Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan. We also publish current El Monte conventional loan rates beneath the calculator to help you compare local offers and find a lender that fits your needs. Beneath the mortgage rate table we offer an in-depth guide comparing conforming home loans to other financing programs.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

Having a place of your own takes a while for most people. We dream of what type of house to buy, all while building enough savings to secure it in time. But apart from gathering ample funds, purchasing a home means understanding different financing options that might work for you.

For first-time homebuyers, this process may really be a struggle, especially if you haven't sorted out your finances. However, once you're more informed about your options, you'll have a better idea of how you can make the most of your housing investment.

To help get you started, we'll talk about one of the most common mortgage types in the country: conforming conventional home loans.

In this article, we'll define what conforming conventional mortgages are and how these loans are typically structured. We'll also discuss how it diverges from jumbo mortgages, as well as other government-sponsored mortgages such as FHA loans, USDA loans, and VA loans. Then, we'll include requirements you need to know about the application process.

A conventional loan or mortgage is a type of financing for homebuyers which is not provided or secured by a government entity. These are offered by private lenders such as banks, mortgage companies, and credit unions. In other cases, some conventional mortgages may also be guaranteed by two government-sponsored institutions: Fannie Mae and Freddie Mac.

A conventional loan is referred to as a conforming loan when it does not exceed the “conforming limit,” which is the dollar limit established by government-sponsored institutions.

Conforming conventional loans constitute around two-thirds of mortgages given to borrowers in the U.S. This makes them the most popular financing option for homebuyers throughout America.

As of 2025, conforming limits for one-unit housing throughout the continental U.S. is set at $806,500, according to the Federal Housing Finance Agency (FHFA). Conforming limits are adjusted every year based on the 2008 Housing and Economic Recovery Act (HERA) to ensure government-backed enterprises adequately reflect annual changes in the average home price.

The limits in the first row apply to all areas of Alabama, Arizona, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Texas, Vermont, Wisconsin & most other parts of the continental United States. Some coastal states are homes to metro areas with higher property prices which qualify the county they are in as a HERA designated high-cost areas.

The limits in the third row apply to Alaska, Guam, Virgin Islands, Washington D.C & Hawaii.

| Units | 1 | 2 | 3 | 4 | |

|---|---|---|---|---|---|

| Continental U.S. Baseline | Continental U.S. Baseline | $806,500 | $1,032,650 | $1,248,150 | $1,551,250 |

| Designated High-cost Areas | $1,209,750 | $1,548,975 | $1,872,225 | $2,326,875 | |

| Alaska, Hawaii, Guam & U.S. Virgin Islands | $1,209,750 | $1,548,975 | $1,872,225 | $2,326,875 |

Meanwhile, mortgages that go above the conforming limit are called nonconforming loans or a jumbo mortgage. For instance, a $900,000 mortgage on a single-family home is a jumbo loan that goes beyond the limits offered by Fannie Mae and Freddie Mac. In this respect, while a jumbo loan is a type of conventional mortgage, it is not a conventional conforming loan. Jumbo loans generally require stricter credit requirements and more scrupulous financial evaluation. They may also have higher interest rates than conventional conforming loans to offset the risk on the lender.

Across the United States 88% of home buyers finance their purchases with a mortgage. Of those people who finance a purchase, nearly 90% of them opt for a 30-year fixed rate loan. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans, with 6% of borrowers choosing a 15-year loan term.

Most conforming conventional mortgages come with a fixed interest rate that is locked for the entire life of the loan, with most home buyers choosing a 30-year payment term. Some lenders also offer 10-year, 15-year and 20-year fixed rate loans.

Conventional loans can also offer adjustable-rates that change in accordance with broader market conditions. Traditional ARM loans adjust interest rates annually. Hybrid ARMs offer a fixed rate introductory period where the rate is fixed for the first 3, 5, 7, or 10 years. After the fixed introductory period rates reset annually for the duration of the loan. A 5/1 ARM means the rate is fixed for the first 5 years and resets annually based on a margin above a reference rate every year after the introductory period.

| Loan Type | Percent of Borrowers Buying a Home | Percent of All Home Buyers |

|---|---|---|

| 30-year Fixed | 90% | 79.2% |

| 15-year Fixed | 6% | 5.28% |

| Adjustable-rate | 2% | 1.76% |

| Other Fixed-Rate Loan Terms | 2% | 1.76% |

| Use Any Type of Financing | 100% | 88% |

| Paid Cash in Full | N/A | 12% |

Source: Freddie Mac's 2016 home buyer statistics, published on April 17, 2017.

ARM loans are risky for consumers who can not stand volatility, but are ideal for consumers with a higher income range and a stable source of revenue. If you have the discipline to make above average payments or believe you will sell the home before rates reset then ARMs can help you save money through charging a lower interest rate.

