

Tourism and Short-term Property Rentals

Puerto Rico is a popular vacation spot for white sand beaches, rain forests, underground caves, and bioluminescent bays. In recent years, visitors flocked to the island during holidays, which brings 100% occupancy rates in many hotels. Tourism is a vital source of income for Puerto Rico, which accounted for more than 8% of its GDP in 2017. While many companies have closed in Puerto Rico in the past decade, tourism has helped the archipelago provide jobs to its people.

But due to the COVID-19 pandemic, Puerto Rico’s tourism industry was struck badly in 2020. It also affected short-term rentals such as Airbnb services. Because tourism activities were restricted until August 15, 2020, including recreation and visits for residents and visitors, many property landlords switched their model into long-term rentals. According to the Weekly Journal, long-term rentals have supplied increasing demand in areas such as Condado, Isla Verde, Old San Juan, and other local tourism hubs. This trend seems to be happening with Airbnb property owners, at least while there is low demand for short-term rentals.

Applying for mortgage approval in Puerto Rico is generally similar to the U.S. mainland process. To secure a home loan, you must also have a good credit score, ample income, and enough down payment to afford the sale. Buyers also typically undergo the pre-qualification and pre-approval process. These steps will let you know the property price range you can afford.

Obtaining funding in Puerto Rico is a little different from the continental U.S. First, mortgage rates in Puerto Rico tend to be higher than the U.S. housing market. If you obtain a mortgage from a bank in the U.S. mainland, this is likely a better option.

After the mid-2000s recession in Puerto Rico, not a lot of banks lend mortgages on the island. Shopping around for a loan may also be difficult especially if you’re not fluent in Spanish. Furthermore, it’s not common for lenders in Puerto Rico to commit to an approved rate. This means they may change the rate by the time of closing. This is the risk most buyers take once they commit to the contract.

As for the down payment, while 20% is recommended, buyers can make a 5% deposit based on the home’s purchase price. Note that the deposit is non-refundable if you back out of the transaction, so be sure about your decision before closing the deal. But if the seller backs out of the deal, they must pay twice the amount of the deposit the buyer offered.

Americans moving from the U.S. mainland can freely buy property in Puerto Rico. But before you can purchase a home, most foreigners should transact with a real estate agent. Since Puerto Rico is also a Spanish speaking territory, having an agent who is fluent in Spanish will help you negotiate deals.

Agent commissions in Puerto Rico typically range between 4% to 6% and is paid by the seller. This is negotiable, so try to talk down the commission costs. It’s also very common for the listing agent to function as a dual agent for the buyer and seller. One of the drawbacks of this arrangement is the limited listings. Once the agent runs out of properties to show you, you must then move on to another agent.

Buyers also have the option to hire their own agent (also called a cooperating broker or co-broker). In this case, the commission is split 50%-50% between your agent and the selling agent. However, under this arrangement, your buying agent’s compensation fee is not yet offered upfront at the time of the listing. Because of this, your agent may have to negotiate their commission with the seller’s agent before showing you the listing. And in certain cases, a buying agent who works closely with a listing agent may be asked to pay a “hunting fee.” As the buyer, your agent might ask you to shoulder those extra costs. Consider this before hiring your own broker.

Find a Reputable Real Estate Agent

Unlike in the mainland U.S., there are no official multiple listing service associations (MLS) tracking the accuracy of Puerto Rico property data. As a foreigner, you must be very careful before closing a sale. There have been instances where a house has been sold for months, yet it is still unavailable. And when buyers call the broker, they’re suddenly unresponsive, or the owner changed their mind. To steer clear of these real estate nightmares, be sure to hire a reputable agent with a trusted background.

Hire Your Own Lawyer. Once you’ve chosen a home and are ready to make an offer, it’s important to consult an attorney. While not mandatory, it’s highly advisable if you are a foreigner to ensure your protection. In Puerto Rico, a notary is required to prepare the sale and purchase of a deed instead of an attorney. The maximum notary fee is usually 1% of the property’s price for the first $500,000, and an added 0.5% for the amount in excess of $500,000.

