The following table shows current 30-year mortgage rates available in El Monte. You can use the menus to select other loan durations, alter the loan amount, or change your location.

Making an informed decision for refinancing your home is well-worth time and effort. Refinancing options will require an understanding of refinance mortgage rates, interest rates, hidden costs, savings and monthly payments. Determining the potential positive, negative or neutral impact for your mortgage will require homework. Your home is possibly your biggest investment and the correct refinancing is an important choice.

Although the reasons for refinancing are many, one point to consider is the underlying reason. If refinancing will result in improved personal financial stability, the option to refinance is both positive and encouraged. If refinancing will ultimately result in additional consumer debt, you should reconsider the long-term impact of refinancing. Increased personal debt may impact your credit score and future loans for several years.

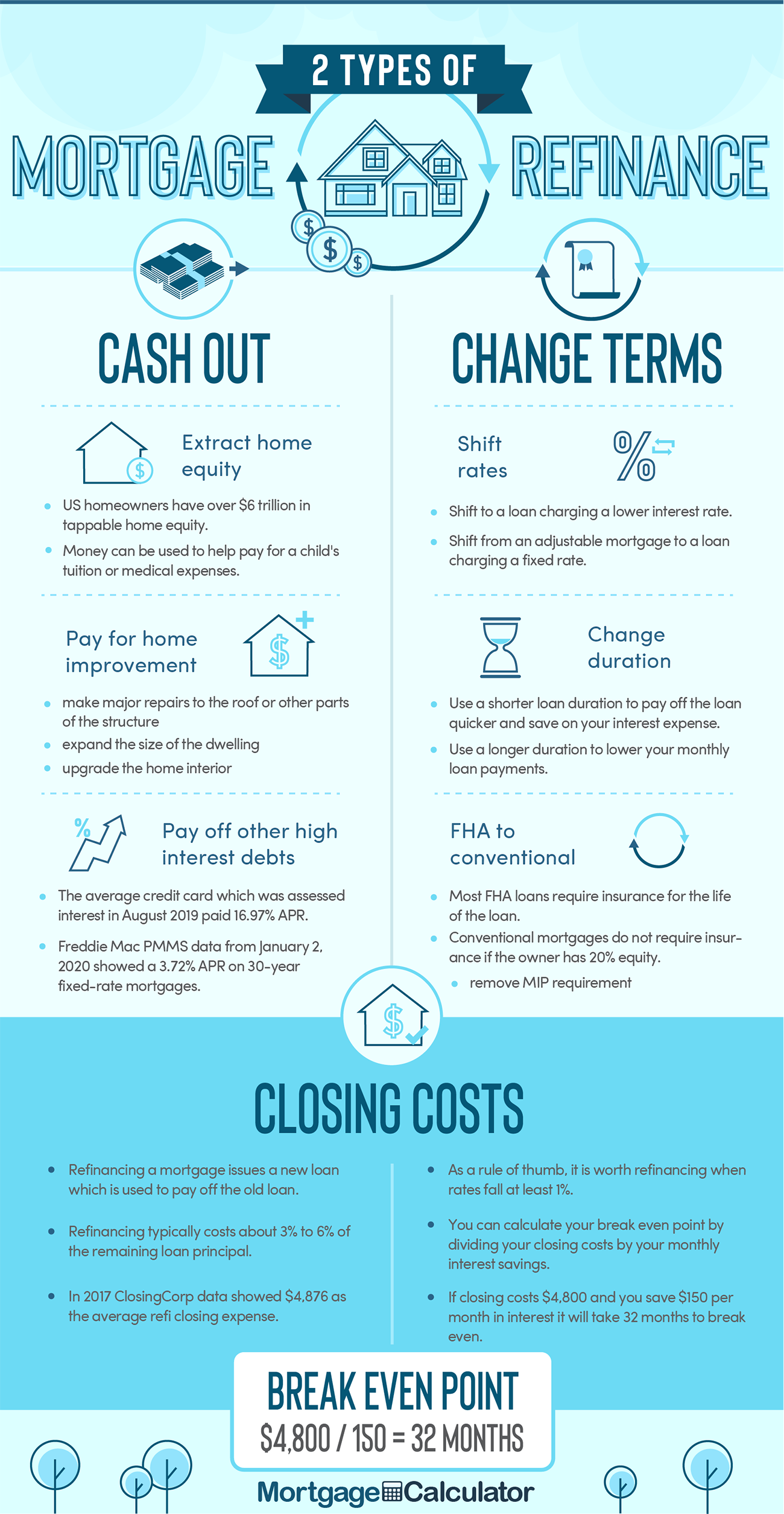

Refinancing may offer attractive advantages to homeowners.

Each of the above points is covered in more detail in the following graphic.

Calculate Your Savings

Our home refinance calculator shows how much you can save locking in lower rates. We also offer a refinance breakeven calculator to show how long it will take your refinance interest savings to cover your closing costs.

If you are consolidating multiple loans you can use our mortgage consolidation calcualtor. Homeowners cashing out equity can use our cash out refi calculator to estimate available equity and monthly loan payments.

As lenders offer many loan packages, with various interest rates, features and fees, careful study is necessary to pick the refinance loan that meets your refinancing objectives. Common refinance loan options include: fixed rate mortgages, adjustable rate mortgages, balloon loans and home equity loans. Each loan has specific criteria that may appeal to a borrower, but has advantages and disadvantages. A brief explanation of each loan type will provide a glimpse into the benefits and potential drawbacks of securing each loan type.

When refinancing your home, costs are associated with the new loan. Understand these costs and how they impact your overall savings is important. Perhaps the most important consideration before researching refinancing is the length you are planning to remain in your current home. If you plan to remain for an extended time period, refinancing is a positive financial consideration. If you plan to sell your house in a short period of time, perhaps within several months, refinancing may not be a positive financial decision. Most refinance loans have costs associated for the new loan and these costs can require upfront payment to secure the loan.

When you secure a loan, costs called “points” attached to these loans. There are two different kinds of points:

Discount Points

Discount points are an upfront fee paid to lower the rate of interest on the loan. Each point costs 1% of the loan principal and lowers the interest rate charged on the loan. For fixed-rate mortgages the discount for each purchased point is usually 0.25% and it applies for the duration of the loan. With adjustable-rate mortgages discount points adjust interest rates by 0.375% though the discount only applies during the introductory period. Discount points can also be negative, which would raise the interest rate charged on the loan. Negative points are known as yield spread premiums or rebates.

Origination Points

Origination points are fees which cover the cost of originating the loan. A lender typically already has significant profit embedded in the interest rate they charge the borrower for the loan. All origination fees are negotiable. You can spot these fees in Section A, Origination Charges of the Loan Estimate lenders are legally required to provide you.

All mortgages have some closing costs. Although the possibility exists of securing a loan that requires no upfront fees, that means the expenses are embedded in the interest rate. These loans are “zero-rate” or “no cost” loans and should be examined carefully to ensure you understand all the pros and cons.

One factor to consider is current interest rates and your current mortgage interest rate. You can refinance to a rate that is lower by one half a percent to several percentage points depending on your original loan and current loan rates. The greater the percentage difference, the greater the savings on the monthly payment. What you should understand is although a lower mortgage rate is realized from refinancing; you must calculate how many months will be needed to recoup the loan fees or “break even” and to start realizing the savings from the new loan.

In order to understand your costs associated with this refinancing, a good-faith estimate of the exact closing costs is a good analysis to request of your potential lenders. This good faith estimate is required by law to protect you from paying additional or higher costs than quoted on the estimate. When signing for the new loan, checking this estimate against the actual costs will avoid additional unforeseen loan costs.

Penalties for Early Repayment

Some loans contain clauses requiring penalties if a homeowner repays the loan before the ending date of the loan. The penalty amount could result in a homeowner paying thousands of dollars. Lenders put these clauses in loan contracts to compensate for lost interest when you sell or payoff your loan. If a prepayment penalty loan is offered with a lower interest rate, you may wish to consider other loan options. Not all loans contain penalties for early loan repayment, but when the loans contain these penalties understanding the financial impact is important. Some homeowners pay off most of their mortgage ahead of schedule and leave a small balance to avoid prepayment penalties.

If you purchased your home with less than the twenty percent down payment, you may have been required to purchase Private Mortgage Insurance (PMI). PMI is insurance protection for your lender in case of loan default. If you have acquired equity in your home that meets or exceeds the twenty percent of the value, PMI will not be required when refinancing your home loan, resulting in tremendous savings. Some borrowers get around PMI requirements by using a piggyback second mortgage.

Refinancing from FHA or USDA to Conventional

FHA loans and USDA loans have mortgage insurance premium which typically last for the duration of the loan while conventional loans drop the insurance requirement at 78% loan-to-value (LTV). Many homeowners who used FHA loans or USDA loans to purchase their homes later refinance into a conventional loan to bypass the mortgage insurance requirement.

The best source for a refinanced loan may be your current lender. Your lender has all your financial records and information already on file and may be able to provide you with several loan options. Your current lender may be willing to offer additional incentives to keep your mortgage with their financial institution. Working with your current lender may result in a faster smoother loan process with terms and conditions pleasing to your monthly budget.

In some cases unscrupulous lenders drag their feet for months trying to milk their clients. You should explore other options in conjunction with working with your lender so that if they are slow or unresponsive you are still making progress on your refinance.

Investigating other mortgage companies and banks is always a positive action because these companies may offer incentives your current lender does not have available. Research into customer satisfaction with outside mortgage companies will help you understand their reputation for customer response and loan issues. Perhaps once the loan is secured, issues may never occur, but the knowledge of your lender’s customer service practices will prevent additional stress should an issue occur. With the above warning in place, it should be noted many loan originators quickly sell loans off into the secondary market and a separate company can then operate as the loan servicer for investors in mortgage-backed securities.

Over the past decade many non-bank lenders have gained marketshare in the mortgage market. Many of these lenders are online-only operations with lower fixed costs than banks with a physical branch network. In 2020 many nonbank mortgage lending companies IPOed or were laying the groundwork to IPO in 2021. Some companies which have recently went public, filed to, or hinted interest in doing so include

These companies are now flush with cash and are competing for marketshare, which should help lower mortgage rates for borrowers across the country.

When refinancing home loans, researching your needs and loan options is an important activity. Check the cost of the loan and the break-even point while considering your long term plans to remain in that residence. Low interest or zero interest loans can be a good investment, but many of these loans require at some point a balloon payment that must be understood to avoid foreclosure, because of an inability to make this payment. A loan amortization schedule that lists payments will allow you to make an informed financial decision and expose any hidden loan costs. Be sure to review all your documents before signing and compare your good faith estimate to the costs quoted in the loan papers. You have rights and obligations that will offer legal protection. Ask questions when you do not understand terms and conditions of the loan. Refinancing your current home loan is an excellent financial decision, but requires homework to ensure you make the best-informed decision.

The Federal Reserve has begun lowering interest rates. Lock in today's low rates and save on your loan.

Are you paying too much for your mortgage?

Check your mortgage options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help save you money today!