The table below shows nationwide average conforming conventional rates as of June 4, 2020 based on the Freddie Mac PMMS.

| Loan Type | Interest Rate | Fees & Points | Margin |

|---|---|---|---|

| Conventional 30-Year FRM | 3.25% | 0.7 | N/A |

| Conventional 15-Year FRM | 2.875% | 0.7 | N/A |

| Conventional 5/1 ARM | 4.125% | 0.4 | 2.75% |

Since most conventional loans are not government-sponsored, their interest rates tend to be higher than federal government-backed loans from sponsors including the Federal Housing Authority (FHA), the U.S. Department of Agriculture (USDA), and the Department of Veterans Affairs (VA).

Interest rates are reliant on several factors, including the size of the loan, the down payment on the home, the length of the term, and whether it's structured as a fixed or adjustable rate mortgage. In most cases a longer durations have higher interest rates and fixed rate loans are typically slightly above the rates charged on adjustable rate loans.

Calculate Payments for Multiple Loan Types

We offer a calculator which enables you to compare fixed and ARM loan payments side by side.

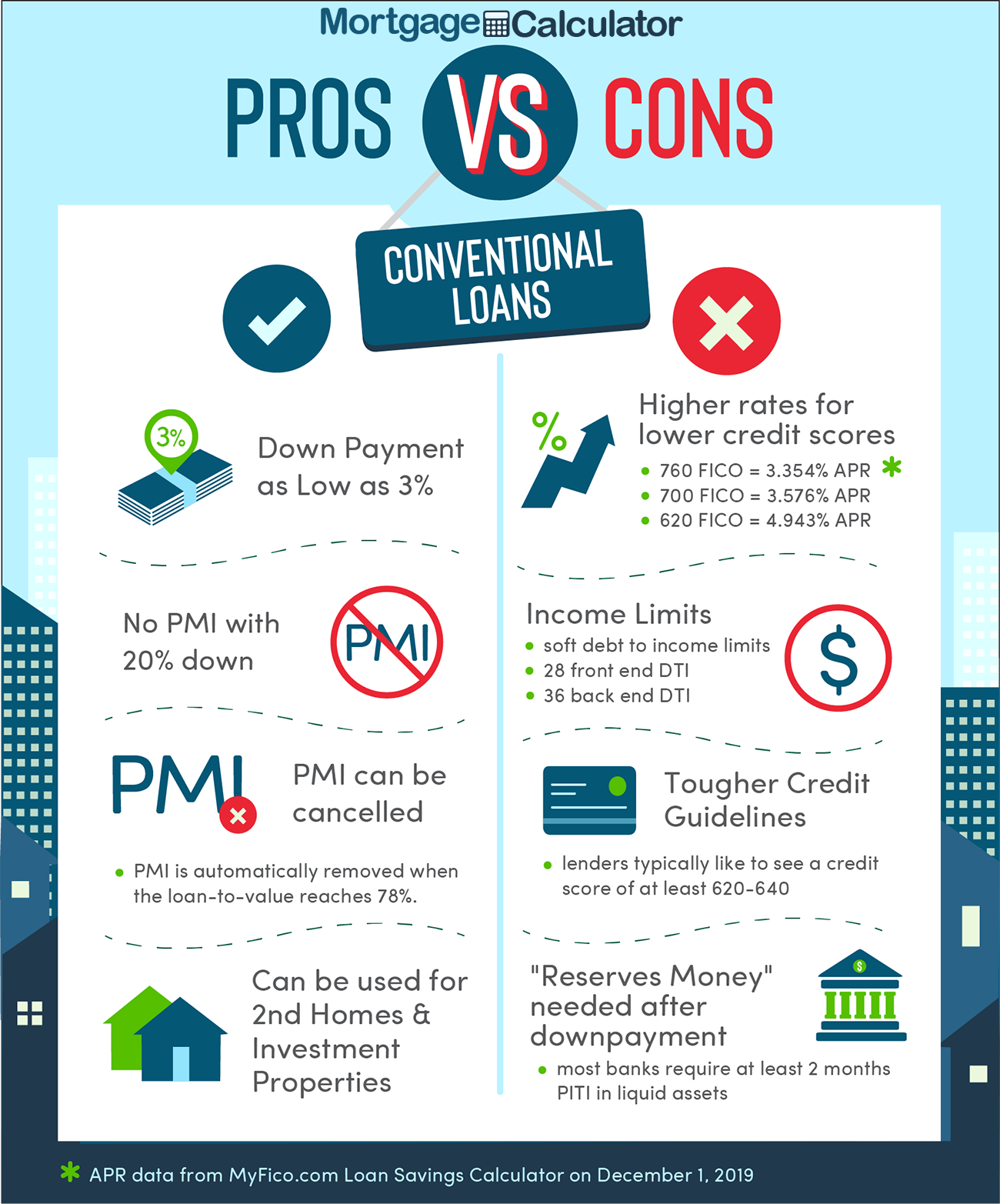

Your creditworthiness or ability to repay your loan is factored in determining the interest rate. This is the reason why your credit score and history must uphold satisfactory records: it reflects low risk of defaulting on a loan. Lower credit scores, on the other hand, are assigned higher rates because they pose greater risk to lending institutions.

Generally, you may have difficulty qualifying for a conforming conventional loan if your financial records reveal the following issues:

There are two important DTI ratios:

Front-end ratio

The percentage of your monthly income that go toward housing costs (ex. mortgage, homeowner's association dues, property taxes, insurance, etc.). Historically a ratio below 28 percent has been considered great.

Back-end ratio

The percentage of your earnings that go toward your home related expenses along with paying off all your other debt payments (including your monthly payments on car loans, credit card payments, student loans, personal loans etc.). Historically a ratio below 36 percent has been considered great.

Your back end debt-to-income ratio (DTI) is estimated by dividing all your monthly debt payments and home-related expenses by your gross monthly income. The result is the percentage of your income that goes to paying debts. The lower your DTI, the higher your chances of securing a mortgage.

As for payment terms, homebuyers have the option to pay within 15, 20, 25, and 30 years. There are lenders who offer 10-year terms. However, take note that shorter terms equate to higher monthly payments. The advantage is you get to pay down your loan sooner, leading to lower interest expense when compared against a 30-year term.

The table below summarizes requirements you'll need to meet to qualify for a conforming conventional loan:

| Requirements | Conforming Conventional Mortgages |

|---|---|

| Credit score | 700 is ideal, lenders typically accept around 680 |

| Front end DTI | Should have a maximum of 28% |

| Back–end DTI | Should not exceed 43% Ideally, borrowers should aim for 36% If you have student loans, you may still qualify up to 50% |

| Rates | Comes in fixed and adjustable-rate mortgage (ARM) Low down payment means higher rates Low credit score means higher rates 15-year fixed term has lower rates than a 30-year fixed term Slightly lower rates compared to nonconforming jumbo loans |

| Down Payment | 10% average down payment 3% is the minimum for a 97-3 loan Paying 20% down removes PMI requirement |

| Cost | Closing cost average is around $3,700 If you are paying PMI, it's automatically canceled when it reaches 78% |

Conventional loans entail thorough lending requirements and background checks by banks and other mortgage lending institutions. They check your assets and liabilities to ensure you have low risk of defaulting on your loan. This is how they deliberate how much monthly payment you can reasonably afford every month, together with other upfront costs such as underwriting fees, loan origination, broker fees and closing costs.

Generally, you need to present the following documents for your application:

Moreover, you will be asked to present cash reserves such as savings accounts, investment accounts, or retirement funds as proof that you can make the down payment. If you receive cash gifts from your relatives, you may include them in your application. Just make sure your relative encloses a notarized letter that certifies the money is a gift, not a loan that must be paid back.

Background checks may also include calling your employer to confirm you are still employed. They also check if you declared the right salary and if you have recently moved to another job. If you are self-employed, you will need to provide additional proof of income as requested by your lender.

Finally, to allow your lender to conduct a credit report, you need to provide government identification. These include your state ID, driver's license, and your social security number.

Of course, conforming conventional loans are not the only financing option in the market. While they are well-suited for people with high credit scores and stable incomes from traditional employment, not everyone can qualify. This is where government-funded housing loans can help people with less than perfect credit scores, interest in rural homes or prior military service still qualify for funding.

Let's see how conforming conventional loans vary from government-backed home financing programs below.

Financing from the FHA is suited for first-time homebuyers who are yet to build more savings. You can afford to make low down payments, as well as qualify with a lower credit score.

For FHA loans, you need to pay a mortgage insurance premium (MIP) to compensate for the low down payment. You can pay a minimum of 3.5 percent of the loan's amount.

FHA loans come in 15 to 30-year fixed terms. As for rates, they typically start low and rise over time as you gain more home equity. As for all mortgages, you will be assigned a lower rate with a higher credit score, which is around 580. You may still qualify even if your score is 500, but you must make a 10 percent down payment.

While FHA loans are affordable in the beginning, they eventually become costly after several years. For this reason, those with FHA loans usually refinance their loan into a conventional loan. This works in their favor especially when they have raised their credit score to qualify for refinancing.

Below is a table for a summary of FHA loan requirements:

| Requirements | FHA Loans |

|---|---|

| Credit score | Aim for 580 500 may qualify if you pay 10% down payment |

| Front end DTI | Should be 31% or lower |

| Back end DTI | Do not go over 43% Can be up to 50% with compensating factors |

| Rates | Rates are lower at the start for buyers with low credit scores Rates get higher over the years while you gain home equity You must pay MIP throughout the entire loan |

| Down payment | Above 580 credit score – down payment can be 3.5% of loan amount Below 580 credit score – down payment must be 10% of loan amount |

| Cost | MIP accounts for about 1.75% of the loan amount Annual MIP expense is around 0.45%-1.05% of the loan amount |

USDA financing is provides loans for moderate income consumers with a credit score of 640. It offers a zero down payment option and requires buyers to get property in locations approved as USDA rural areas.

While rural housing may sound like a limitation, 97 percent of all land in the U.S. is actually legible for USDA housing programs. Furthermore, this mortgage option was developed to help foster economic growth around locations with relatively low population throughout the country.

As for mortgage rates, since USDA loans are government-funded, it's usually lower compared to conforming conventional loans. And while there is no down payment, you must pay an upfront guarantee fee equivalent to 1 percent of the loan a month. It also comes with an annual mortgage insurance premium (MIP) to offset the zero down payment and low rates.

Just take note that there is a maximum income limit for obtaining a USDA loan. For households with 1-4 members, the income limit is around $86,850. Meanwhile the limit is around $114,650 for a household with 5 to 8 family members. But in HERA high-cost areas, income limits are higher: $212,550 for 1-4 member households, and $280,550 for 5-8 member households. So make sure to check USDA income limits in your chosen location.

Below is a brief summary of USDA loan requirements:

| Requirements | USDA Loans |

|---|---|

| Credit score | 640 is the minimum credit score |

| Front–end DTI | Should not go over 29% |

| Back–end DTI | Should not go over 41% |

| Rates | Government backing makes rates lower compared to conforming conventional loans |

| Down payment | No down payment required |

| Cost | Requires an upfront loan guarantee fee, 1 percent Requires annual MIP payment of 0.35% No imposed prepayment penalty |

VA loans, as indicated by the name, are special loans given to military veterans and active duty military members. This also includes staff serving in the National Guard and Reserves. As privilege for their service, veterans and active duty member are offered low-interest, flexible housing rates. And unlike FHA and USDA loans, VA housing programs do not impose a private mortgage insurance (PMI) payment.

Similar to USDA loans, down payments are not required with VA loans. However, a VA funding fee is needed as a percentage of the loan to offset taxpayer's cost. This amount is is usually included in upfront or closing costs.

For a summary of VA loan requirements, see the table below:

| Requirements | VA Loans |

|---|---|

| Credit score | Should not go below 620 |

| Front–end DTI | Primary basis is back-end DTI |

| Back end DTI | Aim for at least 41% DTIIf you have residual income, DTI can be higher |

| Rates | Compared to conventional loans, government sponsorship makes VA rates lower |

| Down payment | Down payment not neededBorrowers refinancing a home with cash out can 90% of the home's equity |

| Cost | No PMI needed. VA funding fee required (fee varies, see complete details) |

As mentioned earlier, jumbo loans are nonconforming mortgages that exceed the limit set by government-sponsored institutions for conventional loans. They are offered by banks, credit unions, and private lenders.

Jumbo loans require stricter financial evaluation and meticulous background checks compared to conforming conventional loans. Financial companies employ more thorough when it comes to assessing creditworthiness to ensure lower risk for the lender. Since the mortgage is not typically sponsored by government funding, any misstep in assessment may cost them a fortune.

As for interest rates, jumbo loans have slightly higher rates than conforming conventional loans. The payment structure usually comes in adjustable-rate mortgages, though there are fixed-rate options. And since it's a larger loan, expect the closing costs to be higher.

Jumbo loans are ideally used by high-income earners with a stable source of funds. They usually need jumbo loans purchase expensive homes at high-cost locations. “Jumbo” may be misconstrued as the size of the house, but it actually refers to the large size of the loan.

To learn more, you may read our guide to jumbo mortgages and use our jumbo mortgage calculator.

Saving up for a home takes time, so you might as well learn more about different mortgage options in the market.

Conforming conventional loans are one of the most popular financing borrowers use in the U.S. This requires a high credit score backed with adequate income and a stable source of funds. And for wealthy homebuyers looking for expensive property, they can make use of jumbo loans.

What if you have a low credit score? For first-time homebuyers with low to moderate income, there are government-sponsored housing programs that you can take advantage of. Remember to check requirements for FHA, USDA, or VA loans to see if you're a right fit for these programs. At the end of the day, it's best to find the right financing that will cater to your needs.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!