To help negotiate your contract, you can hire your own lawyer before closing the sale. This way, if you’re unhappy with certain terms in the agreement, your lawyer can readily back you up. Attorney fees vary depending on the location of your home and the complexity of your mortgage deal. Most lawyers in Puerto Rico typically charge a percent of the selling price, which is 0.5% to 1%. Other lawyers may charge a fixed fee or an hourly rate for their service.

Moreover, you must pay several fees to different offices when buying property in Puerto Rico. These fees are paid to the Municipal Revenues Collection Center (CRIM), Treasury Department, and Registry of Property. The cost for these fees is usually around 0.5% of the property’s value.

All real estate titles in Puerto Rico are recorded in the Registry of Property. These titles are then classified into subsections according to the territory where the property is addressed. It’s important to check if the title of your property is filed under the correct section. If this is not done properly, you might face opposition from Registry Officials who verify the title’s legality and requirements.

Like in the mainland U.S., homeowner’s insurance is not mandatory but may be requested by your lender. They follow the standard home insurance policies for the industry, which include basic property and liability coverage. However, note that different levels of coverage vary depending on your insurance provider and your home’s location. Be sure to secure ample insurance coverage for your protection, especially if your area is prone to natural disaster such as storms and floods.

In the aftermath of hurricane Maria in 2017, the Wall Street Journal reported that only about 50% of homes in Puerto Rico had home insurance coverage that protected against wind damage. Rebuilding disaster-torn communities are also a lot more difficult without adequate insurance coverage. Insurance funds are the best source of money for people seeking to restore their homes and recover most of property losses. Unlike the U.S. mainland, insurance coverage for wind damage is actually uncommon. Be sure to secure this type of coverage especially if you’re living in a storm-prone area in Puerto Rico.

After hurricane Maria, devastated homeowners mostly relied on their own savings to rebuild their property. They also sought aid from the Federal Emergency Management Agency and other government or non-profit institutions for help. People buying inadequate home insurance in Puerto Rico is a reflection of residents’ low incomes. Many old properties in the Caribbean as small houses in poor areas likely do not have insurance coverage. Insured homes in the island tend to be newer, more expensive houses with better quality construction than uninsured properties.

While conventional home loans are available in Puerto Rico, low to moderate-income homebuyers can also seek homeownership assistance from the government or other non-profit organizations. If you need a low down payment option and more relaxed credit standards, certain organizations provide aid for homebuyers. These include the following:

Many Puerto Rico residents struggling with housing turn to CDBG. These grants are available under the HOME affordable housing program and other initiatives by the government to promote economic stabilization and eradicate homelessness. The San Juan Community Planning and Development Office manages the distribution of federal funding to local governments in Puerto Rico and the U.S. Virgin Islands.

Under the Internal Revenue Code (IRC) §933, income source in Puerto Rico is excluded from U.S. federal tax. After the mid-2000s economic recession, Puerto Rico enacted tax laws in 2012 to help boost its economy. Act 20 and Act 22 were meant as primary tax incentives to promote foreign investment. U.S. citizens who become official Puerto Rico residents can take advantage of these benefits.

Under Act 20, companies exporting services from Puerto Rico are entitled to tax incentives. To qualify, you must become a Puerto Rico resident and move your business to the island to generate Puerto Rico sourced income. This allows you to obtain 4% corporate tax or a fixed income tax rate, plus 100% exemption on property taxes. You are also entitled to exemption on dividends and export services.

As for Act 22, new qualifying residents are entitled to 100% tax exemption from Puerto Rico taxes on all dividend and interest income. This includes long-term capital gains you earned after becoming an official resident. All capitals gains generated after taking residency are subject to 100% tax exemption.

Puerto Rico’s housing market has had its share of economic struggles in the past decades. But in 2019, it showed signs of improvement despite the recession, high unemployment rates, and population decline. The government continues to encourage foreign investors to support the archipelago and create more stable industries.

Puerto Rico’s housing market has significantly lower priced homes compared to U.S. continental states. While mortgage rates are higher in Puerto Rico than in the mainland U.S., foreigners are bound to find affordable property in the island. They can also take advantage of certain tax benefits. For additional information on the Puerto Rico housing market, you may visit these sites: