USDA loan programs are provided to potential home buyers through the United States Department of Agriculture (USDA) to give people in rural communities a chance to become homeowners. It has also been called the USDA Rural Development Loan. The USDA guarantees a mortgage that has been issued by a local bank or lender. This subsidy helps lower the mortgage's interest rates and give the homebuyer the opportunity to have a $0 down payment. We will guide you through the application process, eligibility requirements, how to check your application's status, how to find out if you qualify, rates, and much more. You'll end this article will a very good understanding of the USDA loan program, and you'll have links to check further information if you require it.

USDA loan programs are provided to potential home buyers through the United States Department of Agriculture (USDA) to give people in rural communities a chance to become homeowners. It has also been called the USDA Rural Development Loan. The USDA guarantees a mortgage that has been issued by a local bank or lender. This subsidy helps lower the mortgage's interest rates and give the homebuyer the opportunity to have a $0 down payment. We will guide you through the application process, eligibility requirements, how to check your application's status, how to find out if you qualify, rates, and much more. You'll end this article will a very good understanding of the USDA loan program, and you'll have links to check further information if you require it.

The following table shows current 30-year mortgage rates available in New York. You can use the menus to select other loan durations, alter the loan amount, or change your location.

Before you apply for a home loan through the USDA, you should find out if you're an eligible candidate for this type of loan. Typically, there are two factors that the program takes into account, and they are the property and its location, and the person applying for the loan.

The USDA loans are designed to help people with lower incomes become homeowners. This program would be a good fit for anyone who has a decent credit history, steady employment, and who can't qualify for a traditional mortgage. This program offers a more lenient credit requirement as most mortgages require above a 640, and the USDA programs will take people that are as low as 580. You get several benefits from this program including:

Calculate Your USDA Loan Closing Costs & Monthly Payments

Use our USDA loan calculator to estimate closing costs, figure monthly payments, or view current rates below.

There are several people that would not be a good fit for this type of loan program. If you want to live close to the downtown area of a city, there are other loan programs. Also, if you have a 20% you can put down on a home, or if you have a higher income threshold for your location, you won't qualify for this loan program.

The USDA home loan process isn't much different than a traditional mortgage program. The United States Department of Agriculture will guarantee your home loan, but the entire process is handled through a local bank or lender. The USDA will have the final say when it comes to approving your home loan, but your local bank or lender handles this as well. This program aims to help individuals who they deem have the greatest need. This can be an individual or a family that currently doesn't have a safe or sanitary home. The families or individuals also can't afford a traditional mortgage or home loan, and their income is below the low-income line for their location.

There are several steps to the USDA loan application process. While it is true that your USDA qualified lender will handle most of the paperwork for you, you have to start the process on your own. It is critical that you do your research before you apply to make sure you're eligible and that you can prove your eligibility criteria. Your credit is a large factor, and you may have to take time to clean up your credit history as much as you can and check your credit before you apply. This can potentially get you better rates, and it will raise your chances of getting approved.

1

Find an Approved Lender. When you're ready to begin the application process, you have to find an approved lender. If you can't find your local bank on the list, you can always call the bank and ask. They'll know if they can process USDA loans or not.

2

Apply and get Pre-Approved. Once you've found an approved lender, you can apply for the USDA loan at their office. Just like a traditional mortgage, your lender will look at your credit score, income, and your employment information. If you're pre-approved, you'll get a letter in the mail. This letter will help more lenders take you more seriously.

3

Start Searching for a Home. When you get your pre-approval letter, you can start looking for homes in the USDA approved areas. You'll know how much home you can afford with your pre-approval letter, and your real estate agent can tailor searches based on that and any other criteria you want.

4

Get Your Lender's Approval and Make an Offer. Once you've made an offer on a property, get your lender's full approval. Make sure that your agent knows that you're using a USDA loan so that the seller will pay any clothing costs. They'll do one last check of your qualifications, the USDA loan status, and the property you made an offer on. They'll update your profile will all of this information and submit it to the USDA.

5

The USDA Will Sign Off. Your lender will submit your updated loan profile back to the USDA, and they'll double check everything. If everything is in order, they'll give their approval and sign off on the loan.

6

Close the Loan. When the USDA signs off on the loan, your lender can begin the closing process on your new home. If your home has problems, they will have to be fixed before the closing process is finished. All of the paperwork will get signed, a closing date will be set, and the loan will go through for payment on your home.

The qualification process for the USDA loan takes, on average, two to three weeks more than a traditional mortgage will take. You can expect around 40 days from the contract date to the closing date. Your location can also play a role in how fast the processing time is. Once you've submitted your application, you can either call your lender's office, use loan tracking services, or check the automated email for status updates.

Visit USDALoans.com today to prequalify.

The USDA offers three different loan programs for individuals to participate in. Each loan program offers something a little different, and you can see which one suits your needs and qualifications when you start the application process. You will not have a down payment with any of these three loan options. However, they all have different income guidelines you'll have to meet to apply successfully and get approved for.

The USDA Direct Loan gets all of its funding directly from the USDA, and this is unique as most government-backed loan programs don't get funding directly from the source. To successfully qualify, your household must be considered low or very low income. You have to have an annual household income 50% to 80% below average income limit for your local area. If you qualify, this loan offers a few things that will help you repay it including:

The USDA Guaranteed Loan acts just like any other loan that is backed by the government. To qualify for this loan, you have to use a USDA approved lender for the application and financing process. This loan program also has income guidelines, but they are set higher. You can earn as much as 115% of your area's annual income. This loan will guarantee 90% of your home loan. The USDA promises to pay 90% of your original loan if you stop paying or default. This means there are tighter restrictions like:

The USDA Improvement Loan is for low-income families who want to make improvements to their existing home. These repairs are limited to things that will negatively impact the health and safety of the home. To qualify, the individual or family must have a family income 50% lower than your average area income. You also must be ineligible for any other types of home improvement loans or financing. If you're 62 or older and you can't afford payments, you can apply for a grant. A few things this program can be used to fix are:

The Farm Labor Housing Loan and Grant is meant to be used to build year-round housing for migrant and seasonal farm workers. The people who qualify for this loan or grant don't qualify for commercial loans at a rate that would allow them to charge a lower rent rate to their workers. Once the housing has been developed, current farm help, disabled or retired farm help, and very low-income families may reside there.

If you don't think you'll be able to repay your USDA loans, there are grant programs available through the USDA as well. However, they also come with more restrictions and eligibility requirements you will have to meet to get approval and funding. The USDA Home Repair Grant works just like the USDA Improvement Loan. The loan is intended for things that make the home unsafe or unsanitary to occupy. It can be used to either remove things that make your home unsanitary or dangerous or for safety improvements. You have to be low-income and 62 years old or older to qualify for this grant. This grant caps at $7,500, and if you move out of your home within three years of receiving the grant, you'll have to repay it.

The Individual and Household Well System Grants are for tribal people or people residing in a Colonia get access to clean water. Depending on which grant you're applying for, you can have only 10,000 or 50,000 residents. They are also only available in certain states or tribal lands. You can use the grant money to extend current lines, pay for the installation and purchase of plumbing features, and construct bathrooms in current homes.

It can help to compare loan options to see which one would work out best for your situation. For example, if you have a $250,000 mortgage and your interest rate is fixed at 4.5%, how would you know which loan offers a better rate? If you estimate your mortgage insurance and your property taxes to be $280 a month, this is how the USDA loan wouldstack up:

| Loan Type | Minimum Down Payment | Principal and Interest | Taxes and Insurance | Mortgage Insurance | Monthly Payments |

|---|---|---|---|---|---|

| Conventional | $12,500 | $1,203 | $280 | $119 | $1,602 |

| FHA | $8,700 | $1,244 | $280 | $174 | $1,698 |

| USDA | $0 | $1,279 | $280 | $74 | $1,633 |

| VA | $0 | 1,294 | $280 | $0 | $1,574 |

While you will most likely end up paying a little more each month with the USDA loan, you won't have to come up with money for a down payment. Also, the less rigid credit requirements make USDA loans a good choice for people who have thin credit histories or lower credit scores.

Before 2015, more than 90% of properties in the United States were eligible for USDA loans based on the USDA's definition of rural property. The USDA defines rural property as any town, city, or community that has less than 20,000 residents. In 2015, the USDA updated their boundaries for what defines 'rural,' and this may make it harder to get approved for a USDA loan as populations have grown a lot since 2000. If you want to check the status of your area and find out if the USDA considers it rural or not, there are interactive maps on the USDA site you can check. You put your address or location in, and it'll show you if the area is considered rural or not.

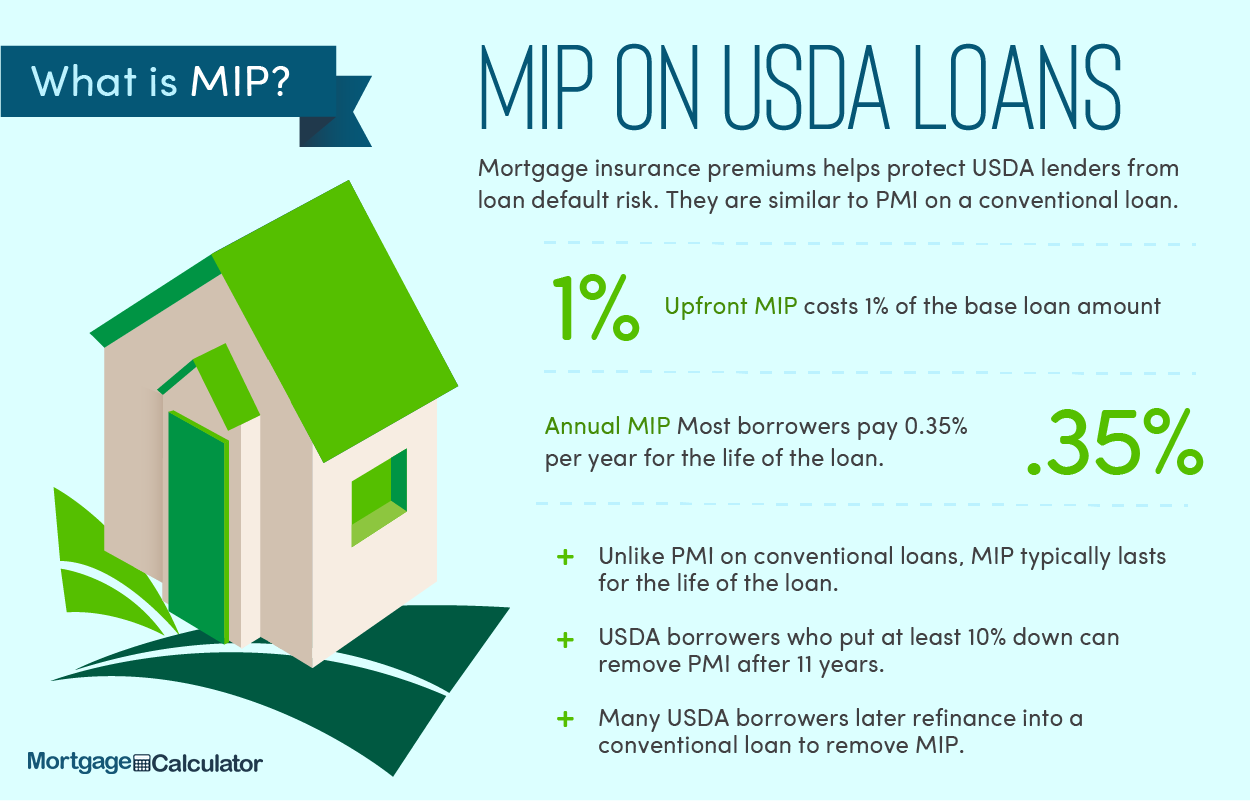

Areas which do not qualify show up in tan on the map, but extended portions of metro areas that are in smaller towns & cities may still qualify.Along with the rural definition update in 2015, a few fees changed as well. This loan program charges an upfront fee called a guarantee fee, and this fee allows the USDA to offer the loans they do to the lower to middle-income families and individuals. The guarantee fee dropped from 2.75% to 1% in 2016. The monthly fee dropped from 0.50% to 0.35% as of October 1, 2016. The drop in the guarantee fee can take thousands off of the total loan's balance. For example, anyone who got a home loan worth $200,000 through the USDA program after October 1, 2016, will pay $3,500 less than anyone who got the same loan amount before October 1, 2016.

On August 1, 2019 HUD announced the new loan-to-value limit for cash out refinance USDA loans would be set to 80%. Previously the limit was 85% LTV.

The USDA Home Loan is slowly gaining popularity among individuals and families that are looking to purchase a home. Several popular lenders offer USDA loans, and many of them have an easy online application process with tracking options.

Like everything, the USDA loan program has its downsides as well as all of the positives that come with it. What it comes down to deciding if the USDA loan is the right loan for you and your situation, it is good to have both the good and the bad so you can make an informed choice.

Income Guidelines

This loan program has very restricted income guidelines. It also goes by your entire household income, rather than just the applicant. This can make it harder to get approved for any of the USDA loans if more than one person in your household works or gets any form of income like disability, alimony, or child support.

Longer Closing Time

Any USDA loan will take a longer period of time to close. This is because each loan through this program is underwritten twice. The first time it is underwritten is by the lender, and then the bank turns it over to the USDA, and they underwrite it again. This can add anywhere from one to three additional weeks to the closing time.

Mortgage Insurance Fee

The USDA charges an upfront fee called the guarantee fee, and this is known as a Mortgage Insurance Premium (MIP). Currently, this fee is 1% of the total loan amount, and it is rolled into your monthly payments. You'll pay this when you pay your loan payment, and it stretches over the life of your loan.

Restricted to Rural Areas

The USDA loan program is restricted to the areas that the USDA considers to be rural. In 2015 they updated their boundaries for what defines rural, and this can make it harder to get accepted into the program with the areas you want to purchase a property in.

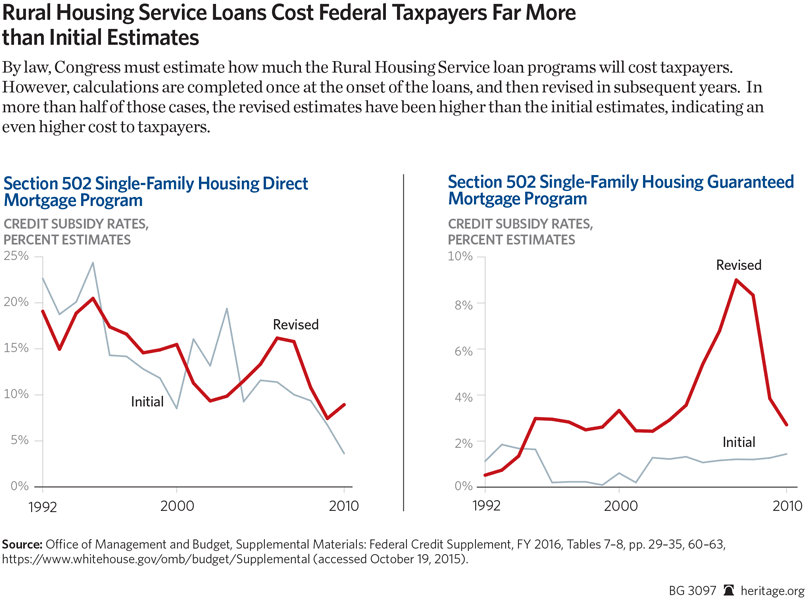

Potential Losses for Taxpayers

The Heritage Foundation is critical of USDA's Rural Housing Service as "the majority of the RHS loan guarantee programs show a net lifetime budgetary cost for each cohort of loans dating back to FY 1992."

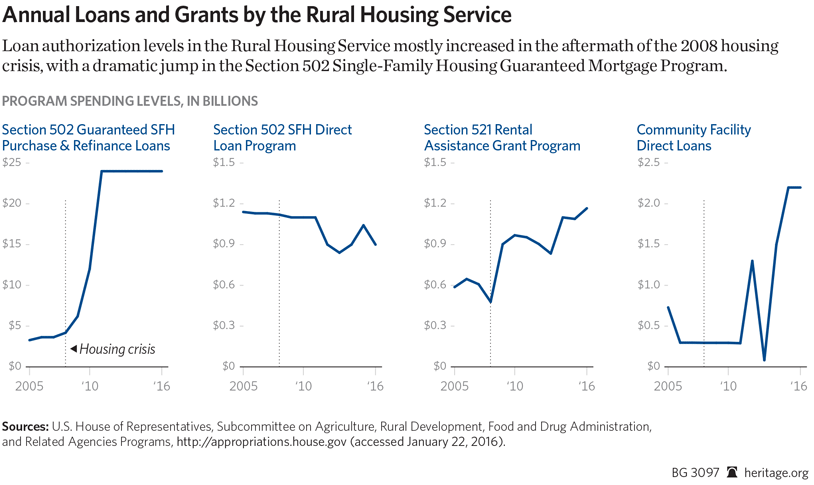

USDA lending programs expanded rapidly since the onset of the 2007 recession & the USDA has an existing loan portfolio of $120 billion in single-family & multi-family homes.

The Congress authorized spending $181.7 billion on rural development in 2025. This includes:

Additional programs support commodity producers, rural infrastructure (water, waste, elecrity, telephone, Internet), community infrastructure, and loan funding for small rural businesses.

Here are links to each of the programs available to individuals.

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility.

Don't pay too much for your mortgage. Leverage our lender network to get a USDA loan at today's historically low mortgage rates.

Check your mortgage options with a trusted New York lender.

Answer a few questions below and connect with a lender who can help you lock-in a low rate USDA loan and save today!